Tradition Theory cost of capital Ks K D必 D% TA 100 TA 100 肖外楂价贸多方号 YO年NEB证事00003

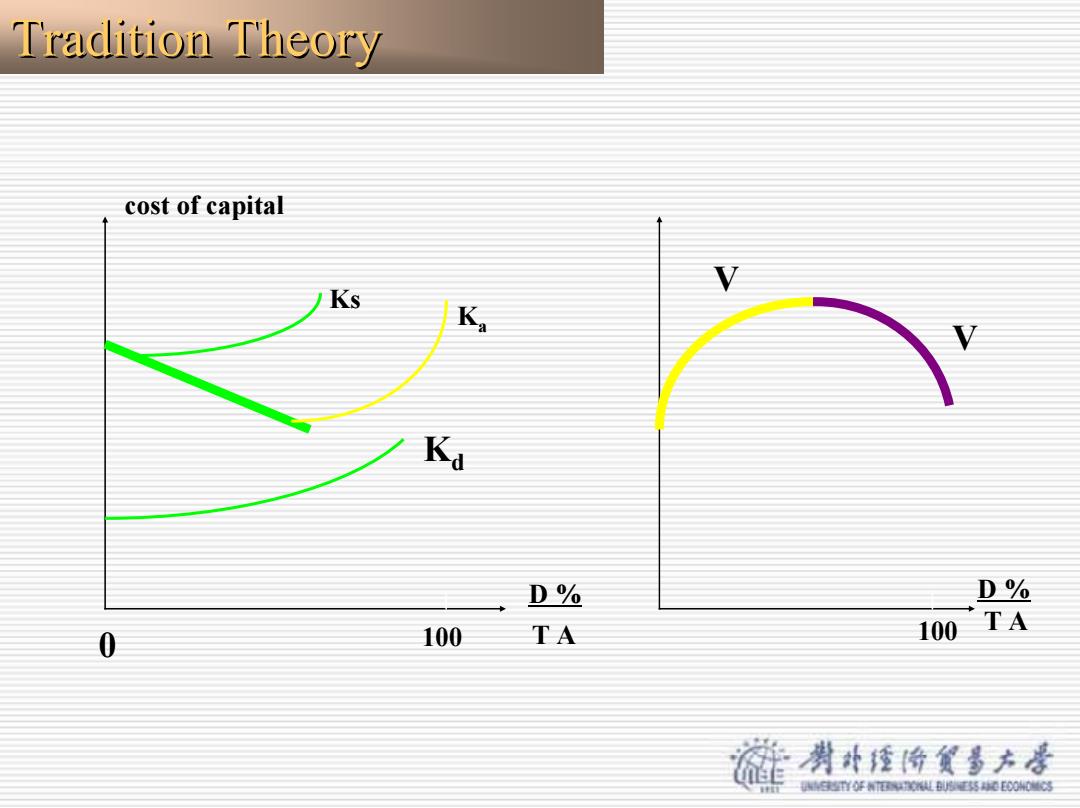

cost of capital D % 100 T A Ks Ka Kd 0 D % T A V V 100 Tradition Theory Tradition Theory

Continued Modigliani and Miller's Analysis(现代资 本结构理论,1958年后) (I)MM without a Corporate Income Tax o Assumptions: No taxes √No transaction costs Individuals and corporations borrow at same rate o Results: Proposition I:VL=Vu(=EBIT/Ka=EBIT/Kcu) /PropositionⅡ:keko+B/E(keu-ka) 渊补楂价贸多方号 YO年NEB证事00003

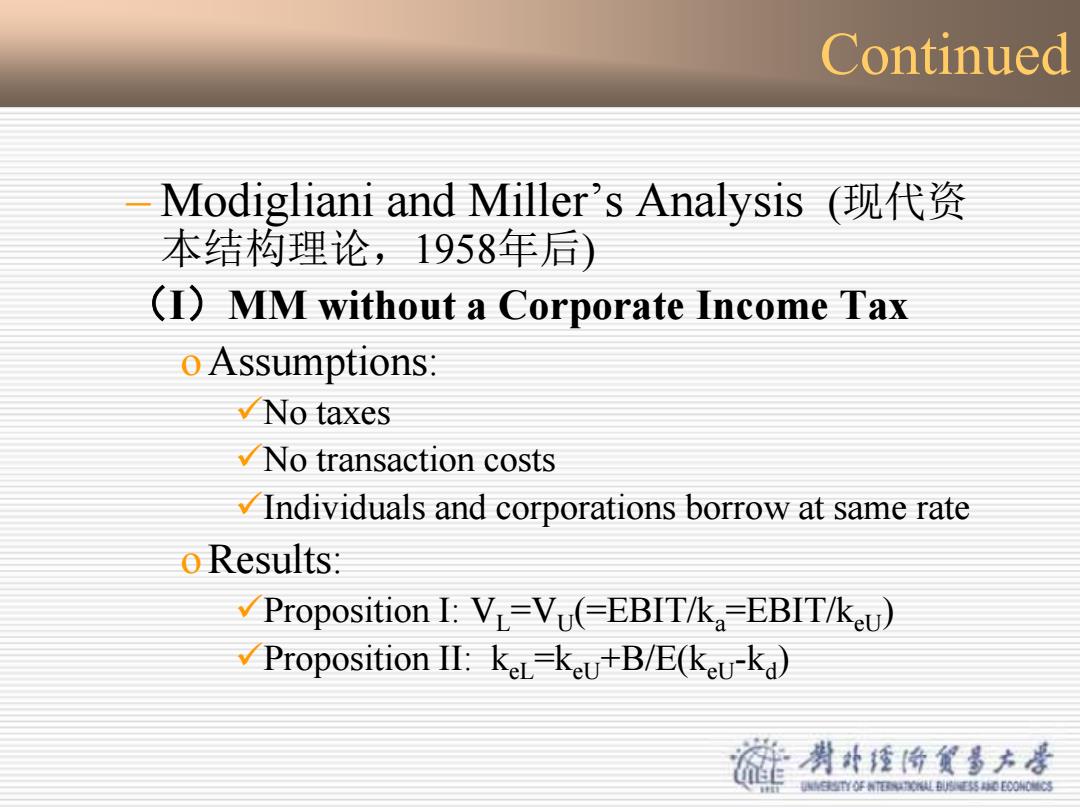

Continued – Modigliani and Miller’s Analysis (现代资 本结构理论,1958年后) (I)MM without a Corporate Income Tax oAssumptions: 9No taxes 9No transaction costs 9Individuals and corporations borrow at same rate oResults: 9Proposition I: VL=VU(=EBIT/ka=EBIT/keU) 9Proposition II: keL=keU+B/E(keU-kd)

Continued Intuition: /Proposition I:Through homemade leverage, Individuals can either duplicate or undo the effects of corporate leverage. Proposition II:The cost of equity rises with leverage,because the risk to equity rises with the leverage. Cost of equity (kL)increases to exactly offset the benefits of more debt financing kd )leaving the cost of capital ka)constant see model 1 剥外校价贫多方号 YO年NEB证事0000

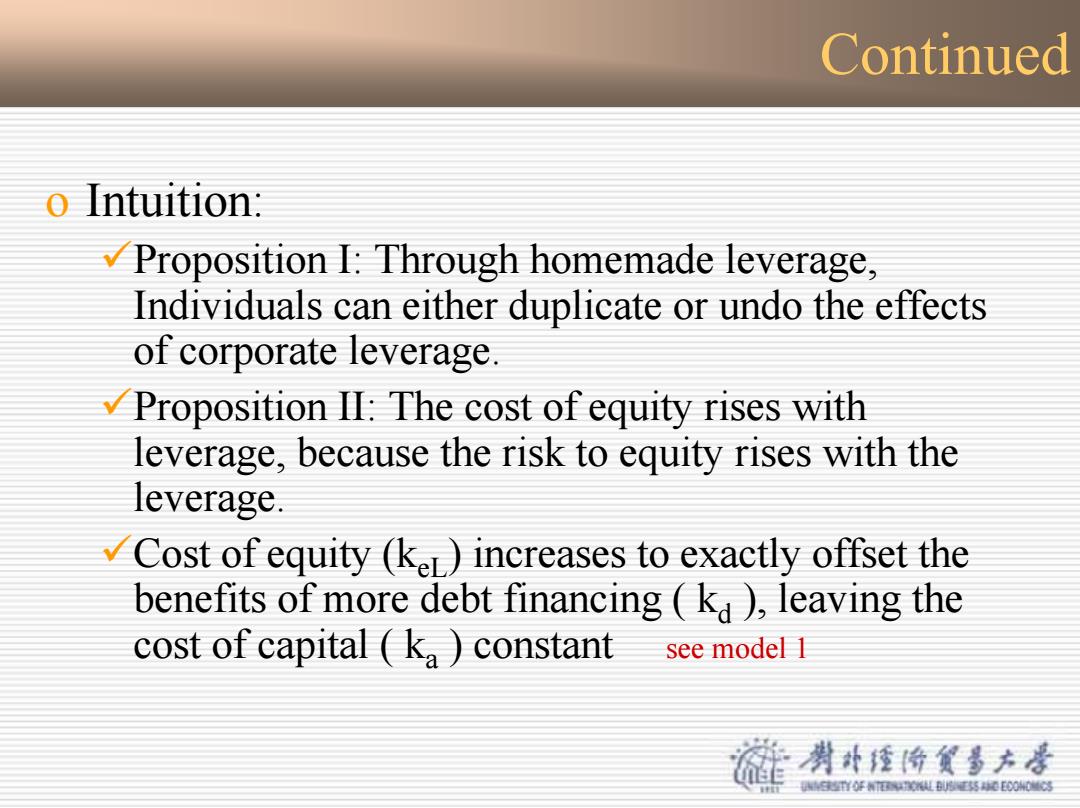

Continued o Intuition: 9Proposition I: Through homemade leverage, Individuals can either duplicate or undo the effects of corporate leverage. 9Proposition II: The cost of equity rises with leverage, because the risk to equity rises with the leverage. 9Cost of equity (keL) increases to exactly offset the benefits of more debt financing ( k d ), leaving the cost of capital ( k a ) constant see model 1

Model 1 Cost k。 of Capital ka k妇 Debt Total Assets The overall cost of capital is independent of the capital structure The firm's value is independent of the capital structure

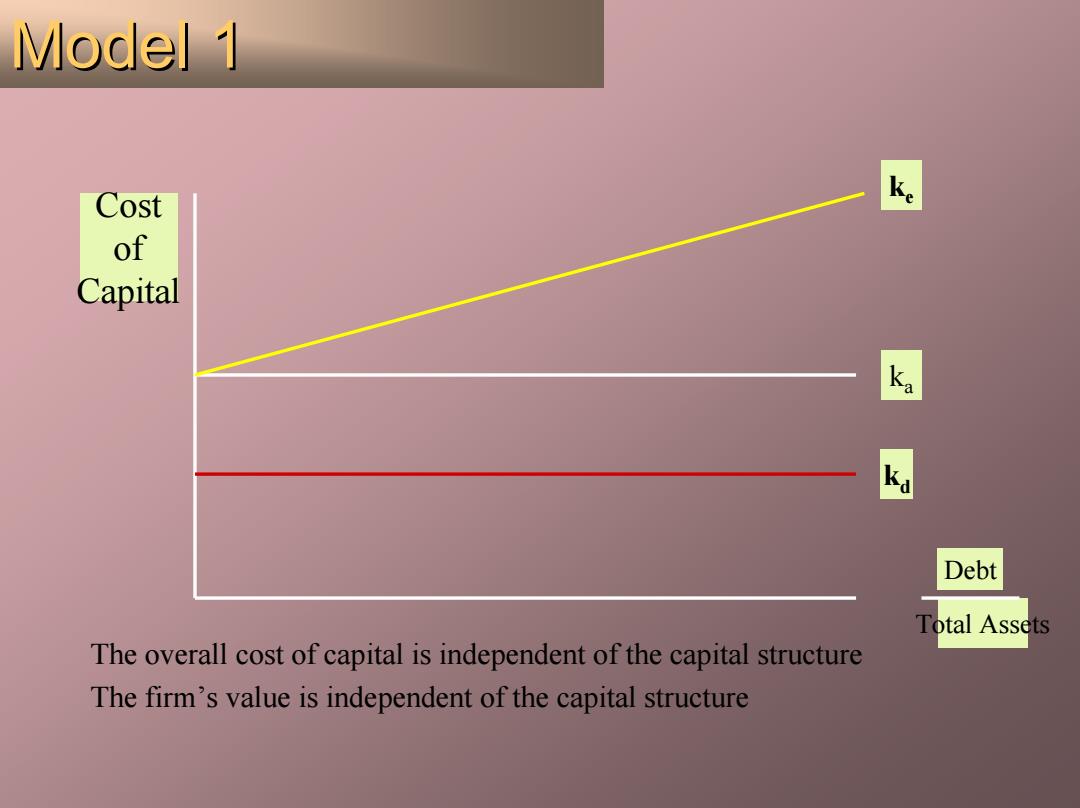

Model 1 Model 1 Cost of Capital Debt Total Assets kd ka ke The overall cost of capital is independent of the capital structure The firm’s value is independent of the capital structure

Continued o MM Arbitrage Proof VU=D/KcU VL=D/KeL I/kd D paid to L's stockholders are reduced by the amount of I paid on the debt k.is higher for L because of the additional leverage-induced risk The values of U and L are identical due to arbitrage 剥外校份贫多方号 YO年N0事0E0003

Continued o MM Arbitrage Proof 9VU = D/ keU 9V L = D/ keL + I/ kd D paid to L’s stockholders are reduced by the amount of I paid on the debt ke is higher for L because of the additional leverage-induced risk The values of U and L are identical due to arbitrage