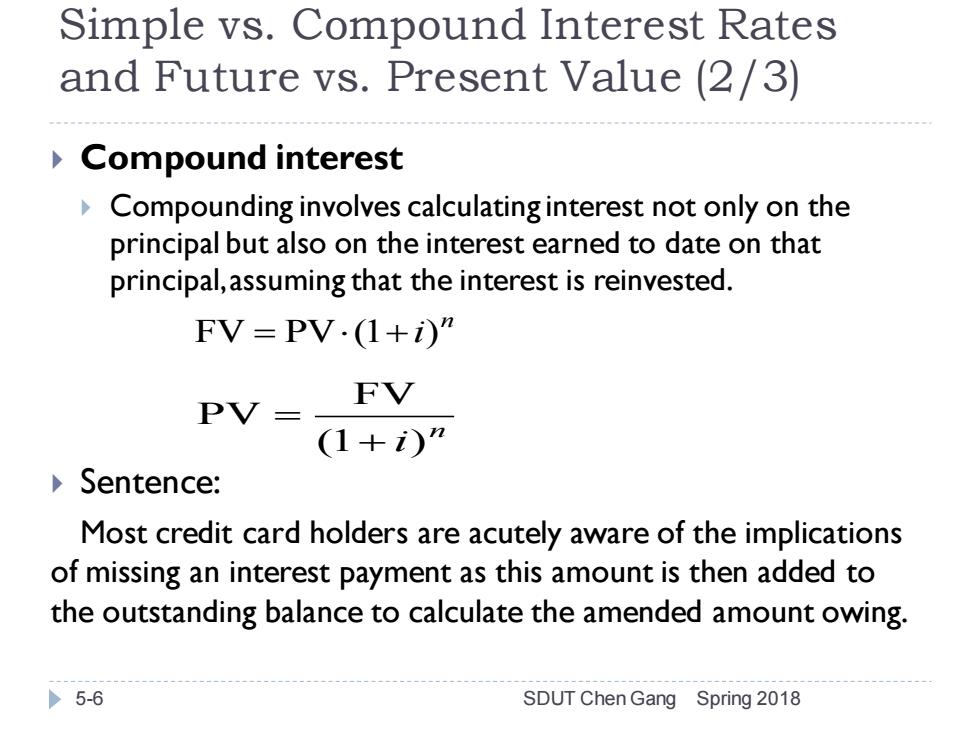

Simple vs.Compound Interest Rates and Future vs.Present Value (2/3) Compound interest Compounding involves calculating interest not only on the principal but also on the interest earned to date on that principal,assuming that the interest is reinvested. FV=PV.(1+i)” FV PV= (1+)” Sentence: Most credit card holders are acutely aware of the implications of missing an interest payment as this amount is then added to the outstanding balance to calculate the amended amount owing. ,5-6 SDUT Chen Gang Spring 2018

Simple vs. Compound Interest Rates and Future vs. Present Value (2/3) Compound interest Compounding involves calculating interest not only on the principal but also on the interest earned to date on that principal, assuming that the interest is reinvested. Sentence: Most credit card holders are acutely aware of the implications of missing an interest payment as this amount is then added to the outstanding balance to calculate the amended amount owing. 5-6 SDUT Chen Gang Spring 2018 FV PV (1 )n = +i FV PV (1 )n i = +

Simple vs.Compound Interest Rates and Future vs.Present Value (3/3) Future Value (FV) Present Value (PV) discount rate opportunity cost,required rate of return,and the cost of capital. >5-7 SDUT Chen Gang Spring 2018

Simple vs. Compound Interest Rates and Future vs. Present Value (3/3) Future Value (FV) Present Value (PV) discount rate opportunity cost, required rate of return, and the cost of capital. 5-7 SDUT Chen Gang Spring 2018

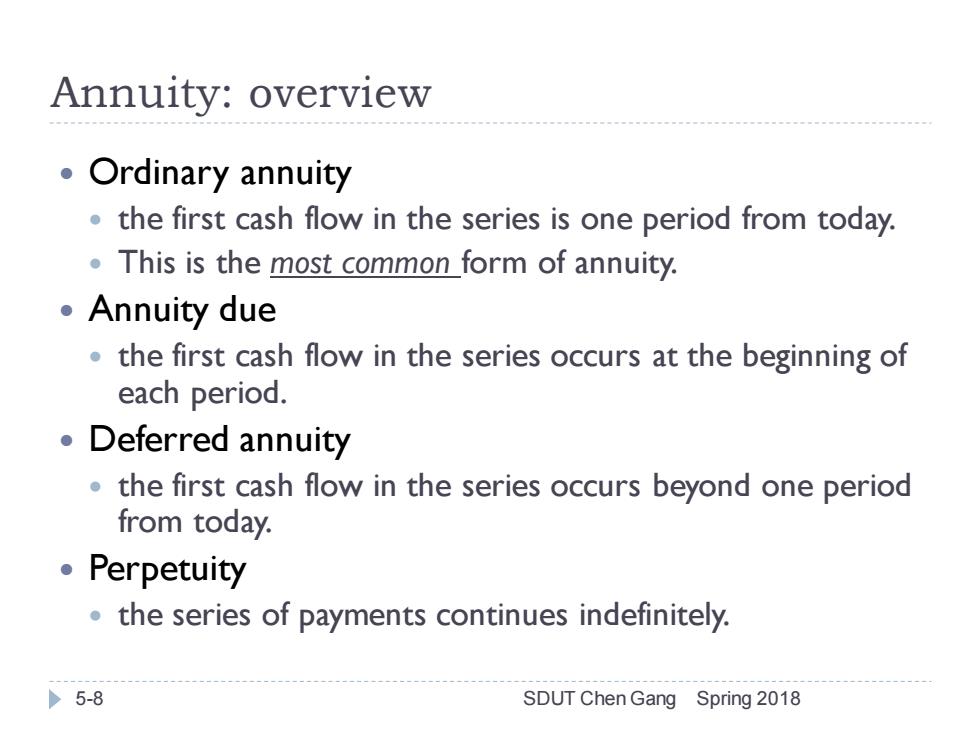

Annuity:overview 。Ordinary annuity the first cash flow in the series is one period from today. This is the most common form of annuity. 。Annuity due the first cash flow in the series occurs at the beginning of each period. Deferred annuity the first cash flow in the series occurs beyond one period from today. 。Perpetuity the series of payments continues indefinitely. >5-8 SDUT Chen Gang Spring 2018

Annuity: overview Ordinary annuity the first cash flow in the series is one period from today. This is the most common form of annuity. Annuity due the first cash flow in the series occurs at the beginning of each period. Deferred annuity the first cash flow in the series occurs beyond one period from today. Perpetuity the series of payments continues indefinitely. 5-8 SDUT Chen Gang Spring 2018

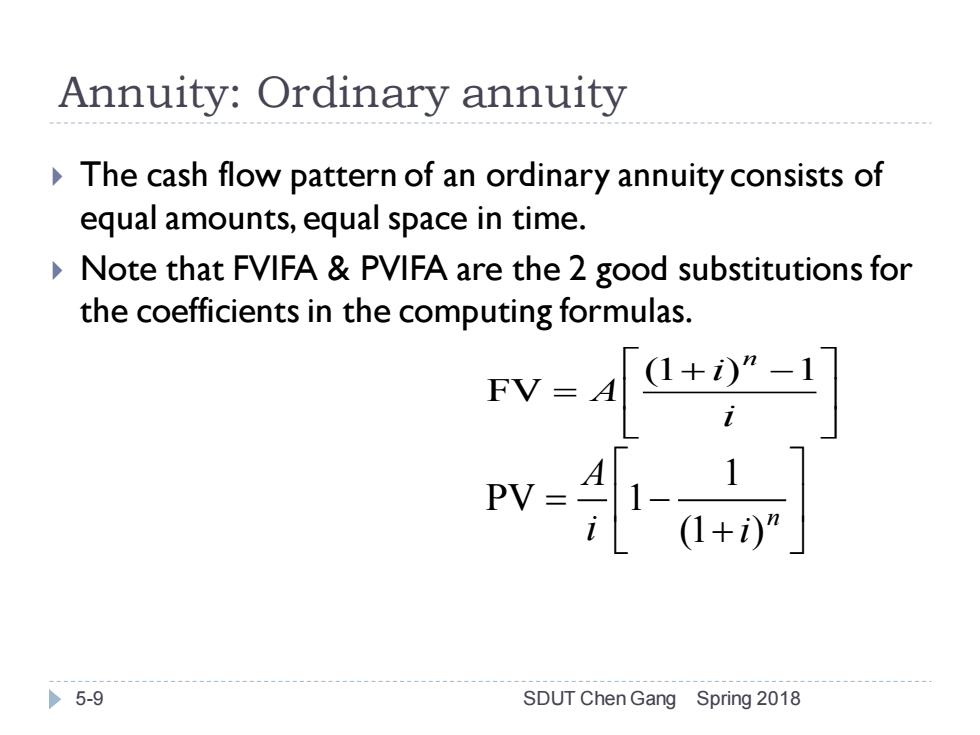

Annuity:Ordinary annuity The cash flow pattern of an ordinary annuity consists of equal amounts,equal space in time. Note that FVIFA PVIFA are the 2 good substitutions for the coefficients in the computing formulas. tv-1 >5-9 SDUT Chen Gang Spring 2018

Annuity: Ordinary annuity The cash flow pattern of an ordinary annuity consists of equal amounts, equal space in time. Note that FVIFA & PVIFA are the 2 good substitutions for the coefficients in the computing formulas. (1 ) 1 FV n i A i + − = 1 PV 1 (1 )n A i i = − + 5-9 SDUT Chen Gang Spring 2018

Annuity due The distinguishing factor with an annuity due is the fact that the first cash flow immediate occurs on the valuation date. The only material difference between an ordinary annuity and an annuity due is the timing of the cash flows Therefore,the correct adjustment for an annuity due is to reduce the discounting factor by one and to add to the reduced calculation a non-discounted cash flow stream 》误译:所以,对先付年全的正确判断一方面是为了降低贴现因素,另一 方面是为了增加非贴现现全流减少的计算。 》参考:所以,对先付年金的正确(纠正差异的)调整是这样的,即,将 其折现系数减去1(按普通年全现值系数的折现期数减1),在系数减1之后 的计算中再加上一期未经折现的现全流量。 >5-10 SDUT Chen Gang Spring 2018

Annuity due The distinguishing factor with an annuity due is the fact that the first cash flow immediate occurs on the valuation date. The only material difference between an ordinary annuity and an annuity due is the timing of the cash flows Therefore, the correct adjustment for an annuity due is to reduce the discounting factor by one and to add to the reduced calculation a non-discounted cash flow stream 误译:所以,对先付年金的正确判断一方面是为了降低贴现因素,另一 方面是为了增加非贴现现金流减少的计算。 参考:所以,对先付年金的正确(纠正差异的)调整是这样的,即,将 其折现系数减去1(按普通年金现值系数的折现期数减1),在系数减1之后 的计算中再加上一期未经折现的现金流量。 5-10 SDUT Chen Gang Spring 2018