Continued... B k2 B+E+P k。+ B+E+P Example with $3 in bonds,$6 in equity,and $1 in preferred stock 6 3+6+1 3+6+1 3+6+1 k=W(ke)W(k)+W(kp) k=60%(ke)+30%(k)+10%(k。 渊外楂价货多方是 YO年N0事0E000

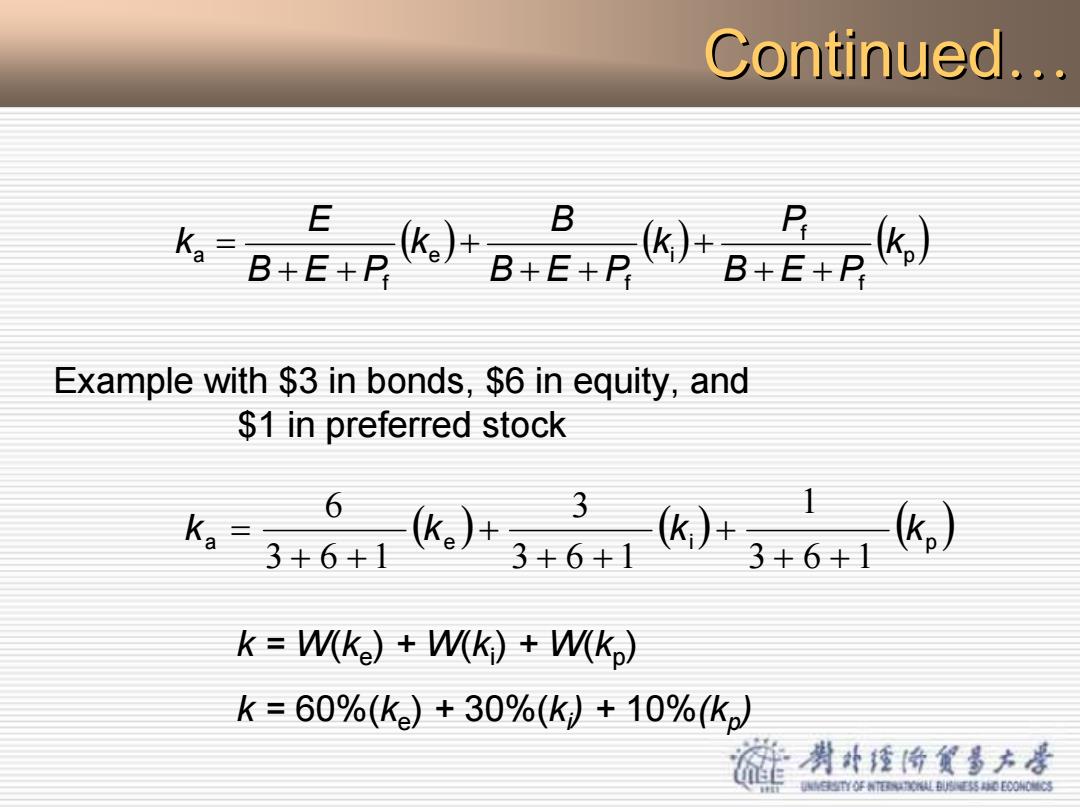

Continued Continued… ( ) ( ) ( ) p f f i f e f a k B E P P k B E P B k B E P E k + + + + + + + + = Example with $3 in bonds, $6 in equity, and $1 in preferred stock ( ) ( ) ( ) ka ke ki kp 3 6 1 1 3 6 1 3 3 6 1 6 + + + + + + + + = k = W(ke) + W(ki) + W(kp) k = 60%(ke) + 30%(ki) + 10%(kp)

Continued... O Risk vs.required return trade-off:Required return rf Risk premium rf risk-free rate o Real rate of return determined by supply and demand o Plus a premium for the effects of inflation Components of the risk premium Business risk -associated with the amount of operating leverage O Financial risk -associated with the use of financial leverage o Marketability risk -refers to the ability to quickly buy and sell O Interest rate risk -arising from changes in interest rates o Seniority risk -due to the priority of a security's claim on assets 渊外经价货多方是 超直O年N0l8药0000习

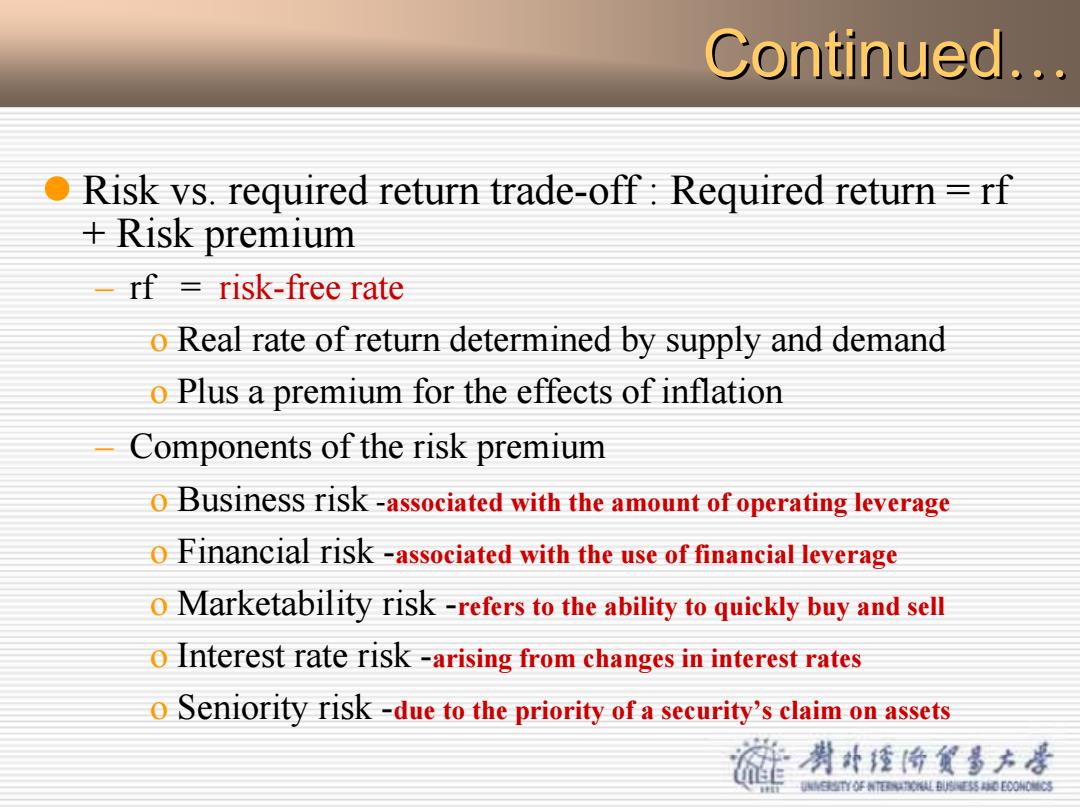

Continued Continued… z Risk vs. required return trade-off : Required return = rf + Risk premium – rf = risk-free rate o Real rate of return determined by supply and demand o Plus a premium for the effects of inflation – Components of the risk premium o Business risk -associated with the amount of operating leverage o Financial risk -associated with the use of financial leverage o Marketability risk -refers to the ability to quickly buy and sell o Interest rate risk -arising from changes in interest rates o Seniority risk -due to the priority of a security’s claim on assets

Continued... Required Return x Common Stock x Low Quality Corp Debt x High Quality P/S x High Quality Corp Debt L-T Government Debt x S-T Government Debt Risk 州升佳份兴方是 YO年N0事0E0003

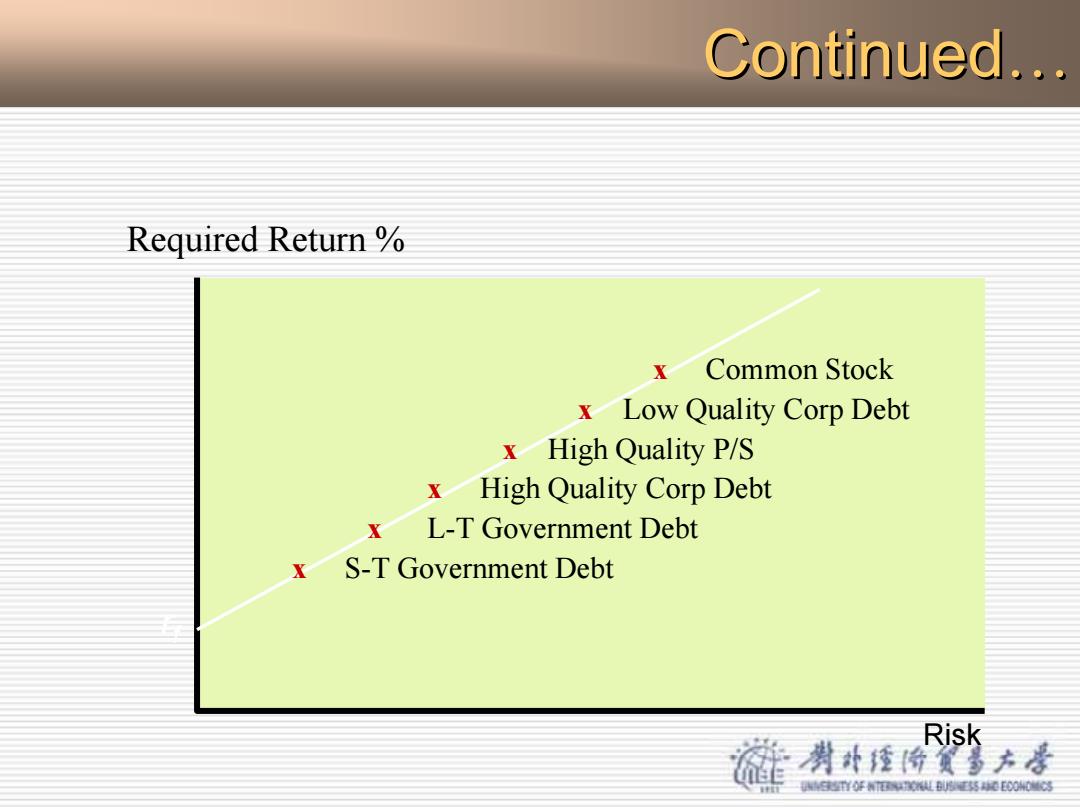

rf Risk Required Return % x Common Stock x Low Quality Corp Debt x High Quality P/S x High Quality Corp Debt x L-T Government Debt x S-T Government Debt Continued Continued…

2.Component Costs Cost of Debt ki=kd (1-T) Interest is tax deductible OCost of Preferred Stock kp=Dy/Pnet Dividends are not tax deductible Pnet:Net of issuance costs 剥外校价贫多方号 YO年N0事0E0003

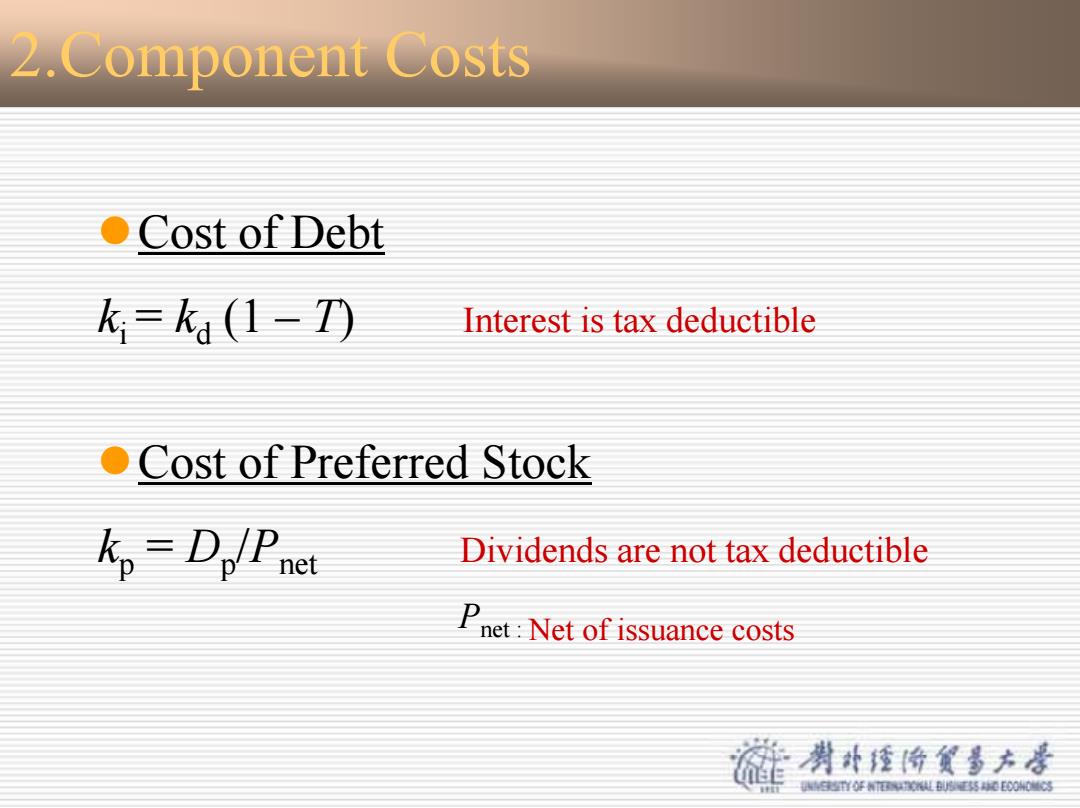

2.Component Costs zCost of Debt ki = kd (1 – T) Interest is tax deductible zCost of Preferred Stock kp = D p /Pnet Dividends are not tax deductible Pnet : Net of issuance costs

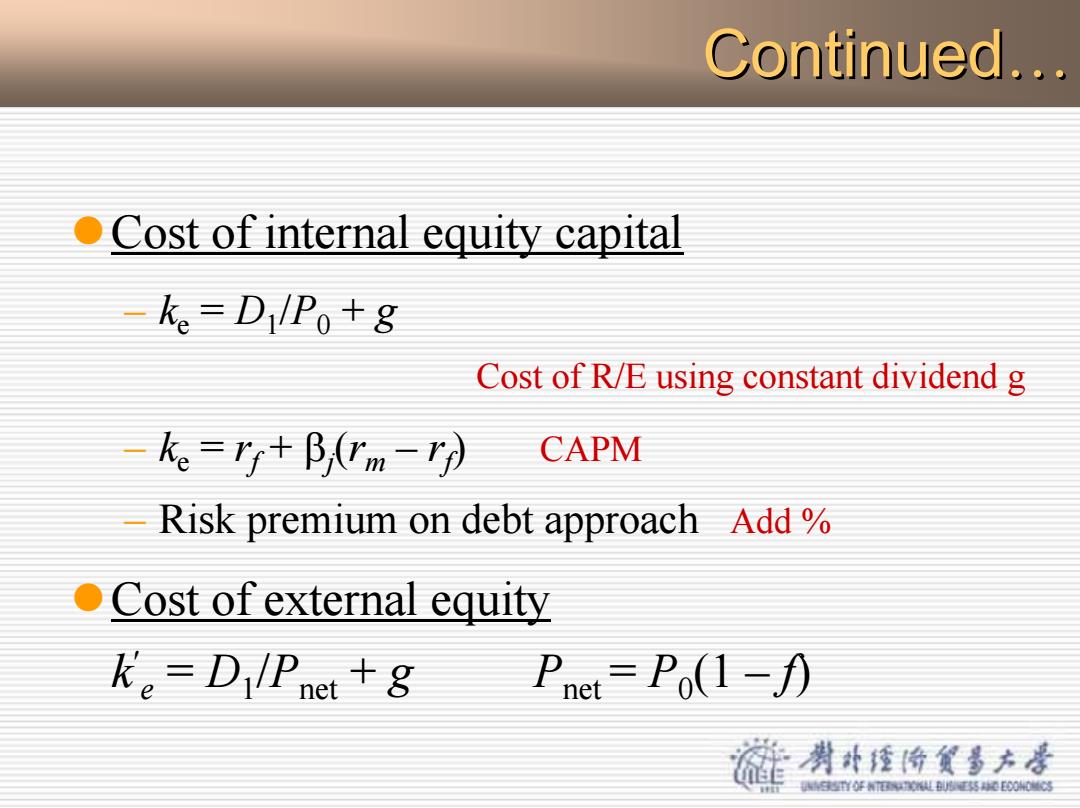

Continued... O Cost of internal equity capital k。=D/Po+8 Cost of R/E using constant dividend g k。=r+B0m-r分 CAPM Risk premium on debt approach Add Cost of external equity ke=DilPnet+g Pnet=Po(1-) 剥外经价贫多方居 YO年N0事0E0003

Continued Continued… zCost of internal equity capital – ke = D1/P0 + g Cost of R/E using constant dividend g – ke = rf + βj(rm – rf) CAPM – Risk premium on debt approach Add % zCost of external equity k′e = D1/Pnet + g Pnet = P0(1 – f)