1.Key terms and concepts in capital budgeting OAvailability of funds:fund constraint /capital rationing Setting limits on Capital expenditures Reason:Most companies have a limited amount of dollars available for investment 渊外经价货最方居 YO年NEB证事0000

16 1. Key terms and concepts in capital budgeting zAvailability of funds: fund constraint /capital rationing – Setting limits on Capital expenditures – Reason: Most companies have a limited amount of dollars available for investment

2.Basic framework for capital budgeting o Economic Theory says:Expand output until marginal revenue equals marginal cost Capital budgeting ●In Capital Budgeting Invest in the most profitable projects first Continue accepting projects as long as the rate of return exceeds the Marginal Cost of Capital (MCC) o Four steps of capital budgeting process generation of proposals estimation of cash flows evaluation and selection of alternatives postaudit or review 渊补经价货多方是 YO年NEB证事0000

17 2.Basic framework for capital budgeting z Economic Theory says: Expand output until marginal revenue equals marginal cost Capital budgeting z In Capital Budgeting – Invest in the most profitable projects first – Continue accepting projects as long as the rate of return exceeds the Marginal Cost of Capital (MCC) z Four steps of capital budgeting process – generation of proposals – estimation of cash flows – evaluation and selection of alternatives – postaudit or review

3.Generating capital investment project proposals O Investment projects can be generated by growth opportunities cost reduction opportunities meeting legal requirements meeting health and safety standards o Project size and decision-making process: decentralized decision-making funetion 渊外校价货最方号 YO年N0事0E000

18 3. Generating capital investment project proposals zInvestment projects can be generated by – growth opportunities – cost reduction opportunities – meeting legal requirements – meeting health and safety standards zProject size and decision-making process: decentralized decision-making function

4.Calculation of cash flow OPrinciples of Estimating Cash Flows Cash flow should be measured on an incremental basis Cash flow should be measured on an after-tax basis All the indirect effects of a project should be included in the cash flow calculations Sunk costs should not be considered The value of resources used in a project should be measured in terms of their opportunity costs 渊外煙价货最方房 YO年NEB证事0000

19 4. Calculation of cash flow zPrinciples of Estimating Cash Flows – Cash flow should be measured on an incremental basis – Cash flow should be measured on an after-tax basis – All the indirect effects of a project should be included in the cash flow calculations – Sunk costs should not be considered – The value of resources used in a project should be measured in terms of their opportunity costs

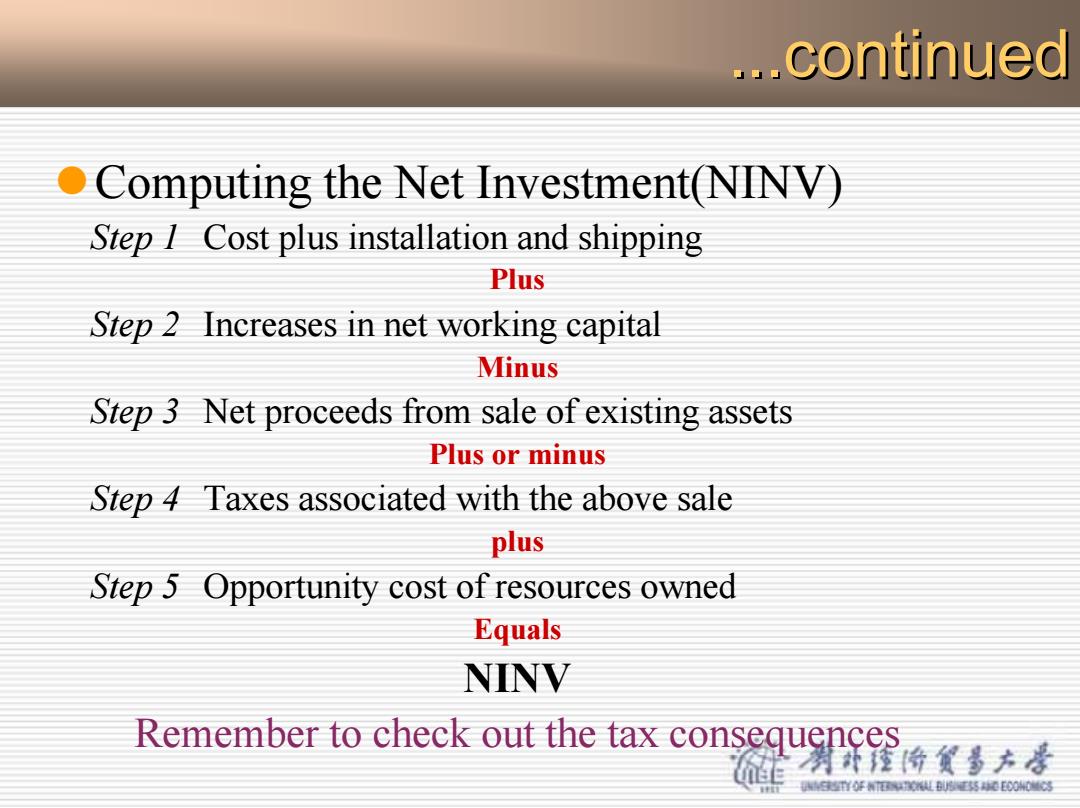

continued Computing the Net Investment(NINV) Step I Cost plus installation and shipping Plus Step 2 Increases in net working capital Minus Step 3 Net proceeds from sale of existing assets Plus or minus Step 4 Taxes associated with the above sale plus Step 5 Opportunity cost of resources owned Equals NINV Remember to check out the tax consequences 消新濯价餐多方是 YO年E0药eO003

...continued continued zComputing the Net Investment(NINV) Step 1 Cost plus installation and shipping Plus Step 2 Increases in net working capital Minus Step 3 Net proceeds from sale of existing assets Plus or minus Step 4 Taxes associated with the above sale plus Step 5 Opportunity cost of resources owned Equals NINV Remember to check out the tax consequences