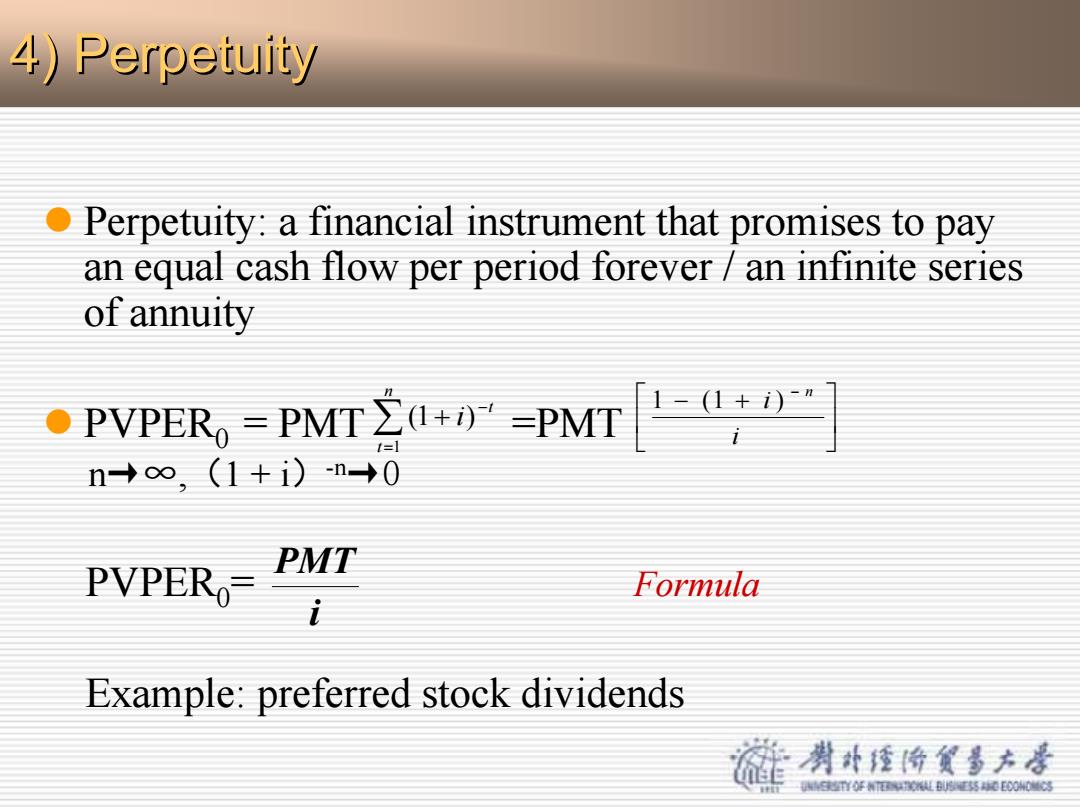

4)Perpetuity o Perpetuity:a financial instrument that promises to pay an equal cash flow per period forever an infinite series of annuity PVPER=PMT∑I+)'=PMT 1-(1+)” =】 n→∞,(1+i)n→0 PVPERo= PMT Formula i Example:preferred stock dividends 渊外经价货多方是 YO年N0事0E000

4) Perpetuity Perpetuity z Perpetuity: a financial instrument that promises to pay an equal cash flow per period forever / an infinite series of annuity z PVPER0 = PMT =PMT n→∞,(1 + i)-n→0 PVPER0= Formula Example: preferred stock dividends i PMT ∑ = − + n t t i 1 (1 ) ⎥⎦⎤ ⎢⎣⎡ − + − i i n 1 (1 )

4.Uneven payment o PV of an uneven payment stream (useful in capital budgeting take individual payment present values and add them up 渊外经价货多方是 YO年NEB证事0000

4. Uneven payment Uneven payment zPV of an uneven payment stream (useful in capital budgeting) – take individual payment present values and add them up

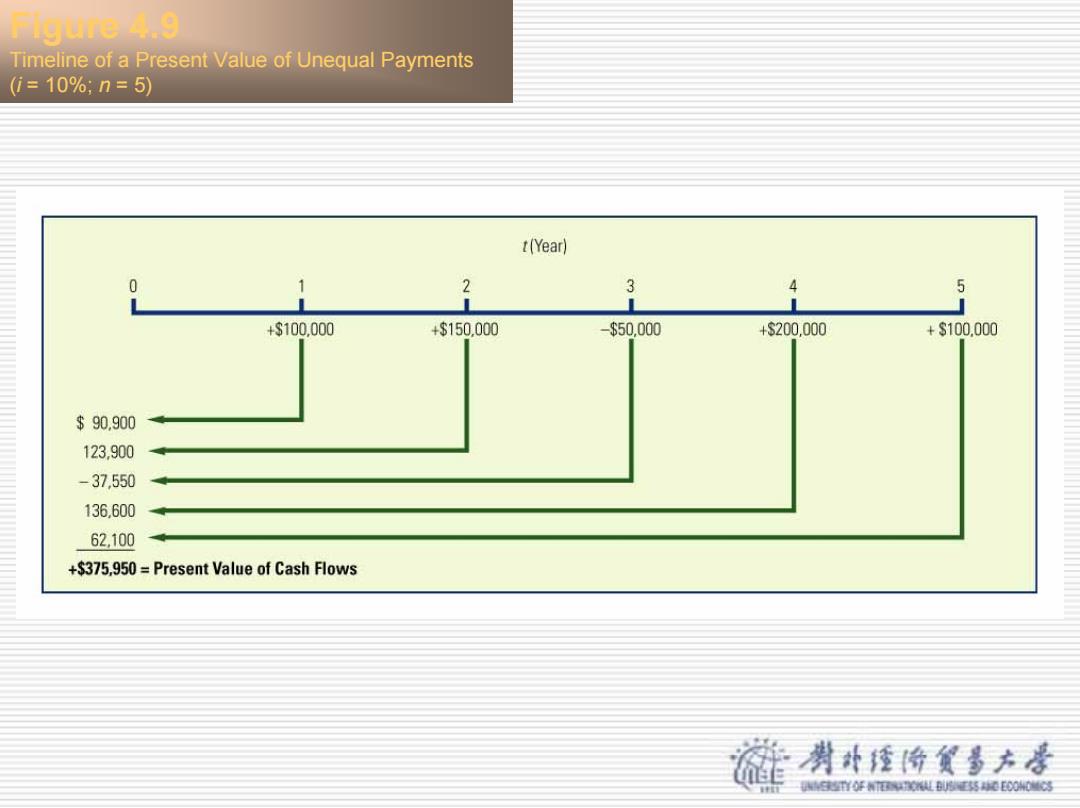

Iigare 4.9 Timeline of a Present Value of Unequal Payments (1=10%;n=5) t(Year) 0 2 3 4 5 +$100.000 +$150.000 -$50.000 +$200000 +$100.000 $90.900 123.900 -37.550 136.600 62.100 南HHHHHHHHHHHHHHHHHHHHHEHHHHHHHHHHHAN +$375,950=Present Value of Cash Flows 剥动楂份货多方是 T0年0LB月50E00以

Figure 4.9 Timeline of a Present Value of Unequal Payments (i = 10%; n = 5)

Chapter 6 Fixed-Income Securities:Characteristics and valuation 渊补经价货多方居 YO年NEB证事0000

Chapter 6 Chapter 6 Fixed-Income Securities: Characteristics and Valuation

Introduction Characteristics of long-term debt 2.Valuation of assets 3.Bond valuation 4.Characteristics of preferred stock 5.Valuation of preferred stock 喇外楂份贸多方是 YO年NEB证事00003

Introduction Introduction 1. Characteristics of long-term debt 2. Valuation of assets 3. Bond valuation 4. Characteristics of preferred stock 5. Valuation of preferred stock