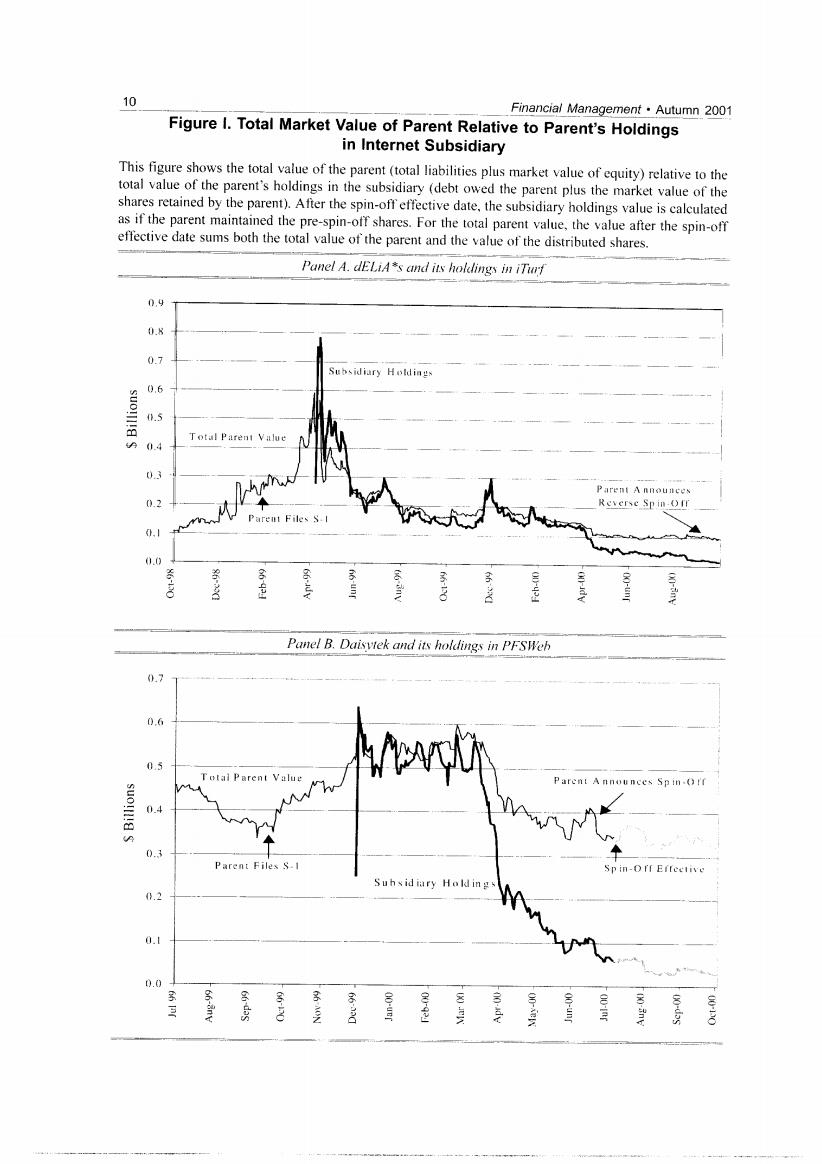

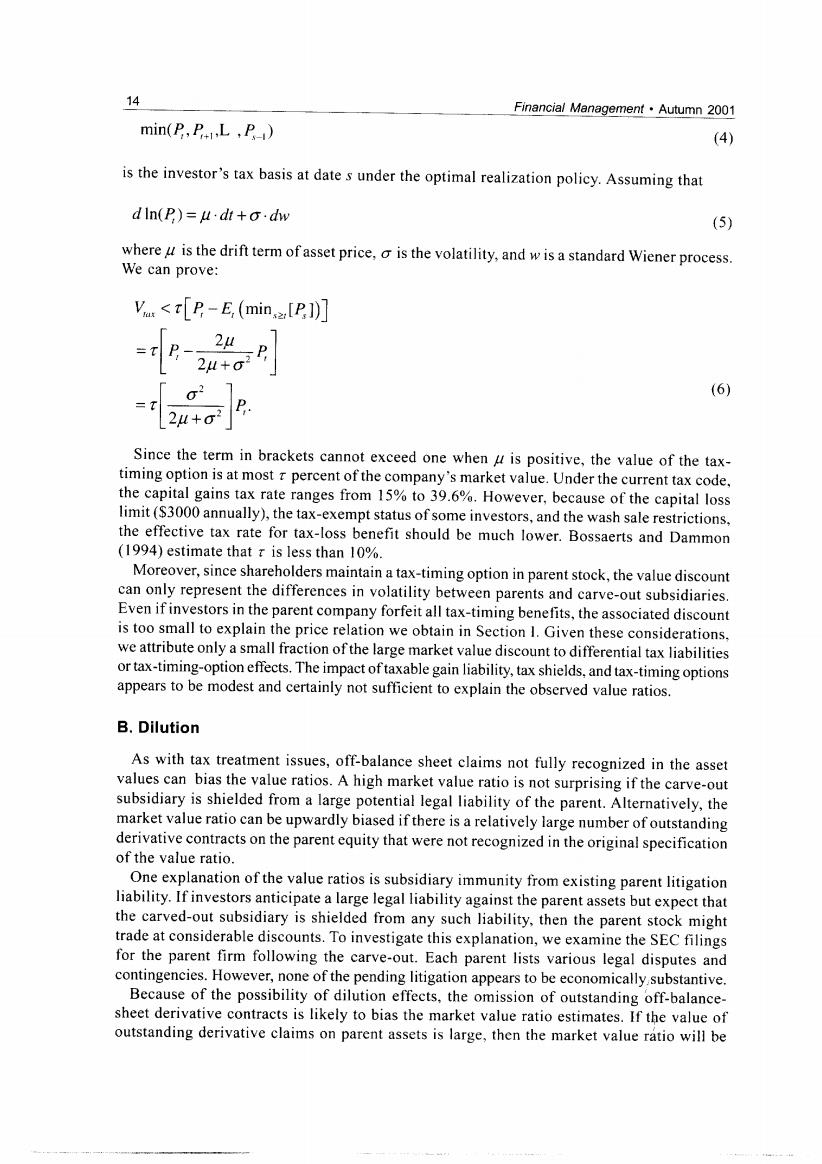

10 Financial Management.Autumn 2001 Figure I.Total Market Value of Parent Relative to Parent's Holdings in Internet Subsidiary This figure shows the total value of the parent(total liabilities plus market value of equity)relative to the total value of the parent's holdings in the subsidiary (debt owed the parent plus the market value of the shares retained by the parent).After the spin-off effective date,the subsidiary holdings value is calculated as if the parent maintained the pre-spin-off shares.For the total parent value,the value after the spin-off effective date sums both the total value of the parent and the value of the distributed shares. Panel A.dELiA*s and its holdlings in iTurf 0.9 0.8 0.7 Subsidiary Holdings 0.6 0.5 Total Parent Value 0.4 0.3 Parent A nnounces 0.2 Reverse Spin-Of Parent Files S. 01 .0 Panel B.Daisvtek and its holdings in PFSWeh 0.7 0.6 05 Total Parent Value D Parent A nnounces Spin.O!f suolll!as 0.4 0.3 Parent Files S-1 Sp in-OIf Effeetive Suhsid iary Holdin g 0.2 0.1 0.0

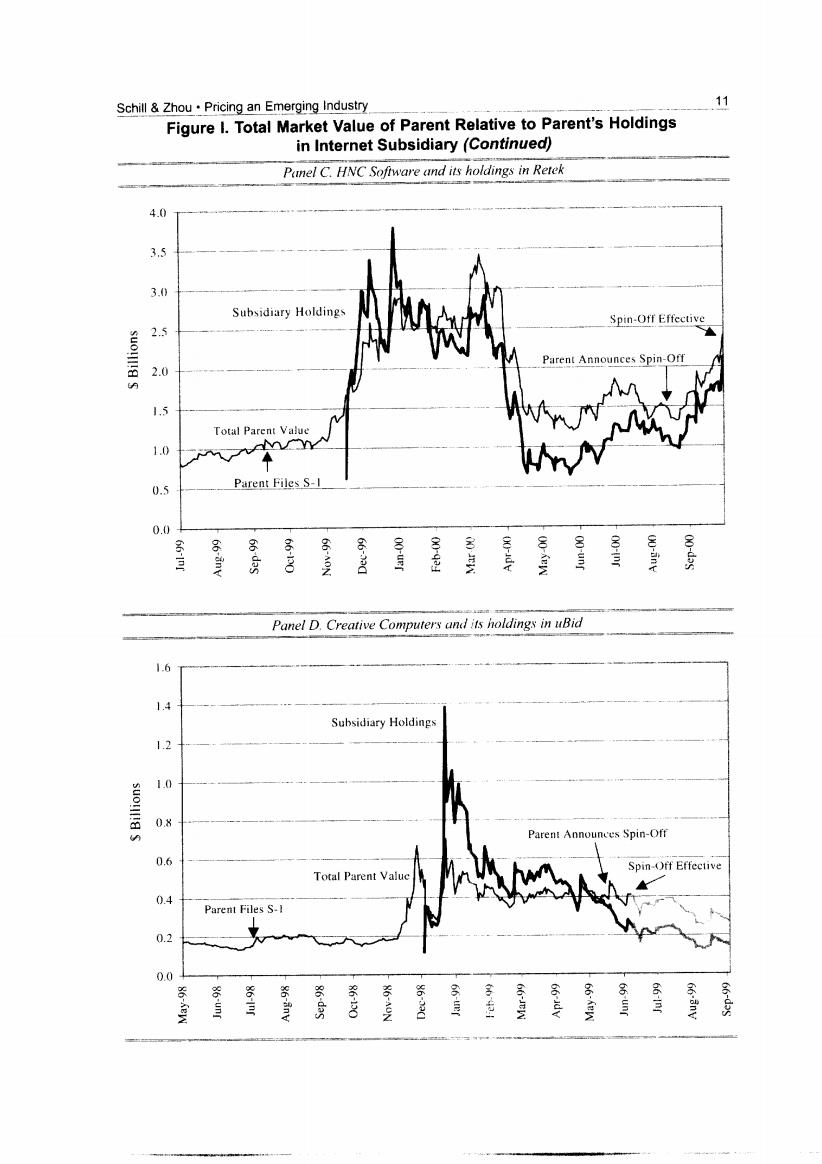

Schill Zhou.Pricing an Emerging Industry 11 Figure I.Total Market Value of Parent Relative to Parent's Holdings in Internet Subsidiary(Continued) Panel C.HNC Software and its holdings in Retek 4.0 3.5 3.0 Subsidiary Holdings Spin-Off Effective 2.5 Parent Announces Spin-Off 2.0 1.5 Total Parent Value 1.0 0.5 Parent Files S-1. 0.0 6 Panel D.Creative Computers and its holdings in uBid 1.6 1.4 Subsidiary Holdings 1.2 1.0 0.8 Parent Announces Spin-Off 0.6 Spin-Off Effective Total Parent Valuc 0.4 Parent Files S-】 丛以 0.2 00 6-o

12 Financial Management Autumn 2001 total assets,appear to have traded at an implied value of less than-$750 million relative to the value for the consolidated parent company of only S600 million.The pricing patterns emphasize that the subsidiary premium is not a short-run,transitional phenomenon,but one which can and does persist for months following the offering. Coincidental with the severe drop of Internet stocks in April 2000,the three subsidiaries still trading through April 2000(UBID was subsequently acquired by CMGI)show a substantial reduction in the value of the subsidiary holdings.The April 2000 value decline is unique to the subsidiary holdings.The consolidated parent values show much less (if any) decrease in value over the April 2000 period.This pattern appears to ignore the substantial drop in value of the parent's most valuable portfolio holding Il.Internet Carve-outs and Traditional Explanations The parent-holding-value-to-total-parent-value relations of Internet carve-outs is similar to the net-asset-value-to-fund-value relations of closed-end mutual funds.In both cases, the indirect holdings of the traded assets sell at a sizeable discount in the market.Because the closed-end fund puzzle has been extensively studied,a review of the closed-fund puzzle literature can shed some light on the puzzle of Internet carve-out pricing.The related nature of Internet carve-out pricing and the closed-end fund discount provides a forum to better understand both phenomena. A.Taxes Subsidiary holding values could be greater than parent values due to tax treatment.For closed-end funds,fund prices might trade at a discount to net asset value because capital gains tax must be paid by the fund if positions within the fund are unwound(Pratt,1966). The tax liability for assets that have appreciated in value reduces the liquidation value of the funds'assets. The parent of a carve-out subsidiary might also trade at a substantial discount to the subsidiary if investors anticipate a large tax liability against the parent upon the sale or distribution of the subsidiary holdings.Since the market value of the subsidiary relative to its tax basis can be large,possible recognition of the capital gain exposes the parent shareholders to a large tax liability. However,the US tax code allows subsidiaries to be spun off to shareholders without capital gain recognition.To avoid capital gain recognition,Section 355 of the US Internal Revenue Code of 1986 requires that the transaction have a valid business purpose rather than merely a tax avoidance motivation,that the parent and subsidiary continue in their respective business operations,that the distribution be sufficiently great so that the parent no longer retains control of the subsidiary,and that the majority of the voting or ownership rights of the parent or subsidiary not be later acquired by a single entity.These qualifications do not appear to be binding for our sample subsidiaries.Parent companies that anticipate a future sale and are exposed to such tax liability are generally careful to follow the tax code provisions. The UBID carve-out is a case in point.UBID's prospectus fully reveals the parent's "The Parent has announced that,subject to certain conditions,the Parent intends to consummate the Offering. to separatc the Company.which owns and operates the Parent's online auction business,from the Parent's other operations and businesses and to distribute to its shareholders all of the Common Stock owned by the Parent in no-event prior to 180 days after consummation of the Offering."uBid Prospectus,1998,page 23

Schill Zhou.Pricing an Emerging Industry 9 intention to completely divest of the subsidiary.The upper bound tax liability to MALL shareholders of a UBID distribution is the value of UBID shares times the shareholders marginal tax rate.The prospectus gives complete details on MALL's compliance with the tax code's requirements for a tax-free spin off,and quotes the positive assurance of its compliance by its auditors.Moreover,the UBID prospectus stipulates that the intended future spin-off is contingent on the transaction's qualification as a tax-free distribution.In June 1999,six months following the original carve-out,MALL effected the tax-free distribution of its 80%stake in UBID,such that its shareholders were not forced to recognize the capital gain in UBID.Yet,if the qualifications were not met,the parent maintained the right to retain their holdings PFSW and RETK also conducted similar tax-free spin-offs of residual holdings.These spin-offs illustrate that through prudent management,shareholders of the parent do not necessarily appear to be highly exposed to untimely capital gains recognition,certainly not to the extent required to justify the resulting market value ratios. Another noteworthy aspect of the tax treatment of carve-out transactions is that of income consolidation.If the parent maintains over 80%of the ownership and voting power of the subsidiary,the tax code allows the parent to consolidate income for tax reporting purposes. For loss-generating subsidiaries,such as the Internet subsidiaries in our sample,full income consolidation provides a valuable tax shield for the parent.Despite the tax shield generated, prospectus disclosure suggests that the parent taxes subsidiary income as a stand-alone business.Thus,the parent,rather than the subsidiary.benefits from the tax shield.Such a policy implies that investors in the subsidiary can receive less benefit from subsidiary losses than do investors in the parent,an implication that contradicts our market-value ratio findings. The value of tax-timing options is a third tax-related feature of the parent-subsidiary relationship.The impact of capital gains recognition timing has been studied by Constantinides(1983),Bossaerts and Dammon(1994),and Dammon and Spatt(1996).These studies observe that capital gains taxation provides investors with a valuable tax-timing option.Since the US tax code specifies that capital gains and losses are not taxed until the investor sells that asset,investors can time asset sales so as to minimize the present value of net tax payments.The tax-timing option for any security is implicit as investors benefit from the flexibility of recognizing losses and deferring gains. As with standard options,the tax-timing option of any security increases in value with underlying security volatility.If the stock prices of the Internet subsidiaries maintain greater price volatility than those of the consolidated parents,then because investors are unable to realize the tax-timing feature of the subsidiary,parent holdings could trade at discounts. To evaluate the merits of tax timing in this context,we follow Bossaerts and Dammon (1994)and assume that all investors are identical and that the same tax rate for capital gains: t.We also assume that all unrealized capital gains and losses remain untaxed,which gives investors the option to time the realization of their capital gains and losses for tax purposes. Throughout the analysis,we ignore the capital loss limit(currently $3,000 per year)imposed by the actual tax code.Constantinides(1983)shows that under these conditions,the optimal policy is to realize losses immediately and to defer capital gains.The tax-timing option value, ignoring all transaction costs and market imperfections.is: vmax[9.(min(.1 1+r (3) where P is the stock price at time t and r is the required discount rate from time date t to date s. Under the optimal realization policy,the investor sells and repurchases the asset only when he has a loss.Therefore

14 Financial Management.Autumn 2001 min(P,PLP) (4) is the investor's tax basis at date s under the optimal realization policy.Assuming that dln(P)=·dt+o·dhw (5) where u is the drift term of asset price,o is the volatility,and w is a standard Wiener process. We can prove: V<[P-E (min,[P1)] n-zui H+02 02 (6) =T 24+σ Since the term in brackets cannot exceed one when u is positive,the value of the tax- timing option is at most r percent of the company's market value.Under the current tax code, the capital gains tax rate ranges from 15%to 39.6%.However,because of the capital loss limit($3000 annually),the tax-exempt status of some investors,and the wash sale restrictions, the effective tax rate for tax-loss benefit should be much lower.Bossaerts and Dammon (1994)estimate that r is less than 10%. Moreover,since shareholders maintain a tax-timing option in parent stock,the value discount can only represent the differences in volatility between parents and carve-out subsidiaries. Even if investors in the parent company forfeit all tax-timing benefits,the associated discount is too small to explain the price relation we obtain in Section I.Given these considerations, we attribute only a small fraction of the large market value discount to differential tax liabilities or tax-timing-option effects.The impact of taxable gain liability,tax shields,and tax-timing options appears to be modest and certainly not sufficient to explain the observed value ratios. B.Dilution As with tax treatment issues,off-balance sheet claims not fully recognized in the asset values can bias the value ratios.A high market value ratio is not surprising if the carve-out subsidiary is shielded from a large potential legal liability of the parent.Alternatively,the market value ratio can be upwardly biased if there is a relatively large number of outstanding derivative contracts on the parent equity that were not recognized in the original specification of the value ratio. One explanation of the value ratios is subsidiary immunity from existing parent litigation liability.If investors anticipate a large legal liability against the parent assets but expect that the carved-out subsidiary is shielded from any such liability,then the parent stock might trade at considerable discounts.To investigate this explanation,we examine the SEC filings for the parent firm following the carve-out.Each parent lists various legal disputes and contingencies.However,none of the pending litigation appears to be economically substantive. Because of the possibility of dilution effects,the omission of outstanding off-balance- sheet derivative contracts is likely to bias the market value ratio estimates.If the value of outstanding derivative claims on parent assets is large,then the market value ratio will be