Continued (II)MM with a Corporate Income Tax o Assumptions: Corporations are taxed at the rate T,on earnings after interest √No transaction costs Individuals and corporations borrow at same rate o Results: Proposition I:VI=Vu+BT(for a firm with perpetual debt)(VU=EBIT(1-T)/KU VL=EBIT(1- T/ka) Proposition II:KeL=Keu+B/E(Keu-kd)(1-T) (WACC=k=k*E/V+k(1-T)*B/V) 渊外经价货多方是 YO年NEB证事00003

Continued (II)MM with a Corporate Income Tax oAssumptions: 9Corporations are taxed at the rate T, on earnings after interest 9No transaction costs 9Individuals and corporations borrow at same rate oResults: 9Proposition I: VL =VU+BT(for a firm with perpetual debt)(VU=EBIT(1-T)/keU VL=EBIT(1- T)/ka) 9Proposition II: keL=keU+B/E(keU-kd)(1-T) (WACC=ka=ke*E/V+kd(1-T)*B/V)

Continued o Intuition: /Proposition I:Since corporations can deduct interest payments but not dividend payments,corporate leverage lowers tax payments. Proposition II:The cost of equity rises with leverage,because the risk to equity rises with the leverage. 渊外经价货多方是 YO年NEB证事00003

Continued o Intuition: 9Proposition I: Since corporations can deduct interest payments but not dividend payments, corporate leverage lowers tax payments. 9Proposition II: The cost of equity rises with leverage, because the risk to equity rises with the leverage

Continued o MM Arbitrage Proof VU=D/ke √VL=D/。+Ika D distributed to U's stockholders are reduced by the taxes paid on operating income and the value of U drops Since I is tax deductible,L realizes a tax savings PV of tax shield=value of debt B)X tax rate (T) 剥外校份贫多方号 YO年N0事0E000

Continued o MM Arbitrage Proof 9VU = D/ke 9VL = D/ke + I/kd D distributed to U’s stockholders are reduced by the taxes paid on operating income and the value of U drops Since I is tax deductible, L realizes a tax savings PV of tax shield = value of debt ( B ) Χ tax rate (T)

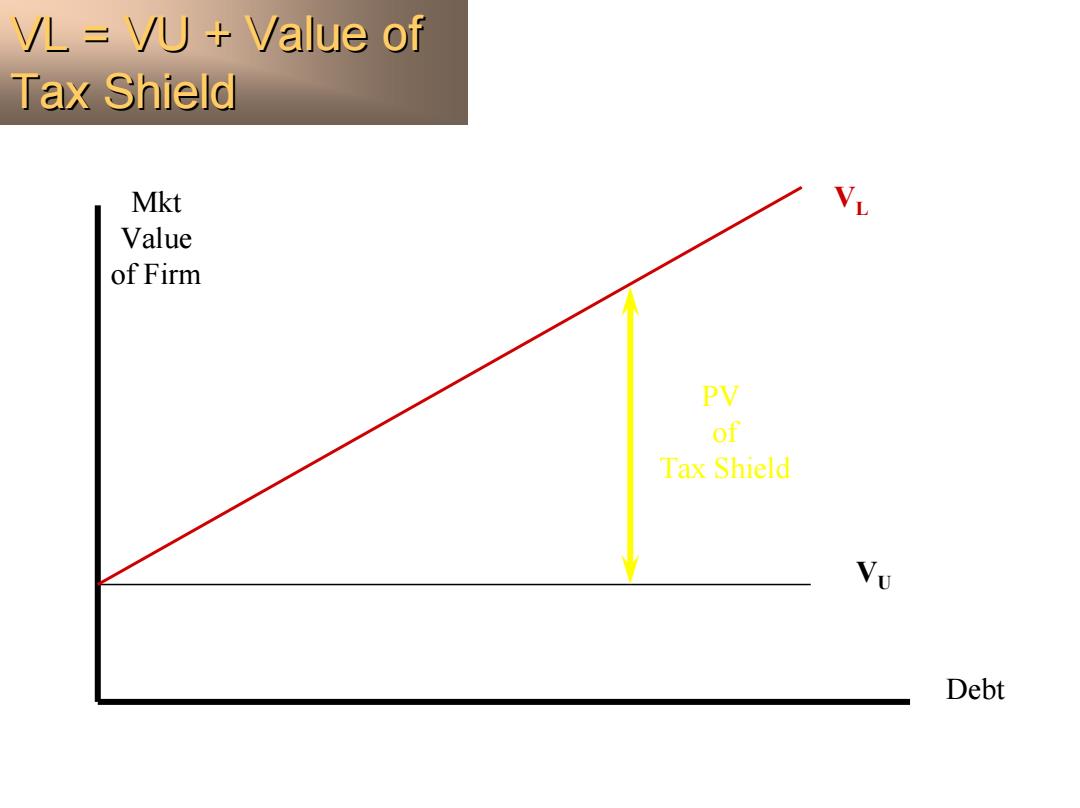

VL=VU Value of Tax Shield Mkt V Value of Firm PV of Tax Shield Vu Debt

Mkt Value of Firm Debt $ VU VL PV of Tax Shield VL = VU + Value of VL = VU + Value of Tax Shield Tax Shield

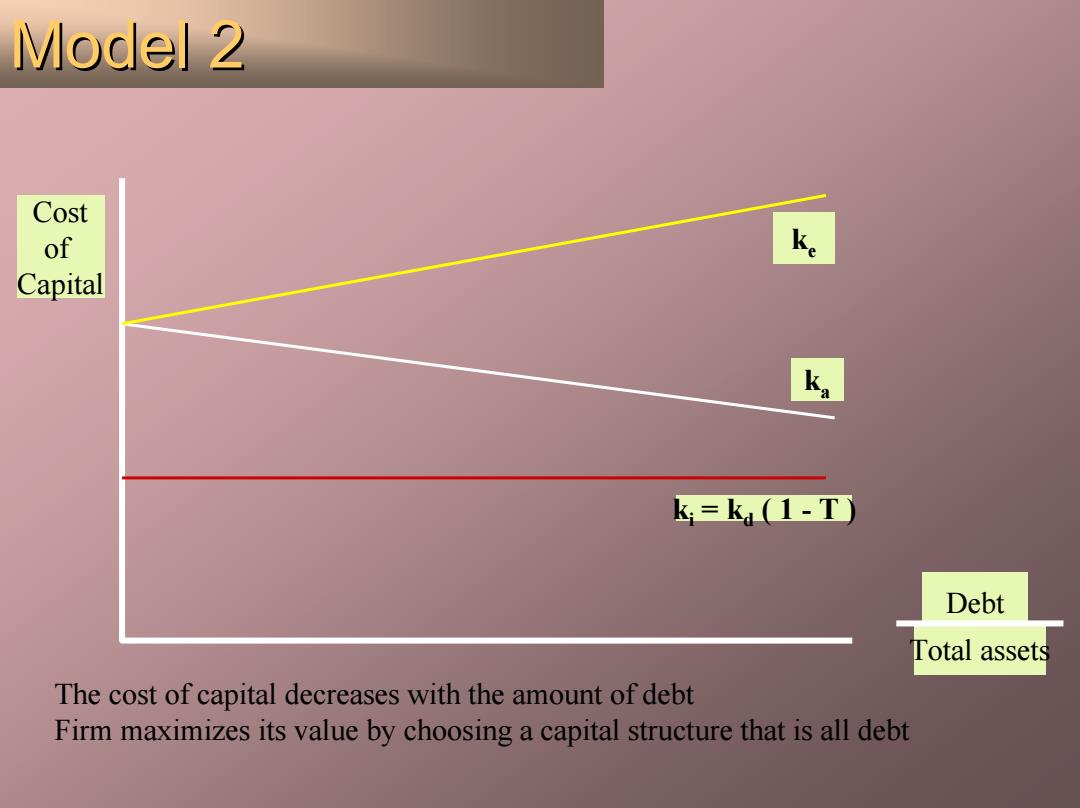

Model 2 Cost of ← Capital ki=kd(1-T) Debt Total assets The cost of capital decreases with the amount of debt Firm maximizes its value by choosing a capital structure that is all debt

Cost of Capital Debt Total assets ki = kd ( 1 - T ) ka ke The cost of capital decreases with the amount of debt Firm maximizes its value by choosing a capital structure that is all debt Model 2 Model 2