Now,we consider trading volume.From time t=1 to time t=t,the price of speculative asset rises by 6 per time period.By assumptions,the old behavior-driven investors sell g shares of the speculative asset while the new behavior-driven investors buy q shares in any period t,such as 1stst.In the mean time,the arbitrageurs sell ao shares each time period. In order to clear the market,the manipulator has to buy ao shares.The total trading volume from time t=1 to time t=t is therefore ao+g shares per period. Because the asset price remains constant from time =1+1 to time t=T-1,the arbitrager will not trade in this case.The old behavior-driven investors who still own the shares at time t>should have bought at the peak price P.=P+1 and must not sell because they have not made any profits.On the other hand,the new behavior-driven investors choose to buy g2 shares at timet>.In order to clear the market,the manipulator has to sell g2 shares. The total trading volume in this case is g2 shares. Figure 1 presents the price dynamics,total trading volume and the buying/selling pattern of the manipulator based on Proposition 2.We use a positive number for the manipulator's buying volume and a negative number for his selling volume.The steep rise in asset price and the purchase by the manipulator clearly demonstrates his "pumping"strategy,while the negative trading volume and a flat price shows the constant sell of his position to the behavioral investors. In the final period T=10,behavioral investors and arbitrageurs settle their shares at the price equal to fundamental value.The manipulator is out of the market,thus there is no trading volume This proposition illustrates a special case in which the manipulator profits from the biases of behavior-driven investors who are not willing to sell losers.In contrast,behavior investors lose money on average.The behavior-driven investors who enter the market at early stage can make 5

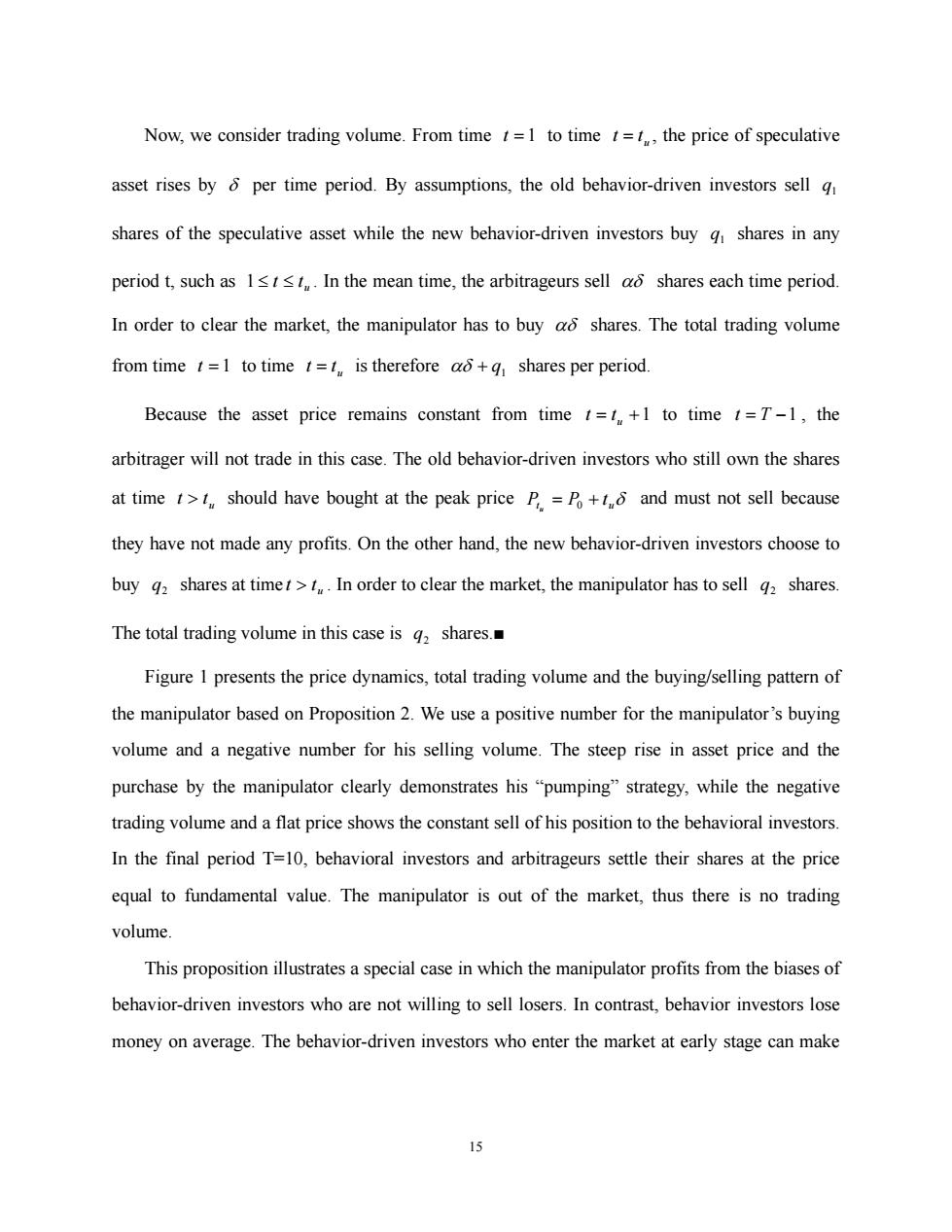

15 Now, we consider trading volume. From time t = 1 to time u t = t , the price of speculative asset rises by δ per time period. By assumptions, the old behavior-driven investors sell 1 q shares of the speculative asset while the new behavior-driven investors buy 1 q shares in any period t, such as u 1 . In the mean time, the arbitrageurs sell ≤ t ≤ t αδ shares each time period. In order to clear the market, the manipulator has to buy αδ shares. The total trading volume from time t = 1 to time u t = t is therefore 1 αδ + q shares per period. Because the asset price remains constant from time 1 t = tu + to time t = T −1 , the arbitrager will not trade in this case. The old behavior-driven investors who still own the shares at time u t > t should have bought at the peak price Pt P tuδ u = 0 + and must not sell because they have not made any profits. On the other hand, the new behavior-driven investors choose to buy 2 q shares at time u t > t . In order to clear the market, the manipulator has to sell 2 q shares. The total trading volume in this case is 2 q shares.■ Figure 1 presents the price dynamics, total trading volume and the buying/selling pattern of the manipulator based on Proposition 2. We use a positive number for the manipulator’s buying volume and a negative number for his selling volume. The steep rise in asset price and the purchase by the manipulator clearly demonstrates his “pumping” strategy, while the negative trading volume and a flat price shows the constant sell of his position to the behavioral investors. In the final period T=10, behavioral investors and arbitrageurs settle their shares at the price equal to fundamental value. The manipulator is out of the market, thus there is no trading volume. This proposition illustrates a special case in which the manipulator profits from the biases of behavior-driven investors who are not willing to sell losers. In contrast, behavior investors lose money on average. The behavior-driven investors who enter the market at early stage can make

profits but those who enter the market lately suffer severe losses'.The arbitrageurs in this case can make a profit because they shorted shares at prices higher than Po from time t=1 to time =t,and are able to cover their short positions at the fundamental value p at the end. However,if the arbitrageurs had to cover their short positions before T,they might suffer a loss. Because 2<,the proposition indicates that the trading activities are more active in an up market than in a down market.This finding is consistent with the typical empirical observations. The proposition also indicates that both short-term momentum and long-term reversal phenomena can be generated in our behavior model even without fundamental shocks:The price of the speculative asset rises for several consecutive periods but moves down eventually In general,when g3>0,the situation will become more complicated.The following propositions illustrate several possible solutions to the model. Proposition 3:Suppose that h=q2-qq>0.Then the manipulator can sell his shares at a high price P.=Po+16 from time t=t+1 through time t=T-1 by appropriately choosing a positive <h=(q2-99) By doing so,the manipulator's total tna…q3 pm咖sml=w-2=a2小2 The trading volume remains at a+q shares per period from time t=1 to time t=t.From time t=t +1 to time t=T-1, trading volume per period is 92 shares and the manipulator is able to sell h=(h shares at timet=tn+j(ji≥1. Proof:If the manipulator maintains the equilibrium price at P=P+t from time=1+1 7 This explains why the behavior investors tend to follow the momentum and trade with the manipulator.Namely,even though they lose money on average,they have chances to make profits and they are just over-optimistic about these chancres.Moreover, Daniel,Hirshleifer and Teoh(2002)claim that investors with behavior biases just trade too aggressively and often make blatant errors.If this were true,it would not be surprising that investors make money-losing trades with the manipulator. 16

16 profits but those who enter the market lately suffer severe losses7 . The arbitrageurs in this case can make a profit because they shorted shares at prices higher than P0 from time t = 1 to time u t = t and are able to cover their short positions at the fundamental value P0 at the end. However, if the arbitrageurs had to cover their short positions before T, they might suffer a loss. Because 2 1 q < q , the proposition indicates that the trading activities are more active in an up market than in a down market. This finding is consistent with the typical empirical observations. The proposition also indicates that both short-term momentum and long-term reversal phenomena can be generated in our behavior model even without fundamental shocks: The price of the speculative asset rises for several consecutive periods but moves down eventually. In general, when 0 q3 > , the situation will become more complicated. The following propositions illustrate several possible solutions to the model. Proposition 3: Suppose that h . Then the manipulator ≡ q2 − q1 ⋅ q3 > 0 can sell his shares at a high price Pt P tuδ u = 0 + from time t through time = tu +1 t = T −1 by appropriately choosing a positive ( ) ( ) 3 2 1 3 3 t q q q q t q h u u ⋅ − ⋅ = ⋅ ⋅ < α α δ . By doing so, the manipulator’s total profit is still 2 2 1 2 1 π δ α ⋅δ − = ⋅ − = ⋅ u u u t t t N . The trading volume remains at 1 αδ + q shares per period from time t = 1 to time u t = t . From time t to time = tu +1 t = T −1 , trading volume per period is 2 q shares and the manipulator is able to sell h ( ) q h j j 1 1 3 − ≡ − shares at time j t t = u + ( j ≥ 1). Proof: If the manipulator maintains the equilibrium price at Pt P tuδ u = 0 + from time 1 t = tu + 7 This explains why the behavior investors tend to follow the momentum and trade with the manipulator. Namely, even though they lose money on average, they have chances to make profits and they are just over-optimistic about these chancres. Moreover, Daniel, Hirshleifer and Teoh (2002) claim that investors with behavior biases just trade too aggressively and often make blatant errors. If this were true, it would not be surprising that investors make money-losing trades with the manipulator