12 Simin,2002).It seems that research on the predictability of security returns will always be interesting, and conditional asset pricing models should be useful in framing many future investigations of these issues. 2.2 Consumption-based Asset Pricing Models In these models the economic agent maximizes a lifetime utility function of consumption (including possibly a bequest to heirs).Consumption models may be derived from equation(4)by exploiting the envelope condition,Ud.)=Jw(.),which states that the marginal utility of consumption must be equal to the marginal utility of wealth if the consumer has optimized the tradeoff between the amount consumed and the amount invested. Breeden (1979)derived a consumption-based asset pricing model in continuous time, assuming that the preferences are time-additive.The utility function for the lifetime stream of consumption is Et BU(C),where B is a time preference parameter and U(.)is increasing and concave in current consumption,C.Breeden's model is a linearization of equation(2)which follows from the assumption that asset values and consumption follow diffusion processes [Bhattacharya (1981), Grossman and Shiller (1982)].A discrete-time version follows Rubinstein (1976)and Lucas(1978), assuming a power utility function: C-a-1 U(C)= 1-a (7) where a0is the concavity parameter.This function displays constant relative risk aversionequal to a.Using(7)and the envelope condition,the IMRS in equation(4)becomes: 5 Relative risk aversion in consumption is defined as-Cu"(C)/u(C).Absolute risk aversion is- u"(C)/u'(C).Ferson (1983)studies a consumption-based asset pricing model with constant absolute risk aversion

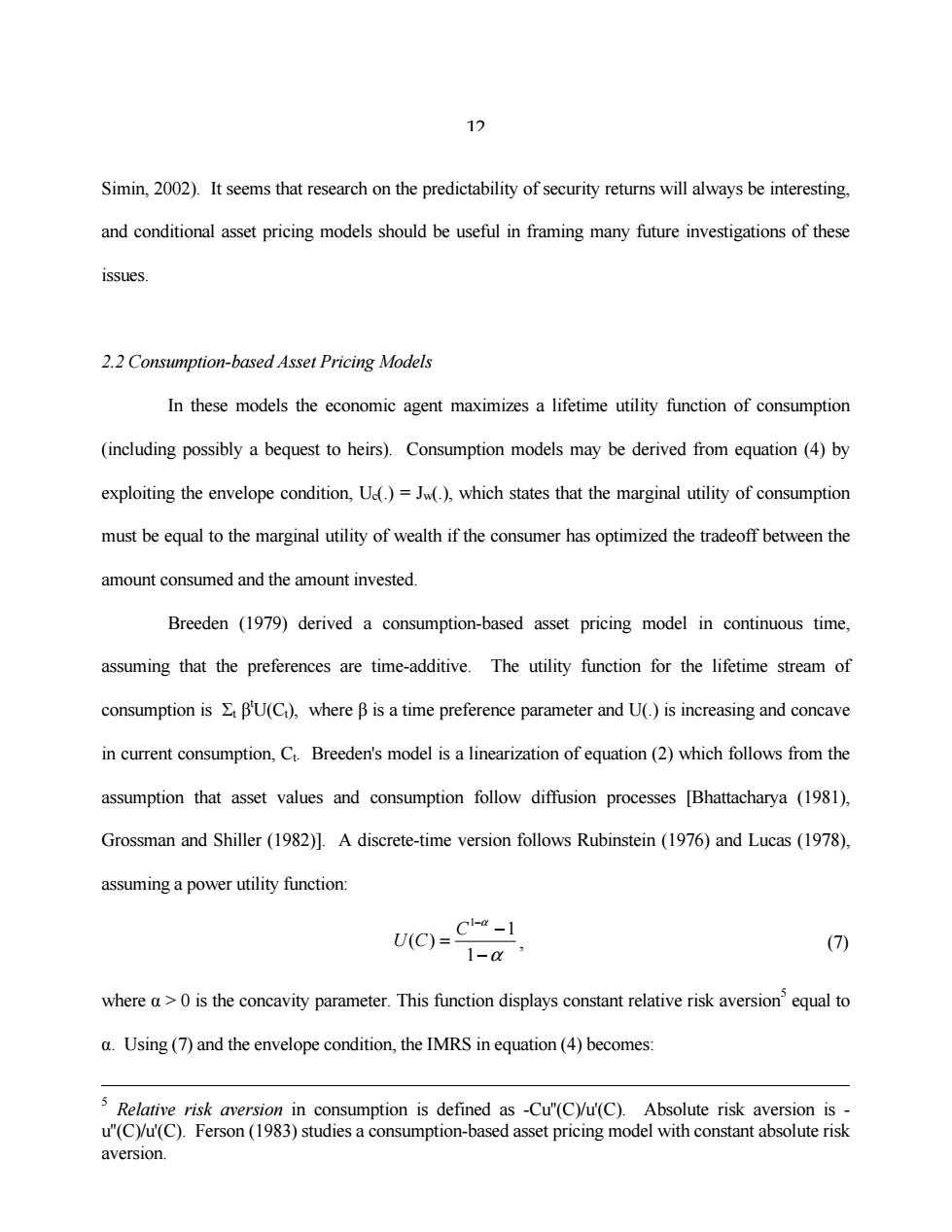

12 Simin, 2002). It seems that research on the predictability of security returns will always be interesting, and conditional asset pricing models should be useful in framing many future investigations of these issues. 2.2 Consumption-based Asset Pricing Models In these models the economic agent maximizes a lifetime utility function of consumption (including possibly a bequest to heirs). Consumption models may be derived from equation (4) by exploiting the envelope condition, Uc(.) = Jw(.), which states that the marginal utility of consumption must be equal to the marginal utility of wealth if the consumer has optimized the tradeoff between the amount consumed and the amount invested. Breeden (1979) derived a consumption-based asset pricing model in continuous time, assuming that the preferences are time-additive. The utility function for the lifetime stream of consumption is Σt β t U(Ct), where β is a time preference parameter and U(.) is increasing and concave in current consumption, Ct. Breeden's model is a linearization of equation (2) which follows from the assumption that asset values and consumption follow diffusion processes [Bhattacharya (1981), Grossman and Shiller (1982)]. A discrete-time version follows Rubinstein (1976) and Lucas (1978), assuming a power utility function: α α − − = − 1 1 ( ) 1 C U C , (7) where α > 0 is the concavity parameter. This function displays constant relative risk aversion5 equal to α. Using (7) and the envelope condition, the IMRS in equation (4) becomes: 5 Relative risk aversion in consumption is defined as -Cu''(C)/u'(C). Absolute risk aversion is - u''(C)/u'(C). Ferson (1983) studies a consumption-based asset pricing model with constant absolute risk aversion

13 m+1=(Ct+/C) (8) A large literature has tested the pricing equation(1),with the SDF given by the consumption model(8), and generalizations of that model.6 2.3 Multi-beta Pricing Models The vast majority of the empirical work on asset pricing models involves expressions for expected returns,stated in terms of beta coefficients relative to one or more portfolios or factors.The beta is the regression coefficient of the asset return on the factor.Multi-beta models have more than one risk factor and more than one beta for each asset.The Arbitrage Pricing Theory (APT)leads to approximate expressions for expected returns with multiple beta coefficients.Models based on investor optimization and equilibrium lead to exact expressions.?Both of these approaches lead to models with the following form: E,(R)for all (9) j=l The bilt...,bikt are the time t betas of asset i relative to the K risk factors Fit,j=1.K.These betas 6 An important generalization allows for nonseparabilities in the U(C)function in(4),as may be implied by the durability of consumer goods,habit persistence in the preferences for consumption over time,or nonseparability of preferences across states of nature.Singleton (1990),Ferson (1995)and Campbell,in Chapter 19 of this volume,review this literature. 7 The multiple-beta equilibrium model was developed in continuous time by Merton(1973),Breeden (1979)and Cox,Ingersoll and Ross (1985).Long (1974),Sharpe (1977),Cragg and Malkiel (1982), Connor(1984),Dybvig (1983),Grinblatt and Titman (1983)and Shanken(1987)provide multibeta interpretations of equilibrium models in discrete time

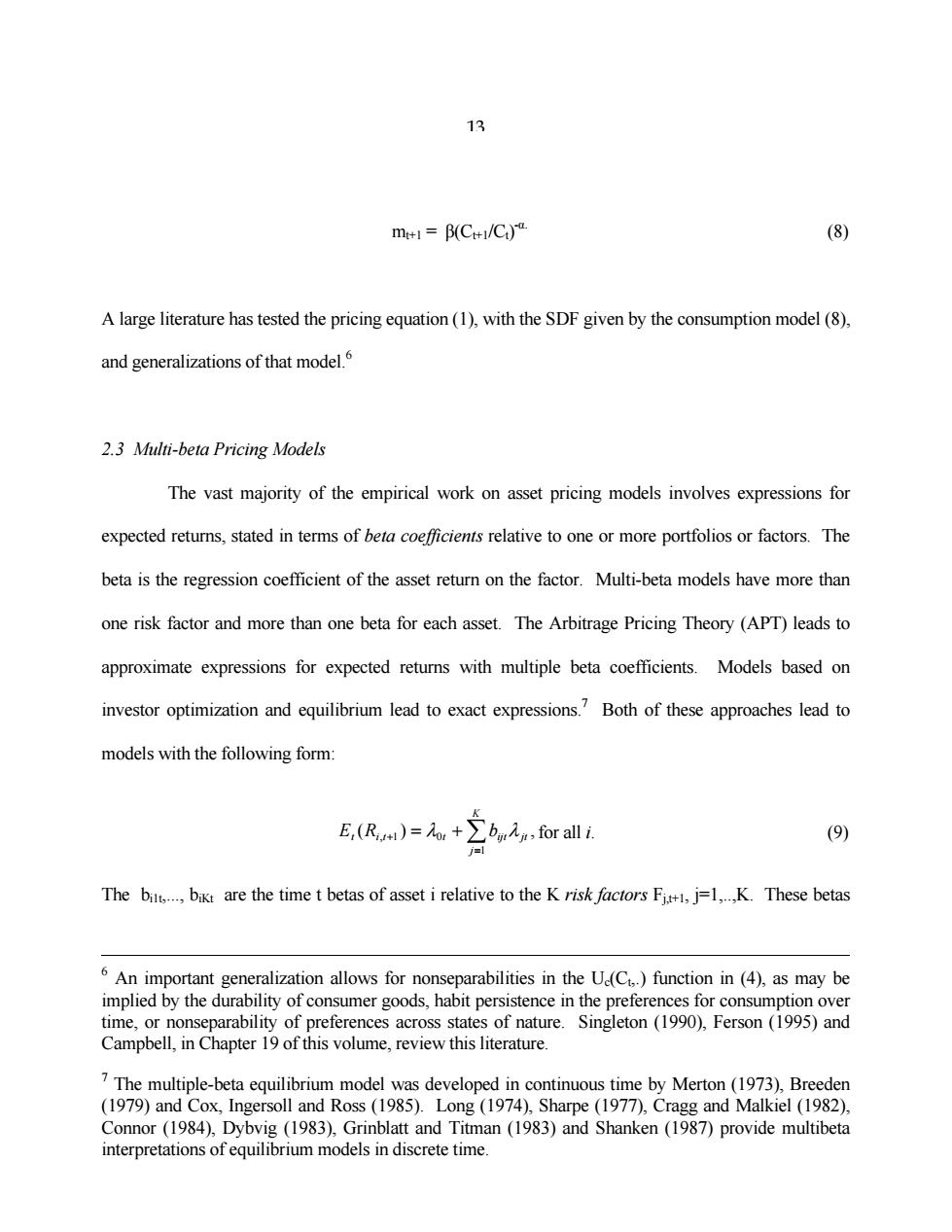

13 mt+1 = β(Ct+1/Ct) -α. (8) A large literature has tested the pricing equation (1), with the SDF given by the consumption model (8), and generalizations of that model.6 2.3 Multi-beta Pricing Models The vast majority of the empirical work on asset pricing models involves expressions for expected returns, stated in terms of beta coefficients relative to one or more portfolios or factors. The beta is the regression coefficient of the asset return on the factor. Multi-beta models have more than one risk factor and more than one beta for each asset. The Arbitrage Pricing Theory (APT) leads to approximate expressions for expected returns with multiple beta coefficients. Models based on investor optimization and equilibrium lead to exact expressions.7 Both of these approaches lead to models with the following form: ∑= + = + K j t i t t ijt jt E R b 1 , 1 0 ( ) λ λ ,for all i. (9) The bi1t,..., biKt are the time t betas of asset i relative to the K risk factors Fj,t+1, j=1,..,K. These betas 6 An important generalization allows for nonseparabilities in the Uc(Ct,.) function in (4), as may be implied by the durability of consumer goods, habit persistence in the preferences for consumption over time, or nonseparability of preferences across states of nature. Singleton (1990), Ferson (1995) and Campbell, in Chapter 19 of this volume, review this literature. 7 The multiple-beta equilibrium model was developed in continuous time by Merton (1973), Breeden (1979) and Cox, Ingersoll and Ross (1985). Long (1974), Sharpe (1977), Cragg and Malkiel (1982), Connor (1984), Dybvig (1983), Grinblatt and Titman (1983) and Shanken (1987) provide multibeta interpretations of equilibrium models in discrete time

14 are the conditional multiple regression coefficients of the assets on the factors.The,j=1,...K are the factor risk premiums,which represent increments to the expected return per unit of type-j beta. These premiums do not depend on the specific security i.is the expected zero-beta rate.This is the expected return of any security that is uncorrelated with each of the K factors in the model(i.e.,boit =0,j=1....,K).If there is a risk-free asset,then o is the return of this asset. Relation to the Stochastic Discount Factor We first show how a multi-beta model can be derived as a special case of the SDF representation,when the factors capture the relevant systematic risks.We take this to mean that the error terms,ui,in a regression of returns on the factors are not"priced;"that is,they are uncorrelated with m+1:Cov(uit+1,m)=0.We then state the general equivalence between the two representations. This equivalence was first discussed,for the case of a single-factor model,by Dybvig and Ingersoll (1982).The general,multi-factor case follows from Ferson and Jagannathan (1996). Let Ro+be a zero beta portfolio,andthe expected retumn on the zero beta portfolio. Equation(6)implies: E(Rit)=o.+Covt(Rit+I;-mt+l)/E(mt+1). (10) Substituting the regression model Rit+1=ai+i bit Fit +uit+into the right hand side of(10)and assuming that Covt(ui.t+1,mt+)-0 implies: E(Rit+i)=o+j=1k bijt Covt{Fjtt1,-m+1 )/E(mt)] (11)

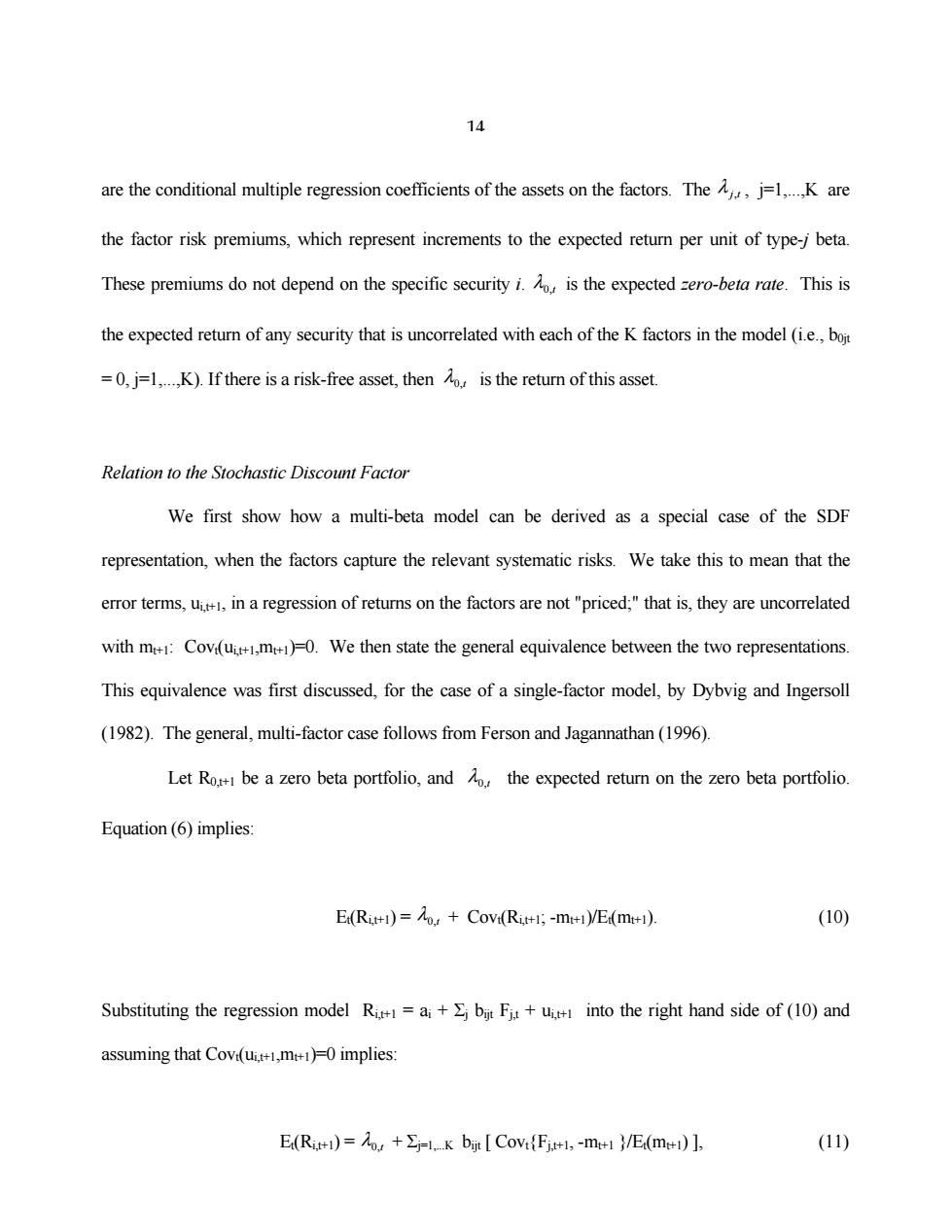

14 are the conditional multiple regression coefficients of the assets on the factors. The λ j,t , j=1,...,K are the factor risk premiums, which represent increments to the expected return per unit of type-j beta. These premiums do not depend on the specific security i. λ0,t is the expected zero-beta rate. This is the expected return of any security that is uncorrelated with each of the K factors in the model (i.e., b0jt = 0, j=1,...,K). If there is a risk-free asset, then λ0,t is the return of this asset. Relation to the Stochastic Discount Factor We first show how a multi-beta model can be derived as a special case of the SDF representation, when the factors capture the relevant systematic risks. We take this to mean that the error terms, ui,t+1, in a regression of returns on the factors are not "priced;" that is, they are uncorrelated with mt+1: Covt(ui,t+1,mt+1)=0. We then state the general equivalence between the two representations. This equivalence was first discussed, for the case of a single-factor model, by Dybvig and Ingersoll (1982). The general, multi-factor case follows from Ferson and Jagannathan (1996). Let R0,t+1 be a zero beta portfolio, and λ0,t the expected return on the zero beta portfolio. Equation (6) implies: Et(Ri,t+1) = λ0,t + Covt(Ri,t+1; -mt+1)/Et(mt+1). (10) Substituting the regression model Ri,t+1 = ai + Σj bijt Fj,t + ui,t+1 into the right hand side of (10) and assuming that Covt(ui,t+1,mt+1)=0 implies: Et(Ri,t+1) = λ0,t + Σj=1,...K bijt [ Covt{Fj,t+1, -mt+1 }/Et(mt+1) ], (11)

15 -wide risk premium per unit of type-j beta is=[Cov(Ft,-m/E(m)].In the special case where the factor F is a traded asset return,equation (11)implies that=E(F)the expected risk premium equals the factor portfolio's expected excess return. Equation (11)is useful because it provides intuition about the signs and magnitudes of expected risk premiums for particular factors.The intuition is the same as in equation(6)above.If a risk factor Fi.is negatively-correlated with m1,the model implies that a positive risk premium is associated with that factor beta.A factor that is positively-related to marginal utility should carry a negative premium,because the big payoffs come when the value of payoffs is high.This implies a high present value and a low expected return.Expected risk premiums for a factor should also change over time if the conditional covariances of the factor with the scaled marginal utility [mui/E(m)]vary over time. The steps that take us from (6)to (11)can be reversed,so the SDF and multi-beta representations are,in fact,equivalent.The formal statement is: Lemma 1 (Ferson and Jagannathan,1996):The stochastic discount factor representation (2)and the multi-beta model(9)are equivalent, Where,mt+1 cot+Cit Fit+1 +...+CKt FKt+l, (12) with cot=[1+E(Fkt+I)/Var(Fkt+i)/ho, and C=-{九u/o Var(Fjt)h,j=l…,K For a proof,see Ferson and Jagannathan(1996). If the factors are not traded asset returns,then it is typically necessary to estimate the expected risk premiums for the factors,.These may be identified as the conditional expected excess returns on factor-mimicking portfolios.A factor-mimicking portfolio is defined as a portfolio whose return can

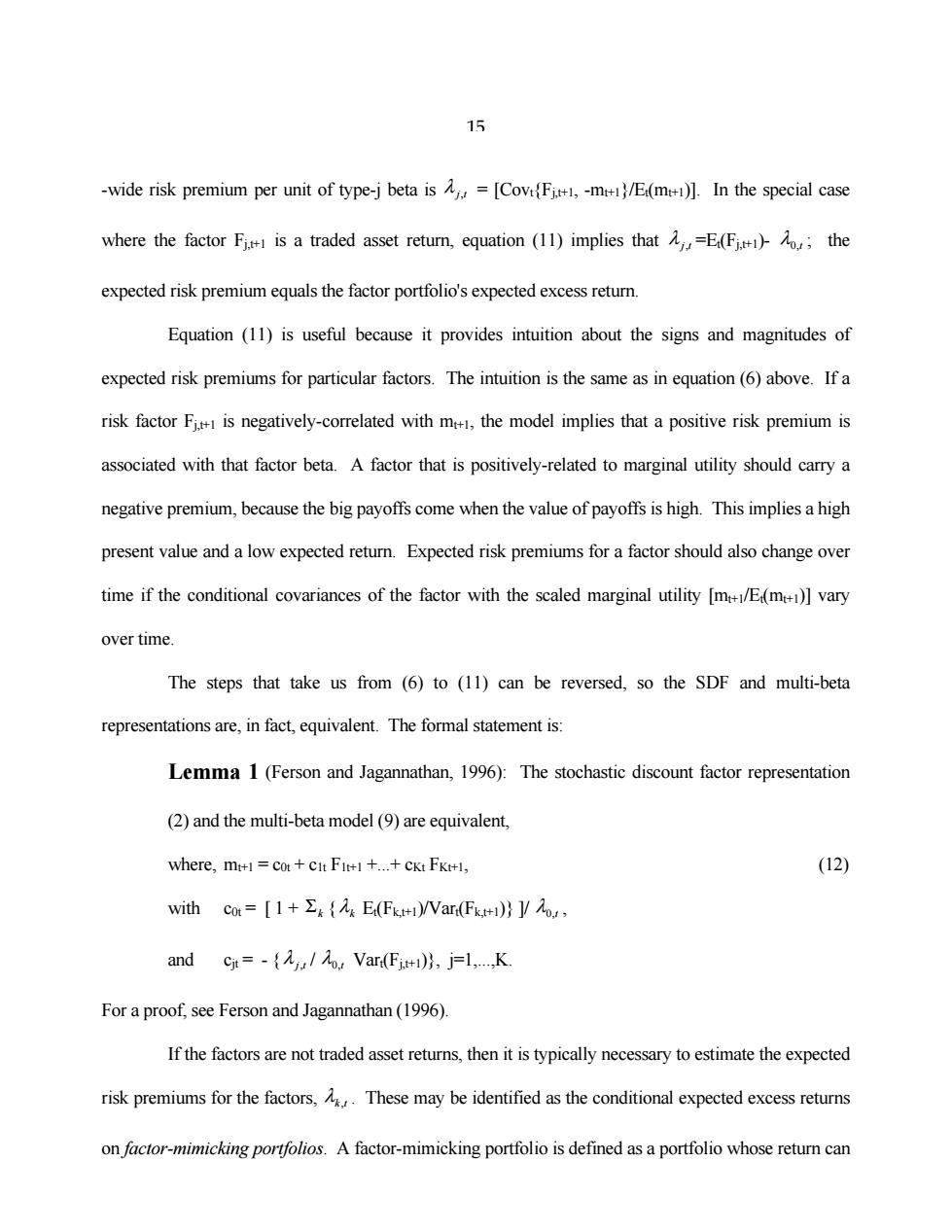

15 -wide risk premium per unit of type-j beta is λ j,t = [Covt{Fj,t+1, -mt+1}/Et(mt+1)]. In the special case where the factor Fj,t+1 is a traded asset return, equation (11) implies that λ j,t =Et(Fj,t+1)- λ0,t ; the expected risk premium equals the factor portfolio's expected excess return. Equation (11) is useful because it provides intuition about the signs and magnitudes of expected risk premiums for particular factors. The intuition is the same as in equation (6) above. If a risk factor Fj,t+1 is negatively-correlated with mt+1, the model implies that a positive risk premium is associated with that factor beta. A factor that is positively-related to marginal utility should carry a negative premium, because the big payoffs come when the value of payoffs is high. This implies a high present value and a low expected return. Expected risk premiums for a factor should also change over time if the conditional covariances of the factor with the scaled marginal utility [mt+1/Et(mt+1)] vary over time. The steps that take us from (6) to (11) can be reversed, so the SDF and multi-beta representations are, in fact, equivalent. The formal statement is: Lemma 1 (Ferson and Jagannathan, 1996): The stochastic discount factor representation (2) and the multi-beta model (9) are equivalent, where, mt+1 = c0t + c1t F1t+1 +...+ cKt FKt+1, (12) with c0t = [ 1 + Σk {λk Et(Fk,t+1)/Vart(Fk,t+1)} ]/ λ0,t , and cjt = - {λ j,t / λ0,t Vart(Fj,t+1)}, j=1,...,K. For a proof, see Ferson and Jagannathan (1996). If the factors are not traded asset returns, then it is typically necessary to estimate the expected risk premiums for the factors, λk ,t . These may be identified as the conditional expected excess returns on factor-mimicking portfolios. A factor-mimicking portfolio is defined as a portfolio whose return can

16 be used in place of a factor in the model.There are several ways to obtain mimicking portfolios,as described in more detail below.8 Relation to Mean variance Efficiency The concept of a minimum variance portfolio is central in the asset pricing literature.A portfolio Rp.t is a minimum variance portfolio if no portfolio with the same expected return has a smaller variance.Roll (1977)and others have shown that the portfolio Rp.ti is a minimum variance portfolio if and only if a beta pricing model holds. E(Ritt-Rpzt}=Bipt E(Rptti-Rpztt1),all i; (13) Bipt=[CoV(Rit+I;Rp.t+I)/Var(Rpt-1)]. In equation (13),Bipt is the conditional beta of Ritti relative to Rpt1.Rpzt is a zero beta asset relative to Rpt+1.A zero beta asset satisfies Cov(Rpzt+;Rp.+1)-0.Equation(13)is essentially a restatement of the first order condition for the optimization problem that defines a minimum variance portfolio. Equation (13)first appeared as an asset pricing model in the famous Capital Asset Pricing Model (CAPM)of Sharpe (1964)and Lintner (1965).The CAPM is equivalent to the statement that the market portfolio Rm.tt is mean variance efficient.The market portfolio is the portfolio of all 8 Breeden(1979,footnote 7derives maximum correlation mimicking portfolios.Grinblatt and Titman (1987),Shanken(1987),Lehmann and Modest(1988),and Huberman,Kandel and Stambaugh (1987) provide further characterizations of mimicking portfolios when there is no conditioning information. Ferson and Siegel(2002b)and Ferson,Siegel and Xu(2002)consider cases where there is conditioning information. It is assumed that the portfolio R is not the global minimum variance portfolio,that is,the minimum variance over all levels of expected return.This is because the betas of all assets on the global minimum variance portfolio are the identical

16 be used in place of a factor in the model. There are several ways to obtain mimicking portfolios, as described in more detail below.8 Relation to Mean variance Efficiency The concept of a minimum variance portfolio is central in the asset pricing literature. A portfolio Rp,t+1 is a minimum variance portfolio if no portfolio with the same expected return has a smaller variance. Roll (1977) and others have shown that the portfolio Rp,t+1 is a minimum variance portfolio if and only if a beta pricing model holds:9 Et{Ri,t+1-Rpz,t+1} = βipt Et{Rp,t+1-Rpz,t+1}, all i; (13) βipt = [Covt(Ri,t+1; Rp,t+1) /Vart(Rp,t+1)]. In equation (13), βipt is the conditional beta of Ri,t+1 relative to Rp,t+1. Rpz,t+1 is a zero beta asset relative to Rp,t+1. A zero beta asset satisfies Covt(Rpz,t+1; Rp,t+1)=0. Equation (13) is essentially a restatement of the first order condition for the optimization problem that defines a minimum variance portfolio. Equation (13) first appeared as an asset pricing model in the famous Capital Asset Pricing Model (CAPM) of Sharpe (1964) and Lintner (1965). The CAPM is equivalent to the statement that the market portfolio Rm,t+1 is mean variance efficient. The market portfolio is the portfolio of all 8 Breeden (1979, footnote 7) derives maximum correlation mimicking portfolios. Grinblatt and Titman (1987), Shanken (1987), Lehmann and Modest (1988), and Huberman, Kandel and Stambaugh (1987) provide further characterizations of mimicking portfolios when there is no conditioning information. Ferson and Siegel (2002b) and Ferson, Siegel and Xu (2002) consider cases where there is conditioning information. 9 It is assumed that the portfolio Rp,t+1 is not the global minimum variance portfolio; that is, the minimum variance over all levels of expected return. This is because the betas of all assets on the global minimum variance portfolio are the identical