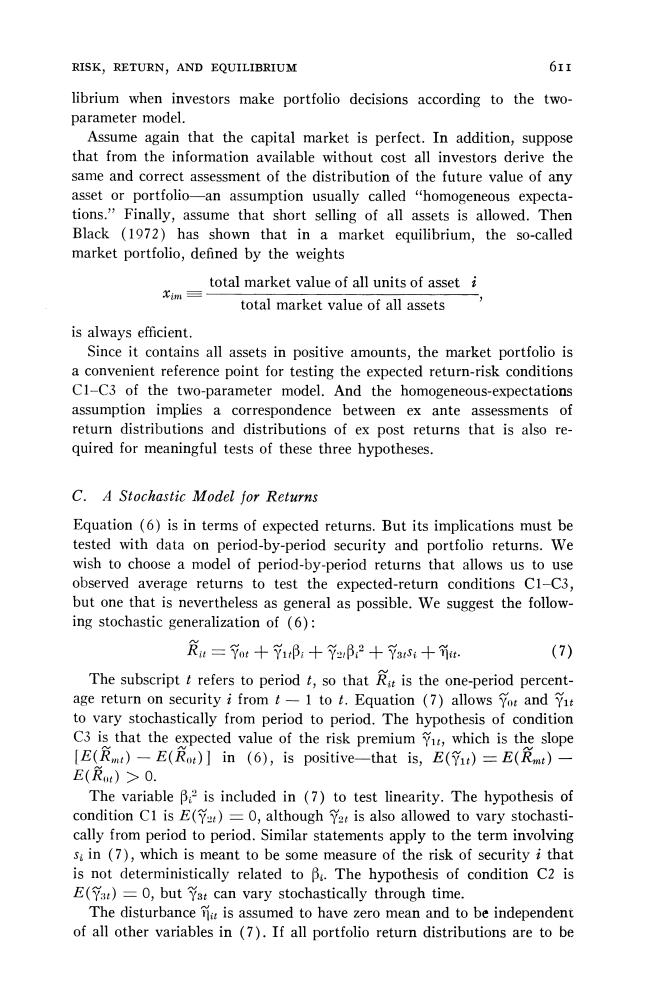

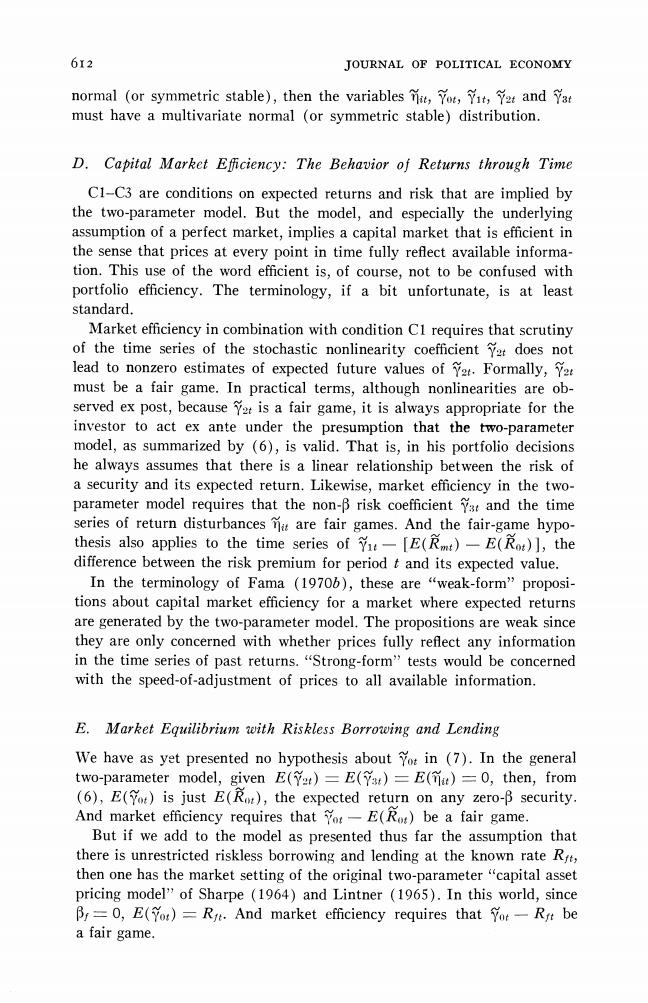

RISK,RETURN,AND EQUILIBRIUM 611 librium when investors make portfolio decisions according to the two- parameter model. Assume again that the capital market is perfect.In addition,suppose that from the information available without cost all investors derive the same and correct assessment of the distribution of the future value of any asset or portfolio-an assumption usually called "homogeneous expecta- tions."Finally,assume that short selling of all assets is allowed.Then Black (1972)has shown that in a market equilibrium,the so-called market portfolio,defined by the weights total market value of all units of asset i xim三 total market value of all assets is always efficient. Since it contains all assets in positive amounts,the market portfolio is a convenient reference point for testing the expected return-risk conditions C1-C3 of the two-parameter model.And the homogeneous-expectations assumption implies a correspondence between ex ante assessments of return distributions and distributions of ex post returns that is also re- quired for meaningful tests of these three hypotheses. C.A Stochastic Model for Returns Equation(6)is in terms of expected returns.But its implications must be tested with data on period-by-period security and portfolio returns.We wish to choose a model of period-by-period returns that allows us to use observed average returns to test the expected-return conditions C1-C3, but one that is nevertheless as general as possible.We suggest the follow- ing stochastic generalization of (6): a=ot+71B:+Yβ:2+7s+it. (7) The subscript t refers to period t,so that R is the one-period percent- age return on security i from t-1 to t.Equation (7)allows yot and Yit to vary stochastically from period to period.The hypothesis of condition C3 is that the expected value of the risk premium,which is the slope [E(Rmt)-E(Rot)in (6),is positive-that is,E()=E(Rit)- E()>0. The variable Bis included in (7)to test linearity.The hypothesis of condition C1 is E()=0,although 2 is also allowed to vary stochasti- cally from period to period.Similar statements apply to the term involving s in (7),which is meant to be some measure of the risk of security i that is not deterministically related to B.The hypothesis of condition C2 is E(Yat)=0,but Yat can vary stochastically through time. The disturbance ne is assumed to have zero mean and to be independent of all other variables in (7).If all portfolio return distributions are to be

612 JOURNAL OF POLITICAL ECONOMY normal (or symmetric stable),then the variables n,Tot,Yt,and Yat must have a multivariate normal (or symmetric stable)distribution. D.Capital Market Eficiency:The Behavior of Returns through Time C1-C3 are conditions on expected returns and risk that are implied by the two-parameter model.But the model,and especially the underlying assumption of a perfect market,implies a capital market that is efficient in the sense that prices at every point in time fully reflect available informa- tion.This use of the word efficient is,of course,not to be confused with portfolio efficiency.The terminology,if a bit unfortunate,is at least standard. Market efficiency in combination with condition Cl requires that scrutiny of the time series of the stochastic nonlinearity coefficient ya does not lead to nonzero estimates of expected future values of Y2t.Formally, must be a fair game.In practical terms,although nonlinearities are ob- served ex post,becauseis a fair game,it is always appropriate for the investor to act ex ante under the presumption that the two-parameter model,as summarized by (6),is valid.That is,in his portfolio decisions he always assumes that there is a linear relationship between the risk of a security and its expected return.Likewise,market efficiency in the two- parameter model requires that the non-B risk coefficient Yat and the time series of return disturbances Ta are fair games.And the fair-game hypo- thesis also applies to the time series of Y-[E(R)-E(Rot)],the difference between the risk premium for period t and its expected value. In the terminology of Fama (19706),these are "weak-form"proposi- tions about capital market efficiency for a market where expected returns are generated by the two-parameter model.The propositions are weak since they are only concerned with whether prices fully reflect any information in the time series of past returns."Strong-form"tests would be concerned with the speed-of-adjustment of prices to all available information. E.Market Equilibrium with Riskless Borrowing and Lending We have as yet presented no hypothesis about Yo in (7).In the general two-parameter model,given E()=E()=E(n)=0,then,from (6),E(T)is just E(Rot),the expected return on any zero-B security. And market efficiency requires that Yr-E(Rot)be a fair game. But if we add to the model as presented thus far the assumption that there is unrestricted riskless borrowing and lending at the known rate Rst, then one has the market setting of the original two-parameter "capital asset pricing model"of Sharpe (1964)and Lintner (1965).In this world,since Bs=0,E(Yo)=Rst.And market efficiency requires that Yot-Rrt be a fair game

RISK,RETURN,AND EQUILIBRIUM 613 It is well to emphasize that to refute the proposition that E(Yot)=Ryt is only to refute a specific two-parameter model of market equilibrium. Our view is that tests of conditions C1-C3 are more fundamental.We regard C1-C3 as the general expected return implications of the two- parameter model in the sense that they are the implications of the fact that in the two-parameter portfolio model investors hold efficient portfolios, and they are consistent with any two-parameter model of market equi- librium in which the market portfolio is efficient. F.The Hypotheses To summarize,given the stochastic generalization of (2)and (6)that is provided by (7),the testable implications of the two-parameter model for expected returns are: C1 (linearity)-E(Y2t)=0. C2 (no systematic effects of non-B risk)-E()=0. C3 (positive expected return-risk tradeoff)-E()=E()- E(驳r)>0. Sharpe-Lintner (S-L)Hypothesis-E(Yot)=Rst. Finally,capital market efficiency in a two-parameter world requires ME (market efficiency)-the stochastic coefficients,,- [E(R)-E(Ror)1,Yor-E(Rot),and the disturbances fit are fair games.4 III.Previous Work The earliest tests of the two-parameter model were done by Douglas (1969),whose results seem to refute condition C2.In annual and quarterly return data,there seem to be measures of risk,in addition to B,that con- tribute systematically to observed average returns.These results,if valid, are inconsistent with the hypothesis that investors attempt to hold efficient portfolios.Assuming that the market portfolio is efficient,premiums are paid for risks that do not contribute to the risk of an efficient portfolio Miller and Scholes (1972)take issue both with Douglas's statistical techniques and with his use of annual and quarterly data.Using different methods and simulations,they show that Douglas's negative results could be expected even if condition C2 holds.Condition C2 is tested below with extensive monthly data,and this avoids almost all of the problems dis- cussed by Miller and Scholes. 4 If and are fair games,then E()=E(Ya)=0.Thus,C1 and C2 are implied by ME.Keeping the expected return conditions separate,however,better emphasizes the economic basis of the various hypotheses. 5 A comprehensive survey of empirical and theoretical work on the two-parameter model is in Jensen (1972)

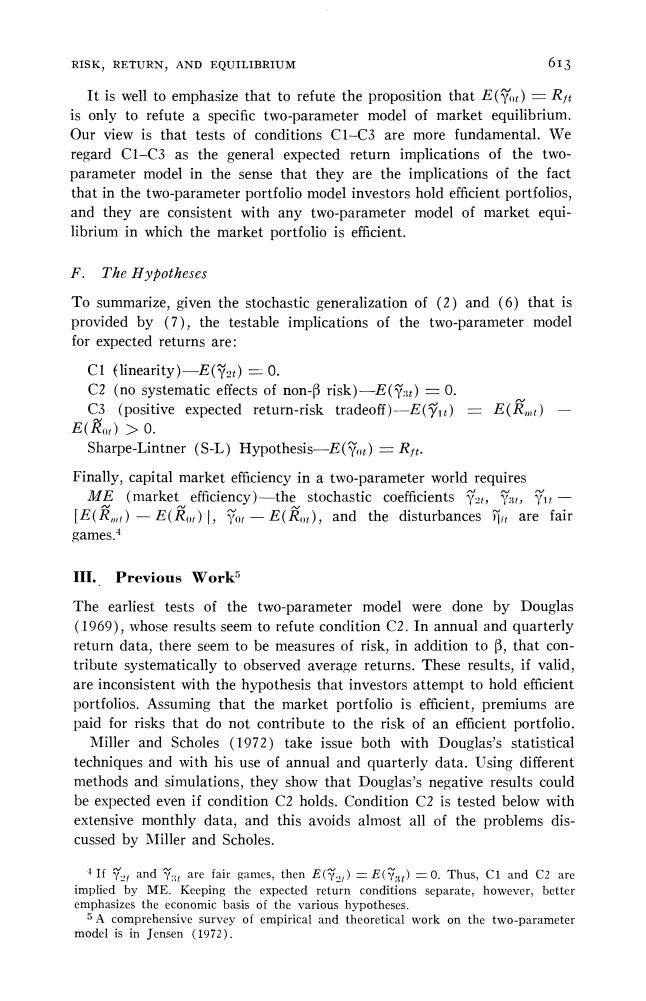

614 JOURNAL OF POLITICAL ECONOMY Much of the available empirical work on the two-parameter model is concerned with testing the S-L hypothesis that E(Y)=Rs.The tests of Friend and Blume (1970)and those of Black,Jensen,and Scholes (1972) indicate that,at least in the period since 1940,on average To is system- atically greater than R.The results below support this conclusion. In the empirical literature to date,the importance of the linearity condi- tion CI has been largely overlooked.Assuming that the market portfolio m is efficient,if E()in (7)is positive,the prices of high-B securities are on average too low-their expected returns are too high-relative to those of low-B securities,while the reverse holds if E()is negative.In short,if the process of price formation in the capital market reflects the attempts of investors to hold efficient portfolios,then the linear relation- ship of (6)between expected return and risk must hold. Finally,the previous empirical work on the two-parameter model has not been concerned with tests of market efficiency. IV.Methodology The data for this study are monthly percentage returns (including divi- dends and capital gains,with the appropriate adjustments for capital changes such as splits and stock dividends)for all common stocks traded on the New York Stock Exchange during the period January 1926 through June 1968.The data are from the Center for Research in Security Prices of the University of Chicago. A.General Approach Testing the two-parameter model immediately presents an unavoidable "errors-in-the-variables"problem:The efficiency condition or expected return-risk equation (6)is in terms of true values of the relative risk measure Bi,but in empirical tests estimates,Bi,must be used.In this paper (,m) 三 2(m) where(R,n)and()are estimates of cov(,飞n)ando(之m) obtained from monthly returns,and where the proxy chosen for Rm is "Fisher's Arithmetic Index,"an equally weighted average of the returns on all stocks listed on the New York Stock Exchange in month t.The properties of this index are analyzed in Fisher (1966). Blume (1970)shows that for any portfolio defined by the weights p,i=1,2,.,·,N, (R,n) 6(Rm) =1 xipRm) 1

RISK,RETURN,AND EQUILIBRIUM 615 If the errors in the B are substantially less than perfectly positively cor- related,the B's of portfolios can be much more precise estimates of true B's than the B's for individual securities. To reduce the loss of information in the risk-return tests caused by using portfolios rather than individual securities,a wide range of values of portfolio B's is obtained by forming portfolios on the basis of ranked values of B:for individual securities.But such a procedure,naively exe- cuted could result in a serious regression phenomenon.In a cross section of Bi,high observed B.tend to be above the corresponding true B:and low observed B:tend to be below the true B.Forming portfolios on the basis of ranked B:thus causes bunching of positive and negative sampling errors within portfolios.The result is that a large portfolio B would tend to over- state the true B,while a low B would tend to be an underestimate. The regression phenomenon can be avoided to a large extent by forming portfolios from ranked B:computed from data for one time period but then using a subsequent period to obtain the Bp for these portfolios that are used to test the two-parameter model.With fresh data,within a portfolio errors in the individual security B:are to a large extent random across securities,so that in a portfolio Bp the effects of the regression phenomenon are,it is hoped,minimized.6 B.Details The specifics of the approach are as follows.Let N be the total number of securities to be allocated to portfolios and let int(N/20)be the largest integer equal to or less than N/20.Using the first 4 years (1926-29)of monthly return data,20 portfolios are formed on the basis of ranked B for individual securities.The middle 18 portfolios each has int(N/20) securities.If N is even,the first and last portfolios each has int(N/20) IN-20 int(N/20)]securities.The last (highest B)portfolio gets an additional security if N is odd. The following 5 years (1930-34)of data are then used to recompute the B,and these are averaged across securities within portfolios to obtain 20 initial portfolio for the risk-return tests.The subscript t is added to indicate that each month t of the following four years (1935-38)these Bare recomputed as simple averages of individual security Bi,thus ad- justing the portfolio Bot month by month to allow for delisting of securi- ties.The component B:for securities are themselves updated yearly-that 6The errors-in-the-variables problem and the technique of using portfolios to solve it were first pointed out by Blume (1970).The portfolio approach is also used by Friend and Blume (1970)and Black,Jensen,and Scholes (1972).The regression phenomenon that arises in risk-return tests was first recognized by Blume (1970) and then by Black,Jensen,and Scholes (1972),who offer a solution to the problem that is similar in spirit to ours