where TR is the investor's coefficient of relative risk tolerance.Equation(10)implies that the risk premium on the domestic market portfolio increases with the variance of the return of the domestic market.This equation has been the basis for a large literature starting from Merton (1980).However,equation(2)provides a different formula for the risk premium on the domestic market portfolio: E(ra)-r=B [E(r )-r]. (11) With equation(11),the risk premium on the domestic market portfolio depends on its world beta.Since stock markets typically have a positive correlation with the world market portfolio,an increase in the variance of the domestic market portfolio will increase its risk premium.However, if one were to look at the cross-section of expected returns across national stock markets,there is no reason for markets with higher variances to have higher risk premiums since a higher variance for a country's market portfolio does not imply that the country's market has a higher correlation with the world market portfolio.In fact,one would expect the opposite,in that emerging markets tend to have high variances but low correlations with the world market portfolio (see Harvey, 1995).So far,we considered a one-period model.If one is willing to assume that equation (11) holds each period,the volatility of the domestic market portfolio could increase at the same time that the risk premium on the domestic market portfolio could fall.This could happen because the correlation of the domestic market portfolio with the world market portfolio falls or the risk premium on the world market portfolio falls. 2.B.Different Consumption Opportunity Sets Across Countries In the previous section,we considered a model where all investors have the same consumption opportunity set.In such a model,the residence of an investor who maximizes the 9

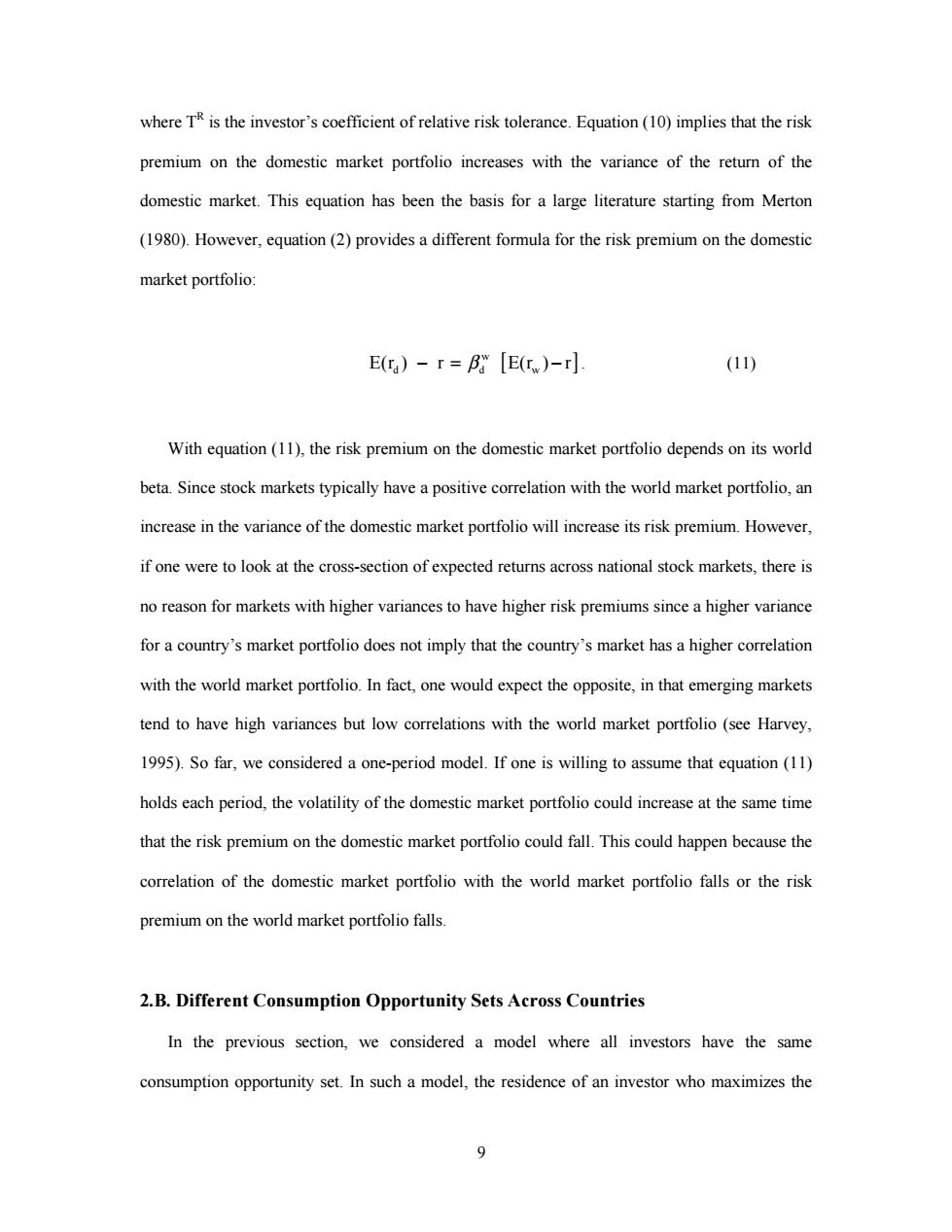

9 where TR is the investor’s coefficient of relative risk tolerance. Equation (10) implies that the risk premium on the domestic market portfolio increases with the variance of the return of the domestic market. This equation has been the basis for a large literature starting from Merton (1980). However, equation (2) provides a different formula for the risk premium on the domestic market portfolio: [ ] w E(r ) r E(r ) r d dw −= − β . (11) With equation (11), the risk premium on the domestic market portfolio depends on its world beta. Since stock markets typically have a positive correlation with the world market portfolio, an increase in the variance of the domestic market portfolio will increase its risk premium. However, if one were to look at the cross-section of expected returns across national stock markets, there is no reason for markets with higher variances to have higher risk premiums since a higher variance for a country’s market portfolio does not imply that the country’s market has a higher correlation with the world market portfolio. In fact, one would expect the opposite, in that emerging markets tend to have high variances but low correlations with the world market portfolio (see Harvey, 1995). So far, we considered a one-period model. If one is willing to assume that equation (11) holds each period, the volatility of the domestic market portfolio could increase at the same time that the risk premium on the domestic market portfolio could fall. This could happen because the correlation of the domestic market portfolio with the world market portfolio falls or the risk premium on the world market portfolio falls. 2.B. Different Consumption Opportunity Sets Across Countries In the previous section, we considered a model where all investors have the same consumption opportunity set. In such a model, the residence of an investor who maximizes the

expected utility of terminal wealth and whose terminal wealth consists only of the value of securities held is irrelevant.In the presence of inflation,purchasing power parity must hold under such conditions.With purchasing power parity,a percentage depreciation of the domestic currency is offset by an equivalent percentage increase in domestic prices.There is a large literature in international economics that documents that purchasing power parity does not hold- at least for countries with moderate and low inflation.3 The assumption that consumption opportunity sets are the same across countries is stronger than the assumption of purchasing power parity.It requires that the relative price of any two consumption goods be the same in each country at all times.Even with purchasing power parity holding,it would be possible that a particular good is not available in one country but is available in another country.The law of one price would not apply for that good even though it has to apply for every good when all investors have the same consumption opportunity set.The empirical evidence shows that there are significant departures from the law of one price across as well as within countries,but keeping distance constant,the departures are more volatile across countries than within countries. A simple way to model a world with departures from the law of one price is to assume that there is a different consumption good in each country.3 This approach was first used by Solnik (1974)to derive an asset pricing model where foreign exchange rate risk is priced.Such an assumption implies that trade takes place in intermediate goods.Solnik(1974)assumes that there is no inflation,so that the price of the consumption good in a country is fixed and the price of a foreign currency is simply the price of the foreign good in terms of the domestic good.With such 3 Froot and Rogoff(1995)state that"price level movements do not begin to offset exchange rate swings on a monthly or even annual basis."(p.1648).In a comprehensive study using 64 real exchange rates, O'Connell (1998)concludes that"no evidence against the random walk null can be found." 4 See Froot and Rogoff(1995)and Sarno and Taylor(2001)for reviews of the evidence.Engel and Rogers (1996)examine deviations from the law of one price across cities in the U.S.and Canada.They find that the volatility of deviations increases as distance between two cities increases but there is also a substantial border effect on this volatility. 10

10 expected utility of terminal wealth and whose terminal wealth consists only of the value of securities held is irrelevant. In the presence of inflation, purchasing power parity must hold under such conditions. With purchasing power parity, a percentage depreciation of the domestic currency is offset by an equivalent percentage increase in domestic prices. There is a large literature in international economics that documents that purchasing power parity does not hold – at least for countries with moderate and low inflation.3 The assumption that consumption opportunity sets are the same across countries is stronger than the assumption of purchasing power parity. It requires that the relative price of any two consumption goods be the same in each country at all times. Even with purchasing power parity holding, it would be possible that a particular good is not available in one country but is available in another country. The law of one price would not apply for that good even though it has to apply for every good when all investors have the same consumption opportunity set. The empirical evidence shows that there are significant departures from the law of one price across as well as within countries, but keeping distance constant, the departures are more volatile across countries than within countries.4 A simple way to model a world with departures from the law of one price is to assume that there is a different consumption good in each country.5 This approach was first used by Solnik (1974) to derive an asset pricing model where foreign exchange rate risk is priced. Such an assumption implies that trade takes place in intermediate goods. Solnik (1974) assumes that there is no inflation, so that the price of the consumption good in a country is fixed and the price of a foreign currency is simply the price of the foreign good in terms of the domestic good. With such 3 Froot and Rogoff (1995) state that “price level movements do not begin to offset exchange rate swings on a monthly or even annual basis.” (p. 1648). In a comprehensive study using 64 real exchange rates, O’Connell (1998) concludes that “no evidence against the random walk null can be found.” 4 See Froot and Rogoff (1995) and Sarno and Taylor (2001) for reviews of the evidence. Engel and Rogers (1996) examine deviations from the law of one price across cities in the U.S. and Canada. They find that the volatility of deviations increases as distance between two cities increases but there is also a substantial border effect on this volatility

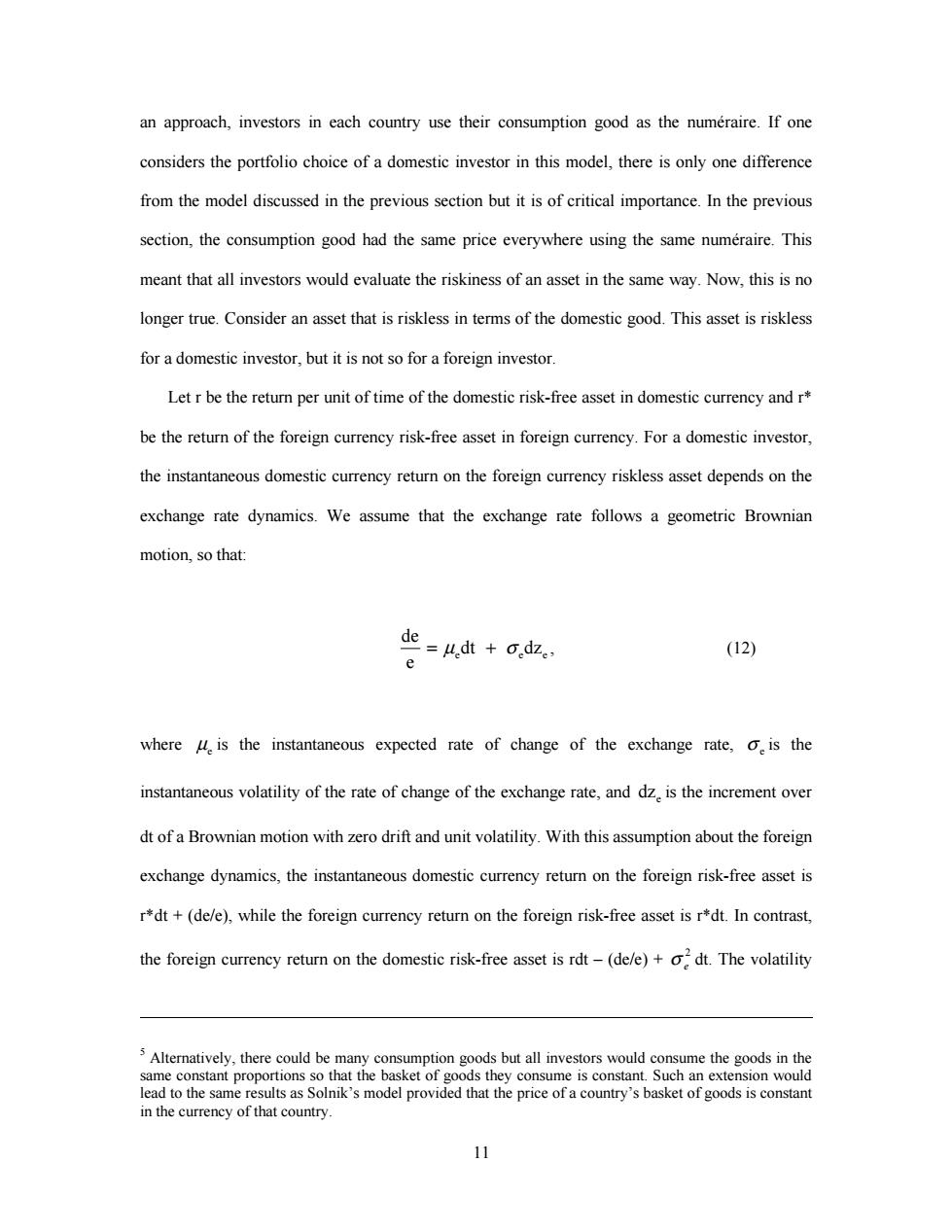

an approach,investors in each country use their consumption good as the numeraire.If one considers the portfolio choice of a domestic investor in this model,there is only one difference from the model discussed in the previous section but it is of critical importance.In the previous section,the consumption good had the same price everywhere using the same numeraire.This meant that all investors would evaluate the riskiness of an asset in the same way.Now,this is no longer true.Consider an asset that is riskless in terms of the domestic good.This asset is riskless for a domestic investor,but it is not so for a foreign investor. Let r be the return per unit of time of the domestic risk-free asset in domestic currency and r* be the return of the foreign currency risk-free asset in foreign currency.For a domestic investor, the instantaneous domestic currency return on the foreign currency riskless asset depends on the exchange rate dynamics.We assume that the exchange rate follows a geometric Brownian motion.so that: de=udt +odz.. (12) where u is the instantaneous expected rate of change of the exchange rate,o is the instantaneous volatility of the rate of change of the exchange rate,and dz is the increment over dt of a Brownian motion with zero drift and unit volatility.With this assumption about the foreign exchange dynamics,the instantaneous domestic currency return on the foreign risk-free asset is r*dt+(de/e),while the foreign currency return on the foreign risk-free asset is r*dt.In contrast, the foreign currency return on the domestic risk-free asset is rdt-(de/e)+o dt.The volatility sAlteratively,there could be many consumption goods but all investors would consume the goods in the same constant proportions so that the basket of goods they consume is constant.Such an extension would lead to the same results as Solnik's model provided that the price of a country's basket of goods is constant in the currency of that country. 11

11 an approach, investors in each country use their consumption good as the numéraire. If one considers the portfolio choice of a domestic investor in this model, there is only one difference from the model discussed in the previous section but it is of critical importance. In the previous section, the consumption good had the same price everywhere using the same numéraire. This meant that all investors would evaluate the riskiness of an asset in the same way. Now, this is no longer true. Consider an asset that is riskless in terms of the domestic good. This asset is riskless for a domestic investor, but it is not so for a foreign investor. Let r be the return per unit of time of the domestic risk-free asset in domestic currency and r* be the return of the foreign currency risk-free asset in foreign currency. For a domestic investor, the instantaneous domestic currency return on the foreign currency riskless asset depends on the exchange rate dynamics. We assume that the exchange rate follows a geometric Brownian motion, so that: e ee de dt dz e = + µ σ , (12) where µe is the instantaneous expected rate of change of the exchange rate, σ e is the instantaneous volatility of the rate of change of the exchange rate, and dze is the increment over dt of a Brownian motion with zero drift and unit volatility. With this assumption about the foreign exchange dynamics, the instantaneous domestic currency return on the foreign risk-free asset is r*dt + (de/e), while the foreign currency return on the foreign risk-free asset is r*dt. In contrast, the foreign currency return on the domestic risk-free asset is rdt – (de/e) + 2 σ e dt. The volatility 5 Alternatively, there could be many consumption goods but all investors would consume the goods in the same constant proportions so that the basket of goods they consume is constant. Such an extension would lead to the same results as Solnik’s model provided that the price of a country’s basket of goods is constant in the currency of that country

term comes from Jensen's inequality:the price of the domestic currency for foreign investors is a convex function of the domestic currency price of the foreign currency. Whenever a domestic investor holds a foreign asset,her return in domestic currency depends on the exchange rate,so that she bears exchange rate risk.Let I be the price in domestic currency of foreign asset j and let I be the price of the same asset in foreign currency.The instantaneous return in domestic currency on foreign asset j is: 1_d+odt+ de (13) e is the instantaneous covariance of the foreign currency retur of foreign asset j with the rate of change of the exchange rate.A domestic investor can make the domestic currency return on her holdings of foreign assets uncorrelated with the rate of change of the exchange rate,so that she does not have to bear foreign exchange rate risk if she does not wish to do so.Let I be the value in foreign currency of a domestic investor's investment in foreign risky assets.If the investor shorts n units of the foreign risk-free asset per unit of investment in the foreign risky assets and puts the proceeds of the short sale in the domestic risk-free asset,the domestic currency return on the investor's holdings of foreign currency risky assets over dt is: (14) If the investor chooses n to be equal to 1+- the domestic currency retum of the investor's investment in the foreign currency risky assets is uncorrelated with the exchange rate. 12

12 term comes from Jensen’s inequality: the price of the domestic currency for foreign investors is a convex function of the domestic currency price of the foreign currency. Whenever a domestic investor holds a foreign asset, her return in domestic currency depends on the exchange rate, so that she bears exchange rate risk. Let fj I be the price in domestic currency of foreign asset j and let * fj I be the price of the same asset in foreign currency. The instantaneous return in domestic currency on foreign asset j is: * fj fj * * fj,e fj fj dI dI de dt II e =+ + σ , (13) * σ fj,e is the instantaneous covariance of the foreign currency return of foreign asset j with the rate of change of the exchange rate. A domestic investor can make the domestic currency return on her holdings of foreign assets uncorrelated with the rate of change of the exchange rate, so that she does not have to bear foreign exchange rate risk if she does not wish to do so. Let * ff I be the value in foreign currency of a domestic investor’s investment in foreign risky assets. If the investor shorts n units of the foreign risk-free asset per unit of investment in the foreign risky assets and puts the proceeds of the short sale in the domestic risk-free asset, the domestic currency return on the investor’s holdings of foreign currency risky assets over dt is: * df ff * * * ff ,e df ff dI dI de de dt n r dt rdt II e e σ = + + − +− . (14) If the investor chooses n to be equal to * ff ,e 2 e 1 σ σ + , the domestic currency return of the investor’s investment in the foreign currency risky assets is uncorrelated with the exchange rate

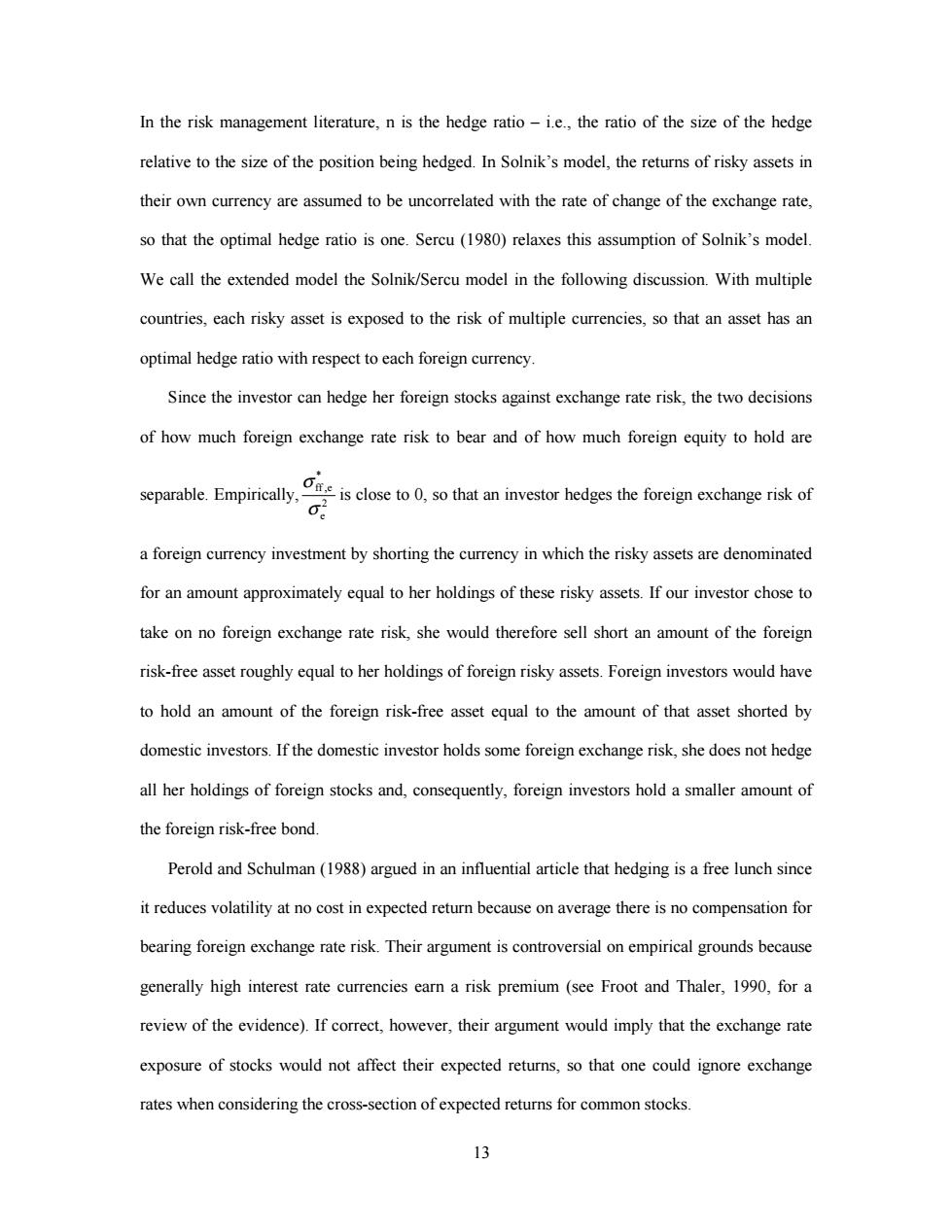

In the risk management literature,n is the hedge ratio-i.e.,the ratio of the size of the hedge relative to the size of the position being hedged.In Solnik's model,the returns of risky assets in their own currency are assumed to be uncorrelated with the rate of change of the exchange rate, so that the optimal hedge ratio is one.Sercu (1980)relaxes this assumption of Solnik's model. We call the extended model the Solnik/Sercu model in the following discussion.With multiple countries,each risky asset is exposed to the risk of multiple currencies,so that an asset has an optimal hedge ratio with respect to each foreign currency. Since the investor can hedge her foreign stocks against exchange rate risk,the two decisions of how much foreign exchange rate risk to bear and of how much foreign equity to hold are separable.Empirically,- iscos toso that an investor hedges the foreign exchange risk of a foreign currency investment by shorting the currency in which the risky assets are denominated for an amount approximately equal to her holdings of these risky assets.If our investor chose to take on no foreign exchange rate risk,she would therefore sell short an amount of the foreign risk-free asset roughly equal to her holdings of foreign risky assets.Foreign investors would have to hold an amount of the foreign risk-free asset equal to the amount of that asset shorted by domestic investors.If the domestic investor holds some foreign exchange risk,she does not hedge all her holdings of foreign stocks and,consequently,foreign investors hold a smaller amount of the foreign risk-free bond. Perold and Schulman(1988)argued in an influential article that hedging is a free lunch since it reduces volatility at no cost in expected return because on average there is no compensation for bearing foreign exchange rate risk.Their argument is controversial on empirical grounds because generally high interest rate currencies earn a risk premium(see Froot and Thaler,1990,for a review of the evidence).If correct,however,their argument would imply that the exchange rate exposure of stocks would not affect their expected returns,so that one could ignore exchange rates when considering the cross-section of expected returns for common stocks. 13

13 In the risk management literature, n is the hedge ratio – i.e., the ratio of the size of the hedge relative to the size of the position being hedged. In Solnik’s model, the returns of risky assets in their own currency are assumed to be uncorrelated with the rate of change of the exchange rate, so that the optimal hedge ratio is one. Sercu (1980) relaxes this assumption of Solnik’s model. We call the extended model the Solnik/Sercu model in the following discussion. With multiple countries, each risky asset is exposed to the risk of multiple currencies, so that an asset has an optimal hedge ratio with respect to each foreign currency. Since the investor can hedge her foreign stocks against exchange rate risk, the two decisions of how much foreign exchange rate risk to bear and of how much foreign equity to hold are separable. Empirically, * ff ,e 2 e σ σ is close to 0, so that an investor hedges the foreign exchange risk of a foreign currency investment by shorting the currency in which the risky assets are denominated for an amount approximately equal to her holdings of these risky assets. If our investor chose to take on no foreign exchange rate risk, she would therefore sell short an amount of the foreign risk-free asset roughly equal to her holdings of foreign risky assets. Foreign investors would have to hold an amount of the foreign risk-free asset equal to the amount of that asset shorted by domestic investors. If the domestic investor holds some foreign exchange risk, she does not hedge all her holdings of foreign stocks and, consequently, foreign investors hold a smaller amount of the foreign risk-free bond. Perold and Schulman (1988) argued in an influential article that hedging is a free lunch since it reduces volatility at no cost in expected return because on average there is no compensation for bearing foreign exchange rate risk. Their argument is controversial on empirical grounds because generally high interest rate currencies earn a risk premium (see Froot and Thaler, 1990, for a review of the evidence). If correct, however, their argument would imply that the exchange rate exposure of stocks would not affect their expected returns, so that one could ignore exchange rates when considering the cross-section of expected returns for common stocks