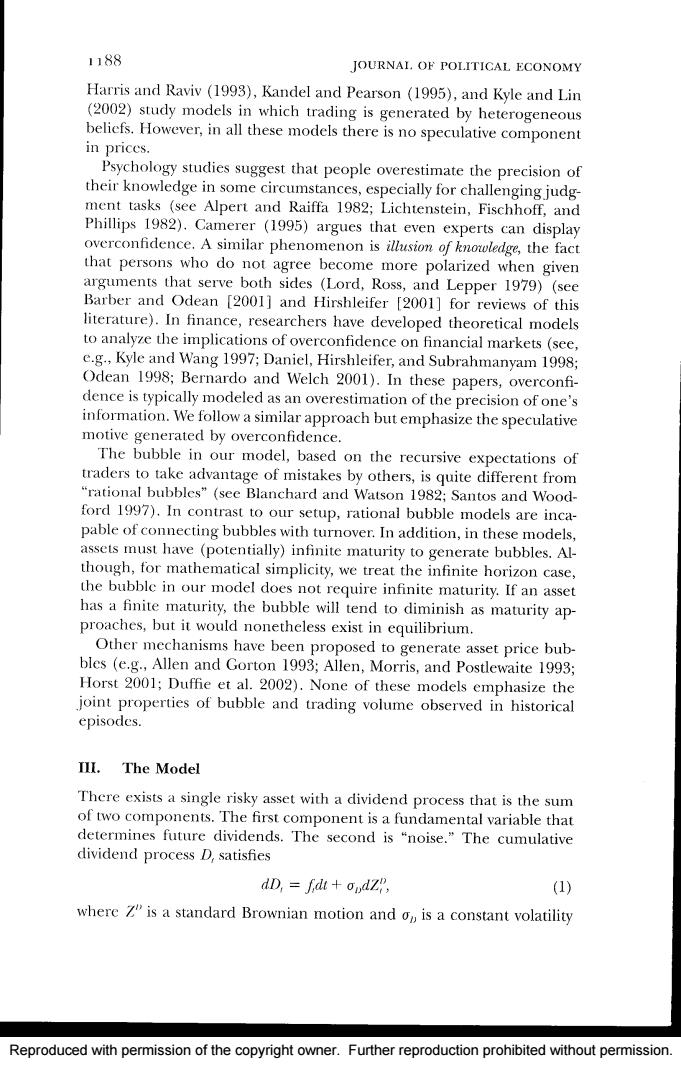

1188 JOURNAI.OF POLITICAL ECONOMY Harris and Raviv (1993),Kandel and Pearson (1995),and Kyle and Lin (2002)study models in which trading is generated by heterogeneous beliefs.However,in all these models there is no speculative component in prices. Psychology studies suggest that people overestimate the precision of their knowledge in some circumstances,especially for challenging judg- ment tasks (see Alpert and Raiffa 1982;Lichtenstein,Fischhoff,and Phillips 1982).Camerer (1995)argues that even experts can display overconfidence.A similar phenomenon is illusion of knowledge,the fact that persons who do not agree become more polarized when given arguments that serve both sides (Lord,Ross,and Lepper 1979)(see Barber and Odean [2001]and Hirshleifer [2001]for reviews of this literature).In finance,researchers have developed theoretical models to analyze the implications of overconfidence on financial markets (see, e.g.,Kyle and Wang 1997;Daniel,Hirshleifer,and Subrahmanyam 1998; Odean 1998;Bernardo and Welch 2001).In these papers,overconfi- dence is typically modeled as an overestimation of the precision of one's information.We follow a similar approach but emphasize the speculative motive generated by overconfidence. The bubble in our model,based on the recursive expectations of traders to take advantage of mistakes by others,is quite different from "rational bubbles"(see Blanchard and Watson 1982;Santos and Wood- ford 1997).In contrast to our setup,rational bubble models are inca- pable of connecting bubbles with turnover.In addition,in these models, assets must have (potentially)infinite maturity to generate bubbles.Al- though,for mathematical simplicity,we treat the infinite horizon case, the bubble in our model does not require infinite maturity.If an asset has a finite maturity,the bubble will tend to diminish as maturity ap- proaches,but it would nonetheless exist in equilibrium. Other mechanisms have been proposed to generate asset price bub- bles (e.g.,Allen and Gorton 1993;Allen,Morris,and Postlewaite 1993; Horst 2001;Duffie et al.2002).None of these models emphasize the joint properties of bubble and trading volume observed in historical episodes. III.The Model There exists a single risky asset with a dividend process that is the sum of two components.The first component is a fundamental variable that determines future dividends.The second is "noise."The cumulative dividend process D,satisfies dD,fdt+opdz, (1) where Z"is a standard Brownian motion and op is a constant volatility Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

OVERCONFIDENCE 118g parameter.The fundamental variable fis not observable.However,it sarisfies 乐=-λ(f-f)du+o,d% (2) where A>0 is the mean reversion parameter,fis the long-run mean of f o>0 is a constant volatility parameter,and Z/is a standard Brownian motion.The asset is in finite supply,and we normalize the total supply to unity. There are two sets of risk-neutral agents.The assumption of risk neu- trality not only simplifies many calculations but also serves to highlight the role of information in the model.Since our agents are risk-neutral, the dividend noise in equation(1)has no direct impact in the valuation of the asset.However,the presence of dividend noise makes it impossible to infer fperfectly from observations of the cumulative dividend process. Agents use the observations of Dand any other signals that are correlated with fto infer current fand to value the asset.In addition to the cu- mulative dividend process,all agents observe a vector of signals s4 and sthat satisfy ds fdt +odz (3) and ds "fidt +odz", (4) where Z4 and Z"are standard Brownian motions,and o >0 is the com- mon volatility of the signals.We assume that all four processes Z,Z, Z,and Z"are mutually independent. Agents in group A (B)think of s(s)as their own signal,although they can also observe s"(s4).Heterogeneous beliefs arise because each agent believes that the informativeness of his own signal is larger than its true informativeness.Agents of group A(B)believe that innovations dz4 (dz")in the signal s4(s")are correlated with the innovations dz in the fundamental process,with (0<<1)as the correlation pa- rameter.Specifically,agents in group A believe that the process for s4 is ds,=fd+o,φdZ+oN1-ΦdZ Although agents in group A perceive the correct unconditional volatility of the signal s",the correlation that they attribute to innovations causes them to overreact to signal s4.Similarly,agents in group B believe that the process for s"is ds,“=fdt+o,dZ+o,v1-中dZ On the other hand,agents in group A (B)believe (correctly)that in- Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

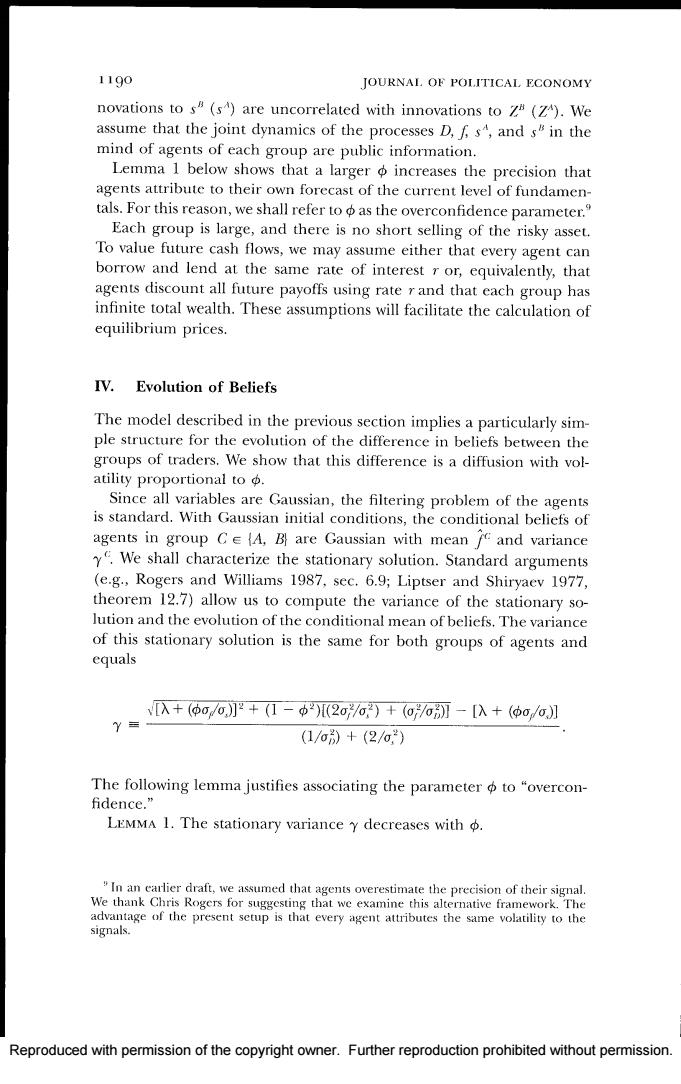

1190 JOURNAL.OF POLITICAL ECONOMY novations to s(s)are uncorrelated with innovations to z(Z).We assume that the joint dynamics of the processes D,fs",and s"in the mind of agents of each group are public information. Lemma 1 below shows that a larger o increases the precision that agents attribute to their own forecast of the current level of fundamen- tals.For this reason,we shall refer toas the overconfidence parameter. Each group is large,and there is no short selling of the risky asset. To value future cash flows,we may assume either that every agent can borrow and lend at the same rate of interest r or,equivalently,that agents discount all future payoffs using rate r and that each group has infinite total wealth.These assumptions will facilitate the calculation of equilibrium prices. IV.Evolution of Beliefs The model described in the previous section implies a particularly sim- ple structure for the evolution of the difference in beliefs between the groups of traders.We show that this difference is a diffusion with vol- atility proportional to o. Since all variables are Gaussian,the filtering problem of the agents is standard.With Gaussian initial conditions,the conditional beliefs of agents in group Ce(A,B are Gaussian with mean f and variance y.We shall characterize the stationary solution.Standard arguments (e.g.,Rogers and Williams 1987,sec.6.9;Liptser and Shiryaev 1977, theorem 12.7)allow us to compute the variance of the stationary so- lution and the evolution of the conditional mean of beliefs.The variance of this stationary solution is the same for both groups of agents and equals 入+(Φ0ōJ2+(I-中)[2oo)+(o/6别-[入+(φ0/6] (1/o)+(2/a,) The following lemma justifies associating the parameter o to "overcon- fidence." LEMMA 1.The stationary variance y decreases with "In an carlier draft,we assumed that agents overestimate the precision of their signal. We thank Chris Rogers for suggesting that we examine this alternative framework.The advantage of the present setup is that every agent attributes the same volatility to the signals. Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

OVERCONFIDENCE 1191 In addition,the conditional mean of the beliefs of agents in group A satisfies r=-A-刀d+o+Yd4-ra0 09 +au-了40+品d0-了a. (5) Since fmean-reverts,the conditional beliefs also mean-revert.The other three terms represent the effects of "surprises."These surprises can be represented as standard mutually independent Brownian motions for agents in group A: dw (as"-pdo. (6) 0 dwg=(ds"-了d0, (7) and wg=上aD-r0. (8) Op Note that these processes are only Wiener processes in the mind of group A agents.Because of overconfidence (>0),agents in group A overreact to surprises in s4. Similarly,the conditional mean of the beliefs of agents in group B satisfies 少=-0-刀l+品k-j0 +-a0. (9) Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

1192 JOURNAL.OF POLITICAL ECONOMY and the surprise terms can be represented as mutually independent Wiener processes: dw"=-(ds"-fdt), 0 dWg=二(ds“-0, 0 dw=三(dD-0. Op These processes are a standard three-dimensional Brownian motion only for agents in group B. Since the beliefs of all agents have constant variance,we shall refer to the conditional mean of the beliefs as their beliefs.We let ga and g"denote the differences in beliefs: g1=-,g"=1- The next proposition describes the evolution of these differences in beliefs. PROPOSITION 1. dg=-pg'dt+odw., where +o+0-(层+》 0=200, and wa is a standard Wicner process for agents in group A,with in- novations that are orthogonal to the innovations of f. Proposition 1 implies that the difference in beliefs g*follows a simple mean-reverting diffusion process in the mind of group A agents.In particular,the volatility of the difference in beliefs is zero in the absence of overconfidence.A larger leads to greater volatility.In addition, -p/202 measures the pull toward the origin.A simple calculation shows that this mean reversion"decreases with o.A higher causes an increase in fluctuations of opinions and a slower mean reversion. In an analogous fashion,for agents in group B,gasatisfies dg"=一pgh+oW, "Conley et al.(1997)arguc that this is the correct measure of mean reversion. Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission