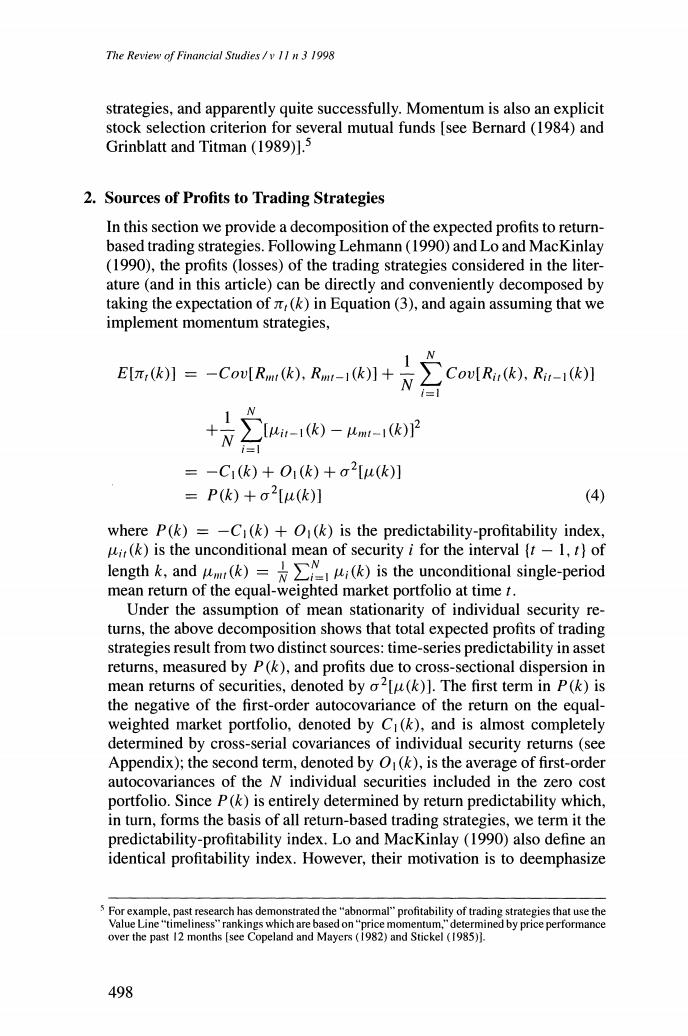

The Review of Financial Studies /y II n 3 1998 strategies,and apparently quite successfully.Momentum is also an explicit stock selection criterion for several mutual funds [see Bernard (1984)and Grinblatt and Titman(1989)]. 2.Sources of Profits to Trading Strategies In this section we provide a decomposition of the expected profits to return- based trading strategies.Following Lehmann(1990)and Lo and MacKinlay (1990),the profits (losses)of the trading strategies considered in the liter- ature (and in this article)can be directly and conveniently decomposed by taking the expectation of (k)in Equation(3),and again assuming that we implement momentum strategies, N Eπ,k1=-CovIRm(k),Rm-1k]+N Cov[Rit(k),Rit-1(k)] =-C1(k)+O1(k)+o2[u(k)] =P(k)+o2[u(k)] (4) where P(k)=-C1(k)+O1(k)is the predictability-profitability index, ir(k)is the unconditional mean of security i for the interval (t-1,t)of length k,and(k)(k)is the unconditional single-period mean return of the equal-weighted market portfolio at time t. Under the assumption of mean stationarity of individual security re- turns,the above decomposition shows that total expected profits of trading strategies result from two distinct sources:time-series predictability in asset returns,measured by P(k),and profits due to cross-sectional dispersion in mean returns of securities,denoted by o2[u(k)].The first term in P(k)is the negative of the first-order autocovariance of the return on the equal- weighted market portfolio,denoted by Ci(k),and is almost completely determined by cross-serial covariances of individual security returns(see Appendix);the second term,denoted by O(k),is the average of first-order autocovariances of the N individual securities included in the zero cost portfolio.Since P(k)is entirely determined by return predictability which, in turn,forms the basis of all return-based trading strategies,we term it the predictability-profitability index.Lo and MacKinlay (1990)also define an identical profitability index.However,their motivation is to deemphasize 5 For example.past research has demonstrated the"abnormal"profitability of trading strategies that use the Value Line"timeliness"rankings which are based on"price momentum,"determined by price performance over the past 12 months [see Copeland and Mayers (1982)and Stickel (1985). 498

An Anatony of Trading Strategies the role of o2u(k)]since it has a small effect on profits to trading strategies that use weekly returns (see also Tables 2 and 4).We,on the other hand, define P(k)to emphasize that total expected profits to return-based trading strategies do not result entirely from time-series predictability in returns. 2.1 The random walk model Although Equation(4)provides a convenient decomposition of expected profits,we need a benchmark model for the return-generating process of financial assets to interpret the two different potential sources of profits to trading strategies.Let us assume that all security prices follow random walks,so that returns can be depicted as Rir(k)=ui(k)+nir(k) i=1,..,N (5) where E[nir(k)]=ovi,k and E[nir(k)nit1(k)]=0i,j,k.6 The usefulness of the random walk model in Equation(5)as a benchmark, particularly for this study,becomes obvious since trading strategies that rely on time-series predictability in returns cannot be profitable by construction because Cov[Rir(k),Rit-1(k)]=0vi,j,k.Equivalently,Equation (5) implies that there is no return predictability in either individual securities or across different securities,and hence the very basis of return-based trad- ing strategies is ruled out.The model in Equation(5)also has economic appeal as a benchmark because changes in stock prices will(generally)be unpredictable in a risk-neutral world with an informationally efficient stock market [see,e.g.,Samuelson (1965)]. The most important property of the model in Equation(5),when com- bined with the decomposition of total expected profits in Equation (4), however,lies in the fact that it helps demonstrate that momentum(con- trarian)strategies will be profitable (unprofitable)even if asset returns are completely unpredictable.More specifically,from Equations (4)and(5)it follows that E[π,(k)]=σ2[u(k)] (6) Equation(6)implies that as long as there are any cross-sectional differ- ences in mean returns of individual securities,momentum strategies will generate profits equal to o-[u(k)].Conversely,contrarian strategies will generate losses of an equal amount.Under the assumption that the mean returns of individual securities are stationary,these profits (losses)have no relation to any time-series predictability in returns.The"profits"in Equa- Technically,all we need in our benchmark model is that the's are uncorrelated:but forease of exposition. we assume a random walk model for stock prices. 7 Of course.although predictability in asset returns is a necessary condition for the success of trading strategies considered in this article,it is not a sufficient condition for "abnormal"gains to be reaped from these strategies.As others have pointed out,time variation in expected returns could also lead to predictability in stock returns [see.e.g.,Fama(1970,1991)]. 499