Target replacement rate of pre-retirement income First compute the retirement income.Many experts recommend a rate of 75%of the pre-retirement income. $30,000*0.75=522,500/year using your calculator compute the present value of the retirement funds as an regular annuity n=15,i=3,V=0,PMT=-22,500->PV=268,604 .THE COURSE OF FINANCE 2017 SPRING SJTU 6

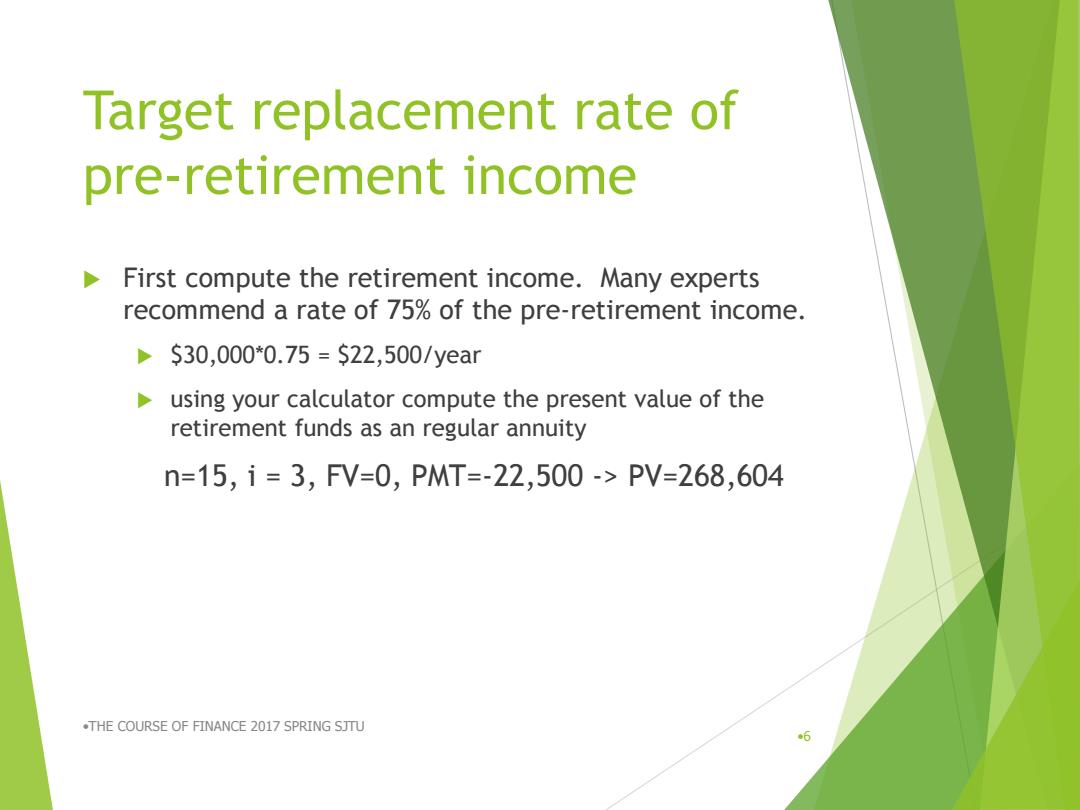

Target replacement rate of pre-retirement income First compute the retirement income. Many experts recommend a rate of 75% of the pre-retirement income. $30,000*0.75 = $22,500/year using your calculator compute the present value of the retirement funds as an regular annuity n=15, i = 3, FV=0, PMT=-22,500 -> PV=268,604 •THE COURSE OF FINANCE 2017 SPRING SJTU •6

Target replacement rate of pre-retirement income (Cont. Next compute the retirement income Next compute how much you need to save each year n=30,i=3,PV=0,FV=-268,604-> PMT=5,646 To obtain a real $22,500 you need to save $5,646 per year! .THE COURSE OF FINANCE 2017 SPRING SJTU

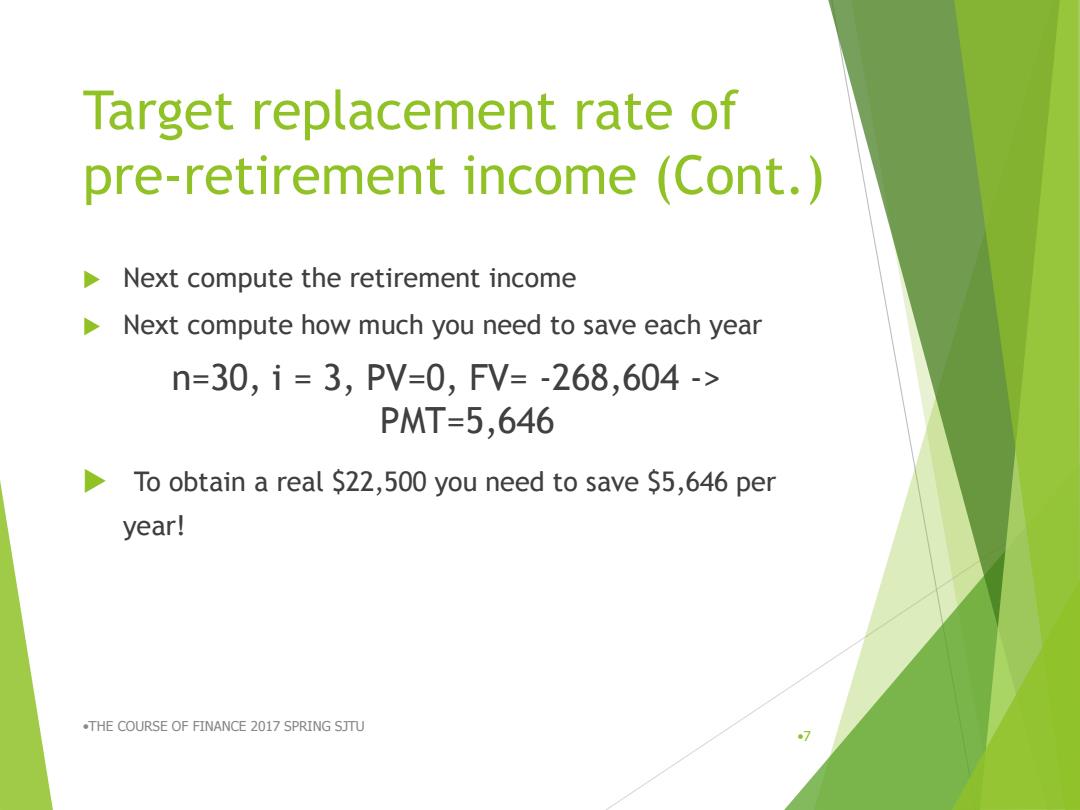

Target replacement rate of pre-retirement income (Cont.) Next compute the retirement income Next compute how much you need to save each year n=30, i = 3, PV=0, FV= -268,604 -> PMT=5,646 To obtain a real $22,500 you need to save $5,646 per year! •THE COURSE OF FINANCE 2017 SPRING SJTU •7

Target replacement rate Conclusion You will have noticed that your pre-retirement consumption is $30,000-$5,646 24,354;but the real retirement income is only $22,500 The next method equates consumption .THE COURSE OF FINANCE 2017 SPRING SJTU 8

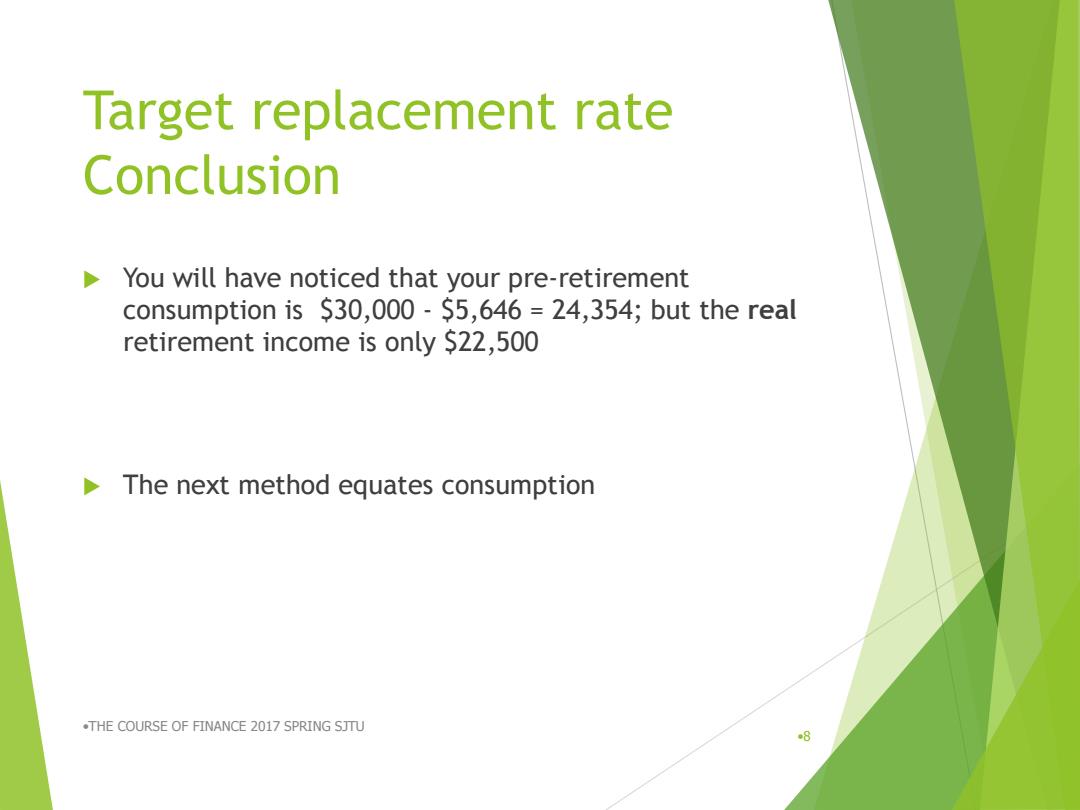

Target replacement rate Conclusion You will have noticed that your pre-retirement consumption is $30,000 - $5,646 = 24,354; but the real retirement income is only $22,500 The next method equates consumption •THE COURSE OF FINANCE 2017 SPRING SJTU •8

Maintain the same level of consumption spending Assume that your level of real consumption is C The present value of consumption over the next 45 years must equal the present value of earnings over the next 30 years Step 1:compute the total PV of income. n=30,i=3%PMT=3,000,then PV=588,013.24 Step 2:compute the equal spending for 45 years n=45i=3%,PV=588,013.24,then PMT=S23,982 Step3:The savings are then $30,000-$23,982 S6,018 for 30 years. .THE COURSE OF FINANCE 2017 SPRING SJTU 9

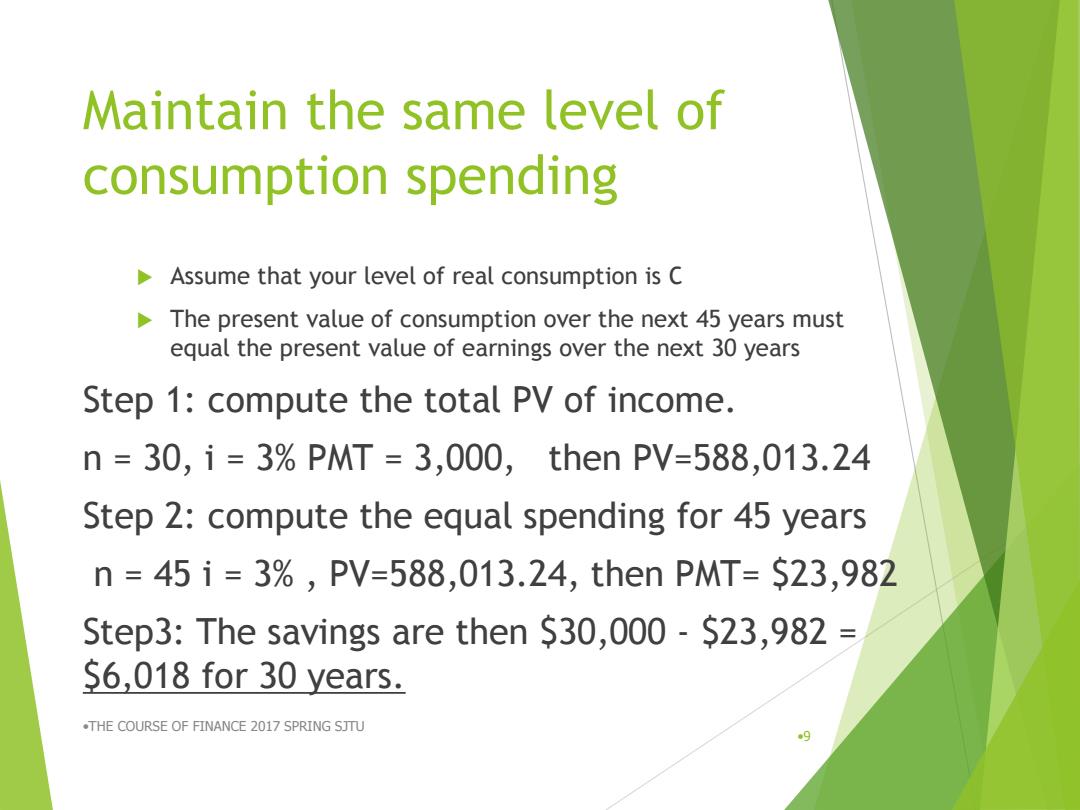

Maintain the same level of consumption spending Assume that your level of real consumption is C The present value of consumption over the next 45 years must equal the present value of earnings over the next 30 years Step 1: compute the total PV of income. n = 30, i = 3% PMT = 3,000, then PV=588,013.24 Step 2: compute the equal spending for 45 years n = 45 i = 3% , PV=588,013.24, then PMT= $23,982 Step3: The savings are then $30,000 - $23,982 = $6,018 for 30 years. •THE COURSE OF FINANCE 2017 SPRING SJTU •9

Human Capital and Permanent Income Human capital The present value of one's future labor income Permanent income The constant level of(real)consumption (such as C in the formula)spending that has a present value equal to one's human capital 5 30 C (1+2)= (1+) Human capital .THE COURSE OF FINANCE 2017 SPRING SJTU 10

Human Capital and Permanent Income Human capital The present value of one’s future labor income Permanent income The constant level of (real) consumption (such as C in the formula)spending that has a present value equal to one’s human capital •THE COURSE OF FINANCE 2017 SPRING SJTU •10 Human capital