398 THE AMERICAN ECONOMIC REVIEW JUNE 1980 E.Equilibrium in the Information Market F.Existence of Overall Equilibrium What we have characterized so far is the Theorem 2 is useful,both in proving the equilibrium price distribution for given A. uniqueness of overall equilibrium and in We now define an overall equilibrium to be analyzing comparative statics.Overall equi- a pair (A,P*)such that the expected utility librium,it will be recalled,requires that for of the informed is equal to that of the unin- O<入<1,EV(W)/EV(Wt)=1.But from formed if0<λ<l;入=0 if the expected (13) utility of the informed is less than that of the uninformed at P;A=I if the expected (14) EV(WA) utility of the informed is greater than the EV(W) uninformed at P*.Let (12a)W≡R(Wo-c) Var(u*0) ≡Y(A) +[4-RPx(8,x)]X,(P(0,x),8) Var(u*wa) (12b)W1三RWo Hence overall equilibrium simply requires, for0<λ<1, +[u-RPx(8,x)]X(P(0,x):P*) (15) y()=1 where c is the cost of observing a realization More precisely,we now prove of *Equation(12a)gives the end of period wealth of a trader if he decides to become THEOREM3:If0≤入≤1,Y()=1,andP* informed,while (12b)gives his wealth if he is given by (A10)in Appendix B,then (A,P*) decides to be uninformed.Note that end of is an overall equilibrium.If y(1)<1,then period wealth is random due to the random- (1,P)is an overall equilibrium.If y(0)>1, ness of Woi,u,6,and x. then (0,P)is an overall equilibrium.For all In evaluating the expected utility ofW, price equilibria P,which are monotone func- we do not assume that a trader knows which tions of wx,there exists a unique overall realization of he gets to observe if he equilibrium(入,P). pays c dollars.A trader pays c dollars and then gets to observe some realization of * PROOF: The overall expected utility of W averages The first three sentences follow im- over all possible 0*,e*,x*,and Woi.The mediately from the definition of overall variable Wo:is random for two reasons. equilibrium given above equation (12),and First from(2)it depends on P(,x),which Theorems I and 2.Uniqueness follows from is random as (,x)is random.Secondly,in the monotonicity of y()which follows from what follows we will assume that X,is ran- (All)and (14).The last two sentences in dom. the statement of the theorem follow im- We will show below that EV(W)/ mediately. Ev(W)is independent of i,but is a func- tion of入,a,c,anda.More precisely,.in In the process of proving Theorem 3,we Appendix B we prove have noted THEOREM 2:Under the assumptions of COROLLARY 1:Y(A)is a strictly mono- Theorem 1,and if X:is independent of tone increasing function of A. (u*,0*,x*)then This looks paradoxical;we expect the (13 EV(WA) Var(u*0) ratio of informed to uninformed expected utility to be a decreasing function of A.But, EV(W) Var(u*wa) we have defined utility as negative.Therefore

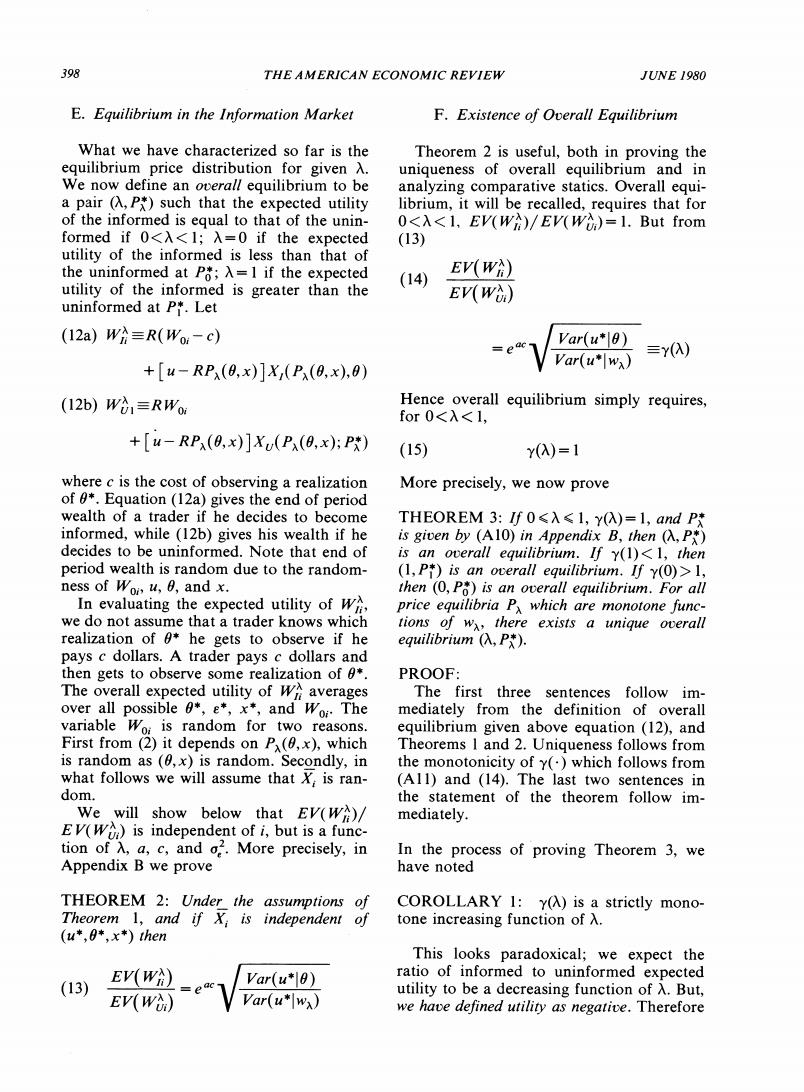

VoL.70N0.3 GROSSMAN AND STIGLITZ:EFFICIENT MARKETS 399 as A rises,the expected utility of informed EV(W) traders does go down relative to uninformed traders. EV(W) Note that the function y(0)=eac(Var(u* 0)/Var u*)1/2.Figure 1 illustrates the de- termination of the equilibrium A.The figure assumes that y(0)<1<y(1). e ac var(u"1e) G.Characterization of Equilibrium vor u We wish to provide some further char- acterization of the equilibrium.Let us define FIGURE 1 (16a) Note that (19)holds for y(0)<I<y(1),since these conditions insure that the equilibrium A is between zero and one.Equation (19b) (16b) n= shows that the equilibrium informativeness of the price system is determined completely by the cost of information c,the quality of Note that m is inversely related to the the informed trader's information n,and the informativeness of the price system since the degree of risk aversion a. squared correlation coefficient between P* and 0*,pa is given by H.Comparative Statics 1 (17) p6=1+m From equation(19b),we immediately ob- tain some basic comparative statics results: Similarly,n is directly related to the quality 1)An increase in the quality of infor- of the informed trader's information be- mation (n)increases the informativeness of cause n/(1+n)is the squared correlation the price system. coefficient between and u*. 2)A decrease in the cost of information Equations (14)and (15)show that the increases the informativeness of the price cost of information c,determines the equi- system. librium ratio of information quality be- 3)A decrease in risk aversion leads tween informed and uninformed traders informed individuals to take larger posi- (Var(u*))/Var(u*wa).From (1),(A11)of tions,and this increases the informativeness Appendix A,and (16),this can be written as of the price system. Further,all other changes in parameters, (18) such that n,a,and c remain constant, do not change the equilibrium degree of in- formativeness of the price system;other Var(u*wx)1+m+nm changes lead only to particular changes in A of a magnitude to exactly offset them.For Substituting(18)into (14)and using (15) example: we obtain,for 0<A<1,in equilibrium 4)An increase in noise (o)increases e2ac-I the proportion of informed traders.At any (19a) m=- given入,an increase in noise reduces the +n-e2ac informativeness of the price system;but it or increases the returns to information and leads more individuals to become informed; the remarkable result obtained above estab- (19b) lishes that the two effects exactly offset each