Coupon Bond Pricing The price of a coupon bond equals the present value of future interest payments plus the present value of the par value (which is returned at maturity) Write the PV of the fixed income security as follows Bond Value PV (Interest,received every year) PV (Par;received at maturity) 2015 Spring SJTU

Coupon Bond Pricing The price of a coupon bond equals the present value of future interest payments plus the present value of the par value (which is returned at maturity) Write the PV of the fixed income security as follows 2015 Spring SJTU 11 Bond Value = PV (Interest, received every year) + PV (Par, received at maturity)

Bond Price and the Discount Rate A change in market interest rates causes a change in the opposite direction in the market values of bonds If i goes up,1+i goes up,(1/(1+i)) goes down then the sum must also go down bond price goes down Similarly,i down->PV up Pr-am” =pm》+m4++m+m4n THE COURSE OF FINANCE 2017 SPRING SJTU

Bond Price and the Discount Rate A change in market interest rates causes a change in the opposite direction in the market values of bonds If i goes up, 1+i goes up, (1/(1+i)) j goes down ,then the sum must also go down ,bond price goes down Similarly, i down -> PV up THE COURSE OF FINANCE 2017 SPRING SJTU 12 n n n n n n n j j j i PAR i pmt i pmt i pmt i pmt i PAR i PV pmt 1 1 1 1 * 1 1 ... * 1 1 * 1 1 * 1 1 1 1 * 1 1 2 2 1 1 1

As to the Discount Rate We need an interest rate (discount rate)to use in pricing bonds formula However,we saw in Chapter 2 that interest rates are a function of time- to-maturity THE COURSE OF FINANCE 2017 SPRING SJTU

As to the Discount Rate We need an interest rate (discount rate) to use in pricing bonds formula However, we saw in Chapter 2 that interest rates are a function of time- to-maturity THE COURSE OF FINANCE 2017 SPRING SJTU 13

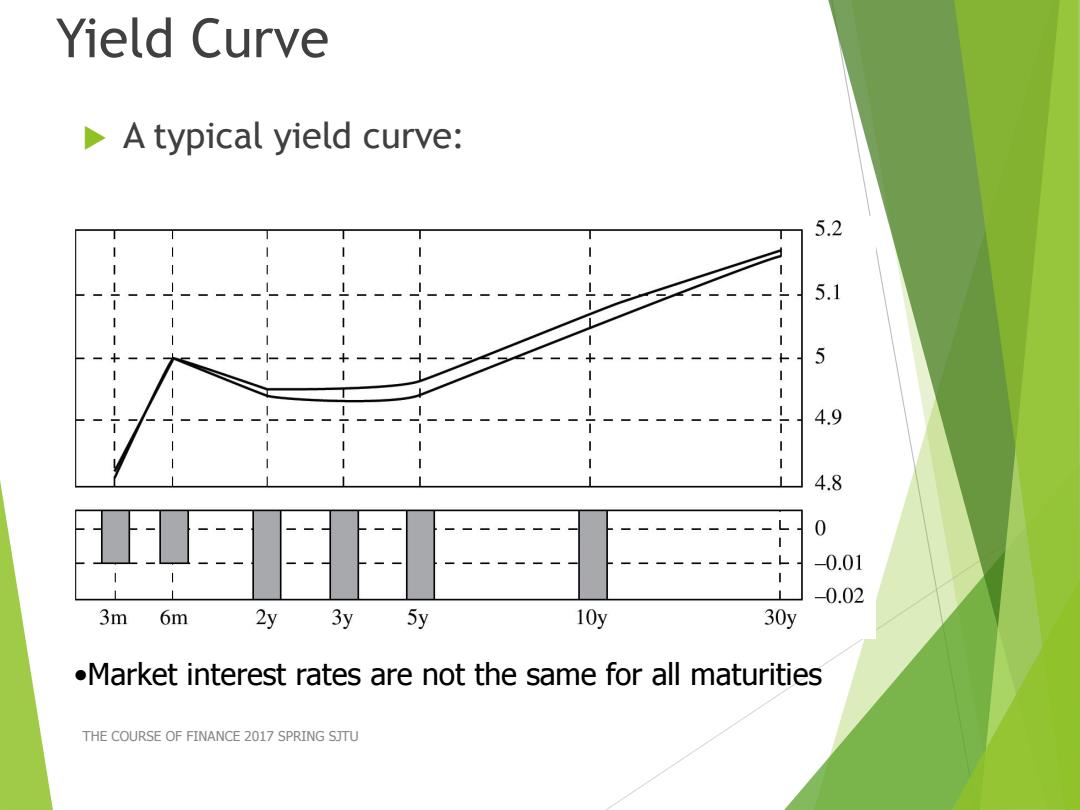

Yield Curve A typical yield curve: 5.2 5.1 5 4.9 4.8 0 -0.01 0.02 3m 6m 2y 3y 5y 10y 30y .Market interest rates are not the same for all maturities THE COURSE OF FINANCE 2017 SPRING SJTU

Yield Curve A typical yield curve: THE COURSE OF FINANCE 2017 SPRING SJTU 14 •Market interest rates are not the same for all maturities