1.Price discrimination requires the ability to sort customers and the ability to Explain how the following can function as price reeminagomes and diseus botorig a.Requiring airline travelers to spend at least one Saturday night away from home to qualify for a low fare. The requirement of staying over Saturday night separates business travelers who prefer to return for the weekend,from tourists,who travel on the weekend Arbitrage is not possible when the ticket specifies the name ofthe traveler. b.Insisting on delivering cement to buvers and basing prices on buvers' locations. By basing prices on the buyers location by geography Prices may then include transportation charges.These costs vary from customer to customer.The customer pays for these transportation charges whether delivery is received at the buyer's location or at the cement plant.Since cement is heavy and bulky.transportation charges may be large.This pricing strategy leads to "based-point-pri systems,"where all cment the same base point and calculate transportation charges from this base point.Individual custome are then quoted the same price.Forexample.in FTCv.Cement Institute,333 U.S 683 [19481.the Court found that sealed bids by eleven companies for a 6.000-barrel government order in 1936 all quoted $3.286854 per barrel. c.Selling food processors along with coupons that can be sent to the manufacturer to obtain a $10 rebate. s mers are ls demand and do not request the rebate:and (2)customers who are more price sensitive,ie.,those who have a higher demand elasticity and do request the rebate. The latter group could buy the food processors,send in the rebate coupons and 四” of arbitrage,selers could limit the numbe of re s per d.Offering temporary price cuts on bathroom tissue. A temporary price cut on bathroom tissue is a form of intertemporal price discrimination.During the price cut,price-sensitive consumers buy greater quantities of tissue than they would otherwise.Non-price-sensitive consumers buy the same amount of tissue that they would buy without the price cut.Arbitrage is possible,but the profits on reselling bathroom tissue probably cannot compensate for the cos of storage,transportation,and resale e.Charging high-income patients more than low-income patients for plastic surgery The plastic surgeon might not be able to separate high-income patients from low-income patients,but he or she can guess.One strategy is to quote a high price

1. Price discrimination requires the ability to sort customers and the ability to prevent arbitrage. Explain how the following can function as price discrimination schemes and discuss both sorting and arbitrage: a. Requiring airline travelers to spend at least one Saturday night away from home to qualify for a low fare. The requirement of staying over Saturday night separates business travelers, who prefer to return for the weekend, from tourists, who travel on the weekend. Arbitrage is not possible when the ticket specifies the name of the traveler. b. Insisting on delivering cement to buyers and basing prices on buyers’ locations. By basing prices on the buyer’s location, customers are sorted by geography. Prices may then include transportation charges. These costs vary from customer to customer. The customer pays for these transportation charges whether delivery is received at the buyer’s location or at the cement plant. Since cement is heavy and bulky, transportation charges may be large. This pricing strategy leads to “based-point-price systems,” where all cement producers use the same base point and calculate transportation charges from this base point. Individual customers are then quoted the same price. For example, in FTC v. Cement Institute, 333 U.S. 683 [1948], the Court found that sealed bids by eleven companies for a 6,000-barrel government order in 1936 all quoted $3.286854 per barrel. c. Selling food processors along with coupons that can be sent to the manufacturer to obtain a $10 rebate. Rebate coupons with food processors separate consumers into two groups: (1) customers who are less price sensitive, i.e., those who have a lower elasticity of demand and do not request the rebate; and (2) customers who are more price sensitive, i.e., those who have a higher demand elasticity and do request the rebate. The latter group could buy the food processors, send in the rebate coupons, and resell the processors at a price just below the retail price without the rebate. To prevent this type of arbitrage, sellers could limit the number of rebates per household. d. Offering temporary price cuts on bathroom tissue. A temporary price cut on bathroom tissue is a form of intertemporal price discrimination. During the price cut, price-sensitive consumers buy greater quantities of tissue than they would otherwise. Non-price-sensitive consumers buy the same amount of tissue that they would buy without the price cut. Arbitrage is possible, but the profits on reselling bathroom tissue probably cannot compensate for the cost of storage, transportation, and resale. e. Charging high-income patients more than low-income patients for plastic surgery. The plastic surgeon might not be able to separate high-income patients from low-income patients, but he or she can guess. One strategy is to quote a high price

initially,observe the patient's reaction,and then negotiate the final price.Many medical insurance policies do not over elective plastic surgery.Since plasti surgery cannot be transferred from low-income patients to high-income patients, arbitrage does not present a problem. 2.Ifthe demand for drive-in movies is more elastic for couples than for single individuals,it will be optimal for theaters to charge one admission fee for the driver ofthe car and an extra fee for passengers.True or False? Explain. is a charge for the car plus the driver and the usage fee is a charge for each additional passenger other than the driver.Assume that the marginal cost of showing the movie is zero,i.e.,all costs are fixed and do not vary with the number of cars.The theater should set its entry fee to capture the consumer surplus of the driver.a single viewer,and should charge a positive price for each passenger. 3.In Example 11.1,we saw how producers of processed foods and related consumer goods use coupons asa means of price diserimination.Although coupons are widely used in the United States,that is not the case in other countries.In Germany,coupons are illegal. a.Does prohibiting the use of coupons in Germany make German consumers better off or worse off? In general.we cannot tell whether consumers will be better off or worse off Total umer surplus can e or decre with price discrimination depending on th number of different price charged and the o consumer demand Note,for example,that the use of coupons can increase the market size and therefore increase the total surplus of the market.Depending on the relative demand curves of the consumer groups and the producer's marginal eost curve,the increase in total surplus can be big enough to incre ase both pr ducer surplus and consumer surplus. Consider the simple example depicte in Figure 11.3.a

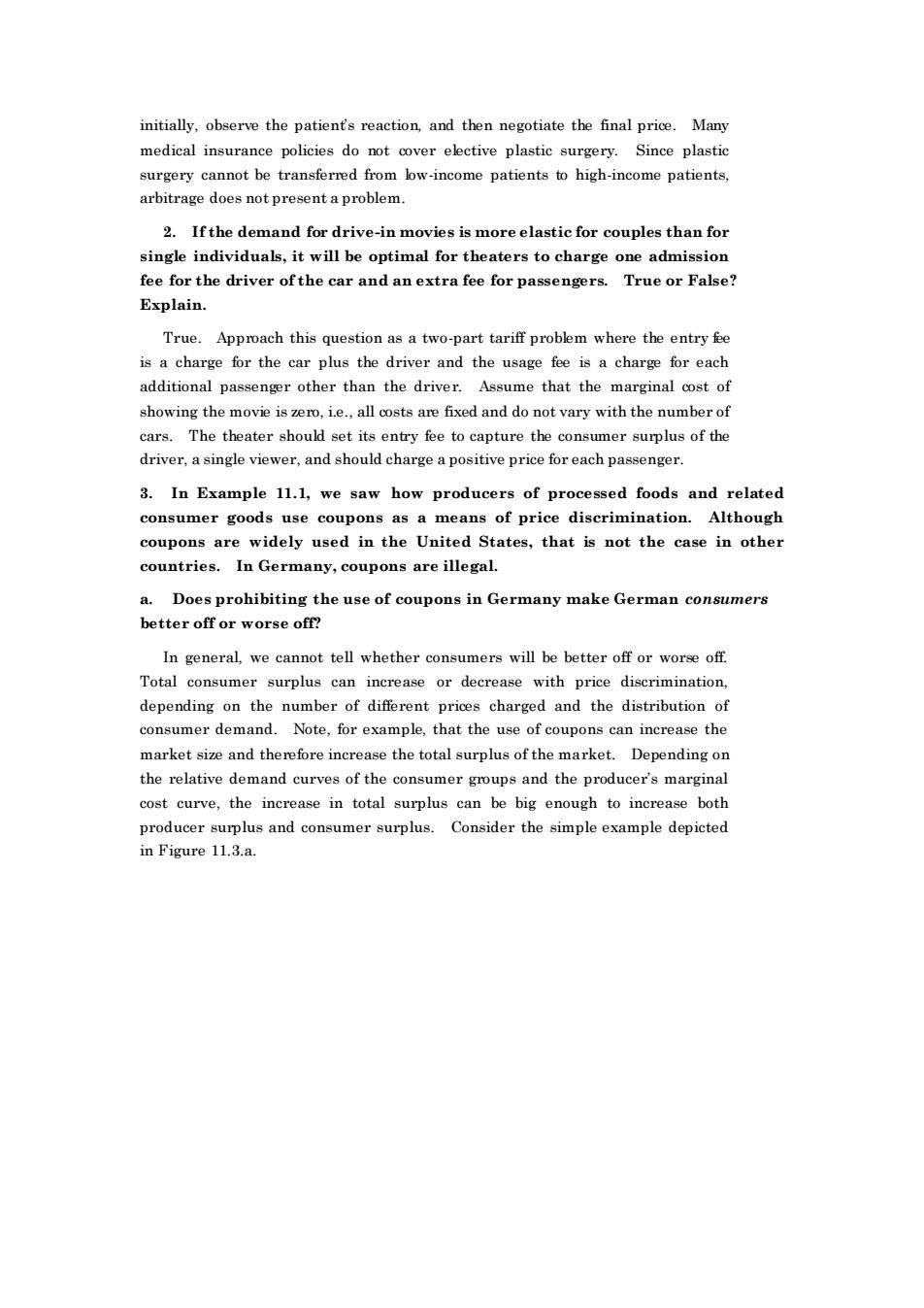

initially, observe the patient’s reaction, and then negotiate the final price. Many medical insurance policies do not cover elective plastic surgery. Since plastic surgery cannot be transferred from low-income patients to high-income patients, arbitrage does not present a problem. 2. If the demand for drive-in movies is more elastic for couples than for single individuals, it will be optimal for theaters to charge one admission fee for the driver of the car and an extra fee for passengers. True or False? Explain. True. Approach this question as a two-part tariff problem where the entry fee is a charge for the car plus the driver and the usage fee is a charge for each additional passenger other than the driver. Assume that the marginal cost of showing the movie is zero, i.e., all costs are fixed and do not vary with the number of cars. The theater should set its entry fee to capture the consumer surplus of the driver, a single viewer, and should charge a positive price for each passenger. 3. In Example 11.1, we saw how producers of processed foods and related consumer goods use coupons as a means of price discrimination. Although coupons are widely used in the United States, that is not the case in other countries. In Germany, coupons are illegal. a. Does prohibiting the use of coupons in Germany make German consumers better off or worse off? In general, we cannot tell whether consumers will be better off or worse off. Total consumer surplus can increase or decrease with price discrimination, depending on the number of different prices charged and the distribution of consumer demand. Note, for example, that the use of coupons can increase the market size and therefore increase the total surplus of the market. Depending on the relative demand curves of the consumer groups and the producer’s marginal cost curve, the increase in total surplus can be big enough to increase both producer surplus and consumer surplus. Consider the simple example depicted in Figure 11.3.a

Pric P .MR AR AR, MR Quantity Figure11.3.a left out of the market and thus has no consumer surplus.With price discrimination,consumer 2 is included in the market and collects some consumer surplus.At the same time,consumer 1 pavs the same price under discrimination in this example,and therefore enjoys the same consu ner surplus.The use of coupons ediscrimination)thu example.Furthermore,although the net change in consumer surplus is ambiguous in general,there is a transfer of consumer surplus from price-insensitive to price-sensitive consumers.Thus,price-sensitive consumers will benefit from coupons,even though on net consumers as a whole can be worse b.Does prohibiting the use of coupons make German producers better off or worse off? Prohibiting the use of coupons will make the German producers worse off,or at least not better off.If firms can successfully price discriminate (i.e.they can prevent resale,there are barriers to entry,etc.).price discrimination can never make a firm worse off. 4.Suppose that BMW can antity of cars at a c onstant marginal equal to$20,000 and a fixed st of 10 billion u ar sked to advise the CEO as to wha at prices and quantities BMW shor ld set for sales in Europe and in the U.S.The demand for BMWs in each market is given by: Qe=4,000,000-100 PE and Qu=1,000,000-20Pu

AR1 MR1 AR2 P1 P2 MR2 Price Quantity Figure 11.3.a In this case there are two consumer groups with two different demand curves. Assuming marginal cost is zero, without price discrimination, consumer group 2 is left out of the market and thus has no consumer surplus. With price discrimination, consumer 2 is included in the market and collects some consumer surplus. At the same time, consumer 1 pays the same price under discrimination in this example, and therefore enjoys the same consumer surplus. The use of coupons (price discrimination) thus increases total consumer surplus in this example. Furthermore, although the net change in consumer surplus is ambiguous in general, there is a transfer of consumer surplus from price-insensitive to price-sensitive consumers. Thus, price-sensitive consumers will benefit from coupons, even though on net consumers as a whole can be worse off. b. Does prohibiting the use of coupons make German producers better off or worse off? Prohibiting the use of coupons will make the German producers worse off, or at least not better off. If firms can successfully price discriminate (i.e. they can prevent resale, there are barriers to entry, etc.), price discrimination can never make a firm worse off. 4. Suppose that BMW can produce any quantity of cars at a constant marginal cost equal to $20,000 and a fixed cost of $10 billion. You are asked to advise the CEO as to what prices and quantities BMW should set for sales in Europe and in the U.S. The demand for BMWs in each market is given by: QE = 4,000,000 - 100 PE and QU = 1,000,000 - 20PU

where the subscript e denotes Europe and the subscript U denotes the United States.Assume that BMW can restrict U.S.sales to authorized BMW dealers only a.What quantity of BMWs should the firm sell in each market,and what will the price be in each market?What will the total profit be? With separate markets,BMW chooses the appropriate levels of and Q to maximize profits,where profits are: π=TR-TC=(gP+QP)-g+Q20,000+10,000,000,000} Solve for Pa and P using the demand equations,and substitute the expressions into the profitequation: x=g(400m-8+e(0om-9-{g,+)20m+100,0m,0o. 100 20Y Differentiating and setting each derivative to zero to determine the profit-maximizing quantities: 0.0r10,0.cm and 10 Substituting and into their respective demand equations we may determine the price ofcars in each market: 1,000,000=4,000,000-100P。orPe=s30,000and 300,000=1,000.000.20PorP=$35.000. Substituting the values for Q.Q.Pe and P into the profit equation,we have x=《1.000,000(S30,000)+(300,000(35,000y·《1,300,000)20,000)+10.000.000,000.or 元=$4.5 billion. b.If BMW were forced to charge the same price in each market,what would be the qu antity sold in each market,the equi riu price,and the company profit? If BMW charged the same price in both markets,we substitute Q=+into the demand equation and write the new demand curve as 120 -120 Since the marginal revenue curve has twice the slope of the demand curve MR5000000_g 120

where the subscript E denotes Europe and the subscript U denotes the United States. Assume that BMW can restrict U.S. sales to authorized BMW dealers only. a. What quantity of BMWs should the firm sell in each market, and what will the price be in each market? What will the total profit be? With separate markets, BMW chooses the appropriate levels of QE and QU to maximize profits, where profits are: = TR− TC= QEPE + QUPU ( )− QE + QU ( )20,000 +10,000,000,000. Solve for PE and PU using the demand equations, and substitute the expressions into the profit equation: = QE 4 0, 000 − QE 100 + QU 5 0, 000 − QU 2 0 − QE + QU ( )2 0, 000 + 1 0,000,000,000. Differentiating and setting each derivative to zero to determine the profit-maximizing quantities: QE = 4 0,000 − QE 5 0 − 2 0, 000 = 0, or QE = 1,000,000 cars and QU = 5 0, 000 − QU 1 0 − 2 0, 000 = 0, o r QU = 300, 000 cars. Substituting QE and QU into their respective demand equations, we may determine the price of cars in each market: 1,000,000 = 4,000,000 - 100PE , or PE = $30,000 and 300,000 = 1,000,000 - 20PU, or PU = $35,000. Substituting the values for QE , QU, PE , and PU into the profit equation, we have = {(1,000,000)($30,000) + (300,000)($35,000)} - {(1,300,000)(20,000)) + 10,000,000,000}, or = $4.5 billion. b. If BMW were forced to charge the same price in each market, what would be the quantity sold in each market, the equilibrium price, and the company’s profit? If BMW charged the same price in both markets, we substitute Q = QE + QU into the demand equation and write the new demand curve as Q = 5,000,000 - 120P, or in inverse for as P = 5,000,000 120 − Q 120 . Since the marginal revenue curve has twice the slope of the demand curve: MR = 5,000,000 120 − Q 60

To find the profit-maximizing quantity,set marginal revenue equal to marginal cost: 300.00_g=20,00,org=130,000 120 60 Substitutinginto the demand equation to determine price: P=300.00 (1300,000 =$30,833.33 120 .120 Substituting into the demand equations for the European and American markets to find the quantity sold Qs=4,000,000-(100(30,833.3),orQs=916,667and Q=1,000,000-(20)30,833.3).0rQc=383,333. Substituting the values for Q and Pinto the profit equation,we find π={1.300.000*$30.833.33-1,300.000)20.000)+10.000.000.000.0r π=$4.083.333,330 5.A monopolist is deciding how to allocate output between two geographically ast and Midwest).Den aand and marginal revenue for P,=15-Q MR=15-2Q P2=25-202 MR2=25-4Qg The monopolist's total cost is C=5+3(+).What are price,output,profits marginal revenues,and deadweight loss (i)if the monopolist can price discriminate?(ii)if the law prohibits charging different prices in the two regions? With price discrimination.the monopolist chooses quantities in each market such that the marginl reven in cost is equal to 3(the slope ofthe total cost curve). In the first market 15.201=3,0rQ1=6. In the second market 25.49=3,0r22=5.5. Substituting into the respective demand equations,we find the following prices for the two markets: P,=15.6=s9and P2=2526.5)=$14 Noting that the total quantity produced is 11.5.then T=(6)9)+(5.514)-(6+(811.5)=s91.5 The monopoly deadweight loss in general is equal to

To find the profit-maximizing quantity, set marginal revenue equal to marginal cost: 5,000,000 120 − Q 60 = 20,000 , or Q* = 1,300,000. Substituting Q* into the demand equation to determine price: P = 5,000,000 120 − 1,300,000 120 = $30,833.33. Substituting into the demand equations for the European and American markets to find the quantity sold QE = 4,000,000 - (100)(30,833.3), or QE = 916,667 and QU = 1,000,000 - (20)(30,833.3), or QU = 383,333. Substituting the values for QE , QU, and P into the profit equation, we find = {1,300,000*$30,833.33} - {(1,300,000)(20,000)) + 10,000,000,000}, or = $4,083,333,330. 5. A monopolist is deciding how to allocate output between two geographically separated markets (East Coast and Midwest). Demand and marginal revenue for the two markets are: P1 = 15 - Q1 MR1 = 15 - 2Q1 P2 = 25 - 2Q2 MR2 = 25 - 4Q2 . The monopolist’s total cost is C = 5 + 3(Q1 + Q2 ). What are price, output, profits, marginal revenues, and deadweight loss (i) if the monopolist can price discriminate? (ii) if the law prohibits charging different prices in the two regions? With price discrimination, the monopolist chooses quantities in each market such that the marginal revenue in each market is equal to marginal cost. The marginal cost is equal to 3 (the slope of the total cost curve). In the first market 15 - 2Q1 = 3, or Q1 = 6. In the second market 25 - 4Q2 = 3, or Q2 = 5.5. Substituting into the respective demand equations, we find the following prices for the two markets: P1 = 15 - 6 = $9 and P2 = 25 - 2(5.5) = $14. Noting that the total quantity produced is 11.5, then = ((6)(9) + (5.5)(14)) - (5 + (3)(11.5)) = $91.5. The monopoly deadweight loss in general is equal to