exercised if new information justifies a price greater than $40.50.A dealer who places a bid at $40 and an ask at $40.50 is writing a strangle.The value of such options depends on the stock's variability and the maturity of the option.A limit order that is monitored infrequently has greater maturity than a dealer quote that is monitored continuously and is quickly adjusted. The Black Scholes model can provide the value of the free trading option. Suppose the limit order to buy at $40 will not be reviewed for an hour,and suppose the one-hour standard deviation of return is 0.033%.(an annualized value of about 200%). The stock price is 40.25 and the exercise price of the put option is $40.The Black Scholes value of a put option maturing in one hour with a one hour standard deviation of 0.033%is $0.23,approximately the discount of the bid from the quote midpoint. Investors who place limit orders expect to trade at favorable prices that offset the losses when their options end up in the money.The option is free to the person exercising it. The option premium,which is the discount of the bid from the stock's consensus value,is paid by traders who sell at the bid in the absence of new information. II.C.Adverse selection. Informed investors will sell at the bid if they have information justifying a lower price.They will buy at the ask if they have information justifying a higher price.In an anonymous market,dealers and limit orders must lose to informed traders,for the informed traders are not identified.If this adverse selection problem is too great the market will fail.As Bagehot(1971)first noted,the losses to informed traders must be offset by profits from uninformed traders if dealers are to stay in business and if limit orders are to continue to be posted.Glosten and Milgrom(1985)model the spread in an asymmetric information world.Important theoretical papers building on the adverse selection sources of the spread include Kyle (1985),Easley and O'Hara(1987),and Amati and Pfleiderer(1988). The determination of the bid-ask spread in the Glosten/Milgrom world can illustrated in the following simple manner.Assume an asset can take on two possible values-a high value,,and a low value,-with equal probability.Informed investors,who know the correct value,are present with probability nt.Assuming risk 14

14 exercised if new information justifies a price greater than $40.50. A dealer who places a bid at $40 and an ask at $40.50 is writing a strangle. The value of such options depends on the stock’s variability and the maturity of the option. A limit order that is monitored infrequently has greater maturity than a dealer quote that is monitored continuously and is quickly adjusted. The Black Scholes model can provide the value of the free trading option. Suppose the limit order to buy at $40 will not be reviewed for an hour, and suppose the one-hour standard deviation of return is 0.033%. (an annualized value of about 200%). The stock price is 40.25 and the exercise price of the put option is $40. The Black Scholes value of a put option maturing in one hour with a one hour standard deviation of 0.033% is $0.23, approximately the discount of the bid from the quote midpoint. Investors who place limit orders expect to trade at favorable prices that offset the losses when their options end up in the money. The option is free to the person exercising it. The option premium, which is the discount of the bid from the stock’s consensus value, is paid by traders who sell at the bid in the absence of new information. II.C. Adverse selection. Informed investors will sell at the bid if they have information justifying a lower price. They will buy at the ask if they have information justifying a higher price. In an anonymous market, dealers and limit orders must lose to informed traders, for the informed traders are not identified. If this adverse selection problem is too great the market will fail. As Bagehot (1971) first noted, the losses to informed traders must be offset by profits from uninformed traders if dealers are to stay in business and if limit orders are to continue to be posted. Glosten and Milgrom (1985) model the spread in an asymmetric information world. Important theoretical papers building on the adverse selection sources of the spread include Kyle (1985), Easley and O’Hara (1987), and Amati and Pfleiderer (1988). The determination of the bid-ask spread in the Glosten/Milgrom world can illustrated in the following simple manner. Assume an asset can take on two possible values – a high value, v H , and a low value, v L -- with equal probability. Informed investors, who know the correct value, are present with probability p . Assuming risk

neutrality,uninformed investors value the asset at=(+)/2.The ask price,A,is then the expected value of the asset conditional on a trade at the ask price: A=vπ+(1-π). (7) The bid price is B=vπ+下(1-π) (8) Since informed investors trade at the ask(bid)only if they believe the asset value is (v,the ask price exceeds the bid price.The bid-ask spread, A-B=π(vH-), (9) depends on the probability of encountering an informed trader and on the degree of asset value uncertainty.Glosten and Milgrom go on to show that prices evolve through time as a martingale,reflecting at each trade the information conveyed by that trade. III.Short-run price behavior and market microstructure Market microstructure is the study of market friction.In cross section,assets with greater friction have larger spreads.Friction also affects the short-term time series behavior of asset prices.Assets with greater friction tend to have greater short run variability of prices.Garman(1976)first modeled microstructure dynamics under the assumption of Poisson arrival of traders.Many papers have modeled the time series behavior of prices and quotes,including Roll (1984),Hasbrouck(1988,1991),Huang and Stoll (1994,1997),Madhavan,Roomans,Richardson(1997). The evolution of prices through time provides insight as to the sources of trading friction-whether order processing costs,inventory effects,information effects,or monopoly rents. If order processing costs were the sole source of the bid-ask spread,transaction prices would simply tend to"bounce"between bid and ask prices.After a trade at the bid, the next price change would be zero or the spread,S.After a trade at the ask,the next price change would be zero or-S.Roll(1984)shows that the effect is to induce negative serial correlation in price changes. If asymmetric information were the sole source of the spread,transaction prices would reflect the information conveyed by transactions.Sales at the bid would cause 15

15 neutrality, uninformed investors value the asset at ( )/2 H L vvv = + . The ask price, A, is then the expected value of the asset conditional on a trade at the ask price: (1 ) H A = v v p p + - . (7) The bid price is (1 ) L B = v v p p + - . (8) Since informed investors trade at the ask (bid) only if they believe the asset value is v H (v L ), the ask price exceeds the bid price. The bid-ask spread, ( ) H L A- B = - p v v , (9) depends on the probability of encountering an informed trader and on the degree of asset value uncertainty. Glosten and Milgrom go on to show that prices evolve through time as a martingale, reflecting at each trade the information conveyed by that trade. III. Short-run price behavior and market microstructure Market microstructure is the study of market friction. In cross section, assets with greater friction have larger spreads. Friction also affects the short-term time series behavior of asset prices. Assets with greater friction tend to have greater short run variability of prices. Garman (1976) first modeled microstructure dynamics under the assumption of Poisson arrival of traders. Many papers have modeled the time series behavior of prices and quotes, including Roll (1984), Hasbrouck (1988, 1991), Huang and Stoll (1994, 1997), Madhavan, Roomans, Richardson (1997). The evolution of prices through time provides insight as to the sources of trading friction – whether order processing costs, inventory effects, information effects, or monopoly rents. · If order processing costs were the sole source of the bid-ask spread, transaction prices would simply tend to “bounce” between bid and ask prices. After a trade at the bid, the next price change would be zero or the spread, S. After a trade at the ask, the next price change would be zero or -S. Roll (1984) shows that the effect is to induce negative serial correlation in price changes. · If asymmetric information were the sole source of the spread, transaction prices would reflect the information conveyed by transactions. Sales at the bid would cause

a permanent fall in bid and ask prices to reflect the information conveyed by a sale. Conversely purchases at the ask would cause a permanent increase in bid and ask prices to reflect the information conveyed by a purchase.Given the random arrival of traders,price changes and quote changes would be random and unpredictable. If inventory costs were the source of the spread,quotes would adjust to induce inventory equilibrating trades.After a sale at the bid,bid and ask prices would fall, not to reflect information as in the asymmetric information case,but to discourage additional sales and to encourage purchases.Correspondingly,after a purchase at the ask,bid and ask prices would rise to discourage additional purchases and to encourage sales.Over time,quotes would return to normal.Trade prices and quotes would exhibit negative serial correlation. In this section,a model for examining short run behavior of prices is first presented.The model is then used to analyze the realized spread(what a supplier of immediacy earns)and the serial covariance of price changes.The realized spread and the serial covariance of price changes provide insight into the sources of the quoted spread. III.A.A model of short term price behavior The short run evolution of prices can be more formally stated.Let the change in the quote midpoint be given as S M,-M-1=元9Q,+6, (10) 2 where M quote midpoint immediately after the trade at time t-1. Q =trade indicator for the trade at time t.Equals 1 if a purchase at the ask and equals-1 if a sale at the bid. S dollar bid-ask spread 入 fraction of the half-spread by which quotes respond to a trade at t.The response reflects inventory and asymmetric information factors serially uncorrelated public information shock. 16

16 a permanent fall in bid and ask prices to reflect the information conveyed by a sale. Conversely purchases at the ask would cause a permanent increase in bid and ask prices to reflect the information conveyed by a purchase. Given the random arrival of traders, price changes and quote changes would be random and unpredictable. · If inventory costs were the source of the spread, quotes would adjust to induce inventory equilibrating trades. After a sale at the bid, bid and ask prices would fall, not to reflect information as in the asymmetric information case, but to discourage additional sales and to encourage purchases. Correspondingly, after a purchase at the ask, bid and ask prices would rise to discourage additional purchases and to encourage sales. Over time, quotes would return to normal. Trade prices and quotes would exhibit negative serial correlation. In this section, a model for examining short run behavior of prices is first presented. The model is then used to analyze the realized spread (what a supplier of immediacy earns) and the serial covariance of price changes. The realized spread and the serial covariance of price changes provide insight into the sources of the quoted spread. III.A. A model of short term price behavior The short run evolution of prices can be more formally stated. Let the change in the quote midpoint be given as 1 1 , 2 t t t t S M M Q l e - - - = + (10) where Mt = quote midpoint immediately after the trade at time t-1. Qt = trade indicator for the trade at time t. Equals 1 if a purchase at the ask and equals -1 if a sale at the bid. S = dollar bid-ask spread l = fraction of the half-spread by which quotes respond to a trade at t. The response reflects inventory and asymmetric information factors. e = serially uncorrelated public information shock

The quote midpoint changes either because there is new public information,8,or because the last trade,O induces a change in quotes.A change in the quotes is induced because the trade conveys information and because it distorts inventory. The trade at price P,takes place either at the ask (half-spread above the midpoint) or at the bid (half-spread below the midpoint):4 B=M+20,+n, (11) where P trade price at time t. nt error term reflecting the deviation of the constant half-spread from the observed half-spread,P,-M,and reflecting price discreteness. Combining (10)and(11)gives S (12) where e,=e+△nk, III.B.The realized spread What can a supplier of immediacy expect to realize by buying at the bid and selling his position at a later price(or by selling at the ask and buying to cover the short position at a later price)?The realized half-spread is the price change conditional on a purchase at the bid (or the negative of the price change conditional on a sale at the ask).Since quotes change as a result of trades,the amount earned is less than would be implied if quotes did not change.The difference between the realized and quoted spreads provides evidence about the sources of the spread. In terms of the model (12),the expected realized half-spread conditional on a purchase at the bid (.1=-1)is 4 It would be a simple matter to model the fact that some trades take place inside the quotes.For example one could assume that trades are at the quotes with probability and at the midpoint with probability (1- )Then P=M,++n,,Madhavan,Richardson,Roomans (1997),for example,make such an adjustment. 17

17 The quote midpoint changes either because there is new public information, e, or because the last trade, Qt-1 induces a change in quotes. A change in the quotes is induced because the trade conveys information and because it distorts inventory. The trade at price Pt takes place either at the ask (half-spread above the midpoint) or at the bid (half-spread below the midpoint): 4 P M S t = t + Qt + t 2 h , (11) where Pt = trade price at time t. ht = error term reflecting the deviation of the constant half-spread from the observed half-spread, Pt – Mt , and reflecting price discreteness. Combining (10) and (11) gives DP S Q Q S Q e t = t - t - + t- + t 2 2 1 1 ( ) l , (12) where et = et + Dht . III.B. The realized spread What can a supplier of immediacy expect to realize by buying at the bid and selling his position at a later price (or by selling at the ask and buying to cover the short position at a later price)? The realized half-spread is the price change conditional on a purchase at the bid (or the negative of the price change conditional on a sale at the ask). Since quotes change as a result of trades, the amount earned is less than would be implied if quotes did not change. The difference between the realized and quoted spreads provides evidence about the sources of the spread. In terms of the model (12), the expected realized half-spread conditional on a purchase at the bid (Qt-1=-1) is 4 It would be a simple matter to model the fact that some trades take place inside the quotes. For example one could assume that trades are at the quotes with probability f and at the midpoint with probability (1- f). Then 2 , t t t t S P = M Q + + f h Madhavan, Richardson, Roomans (1997), for example, make such an adjustment

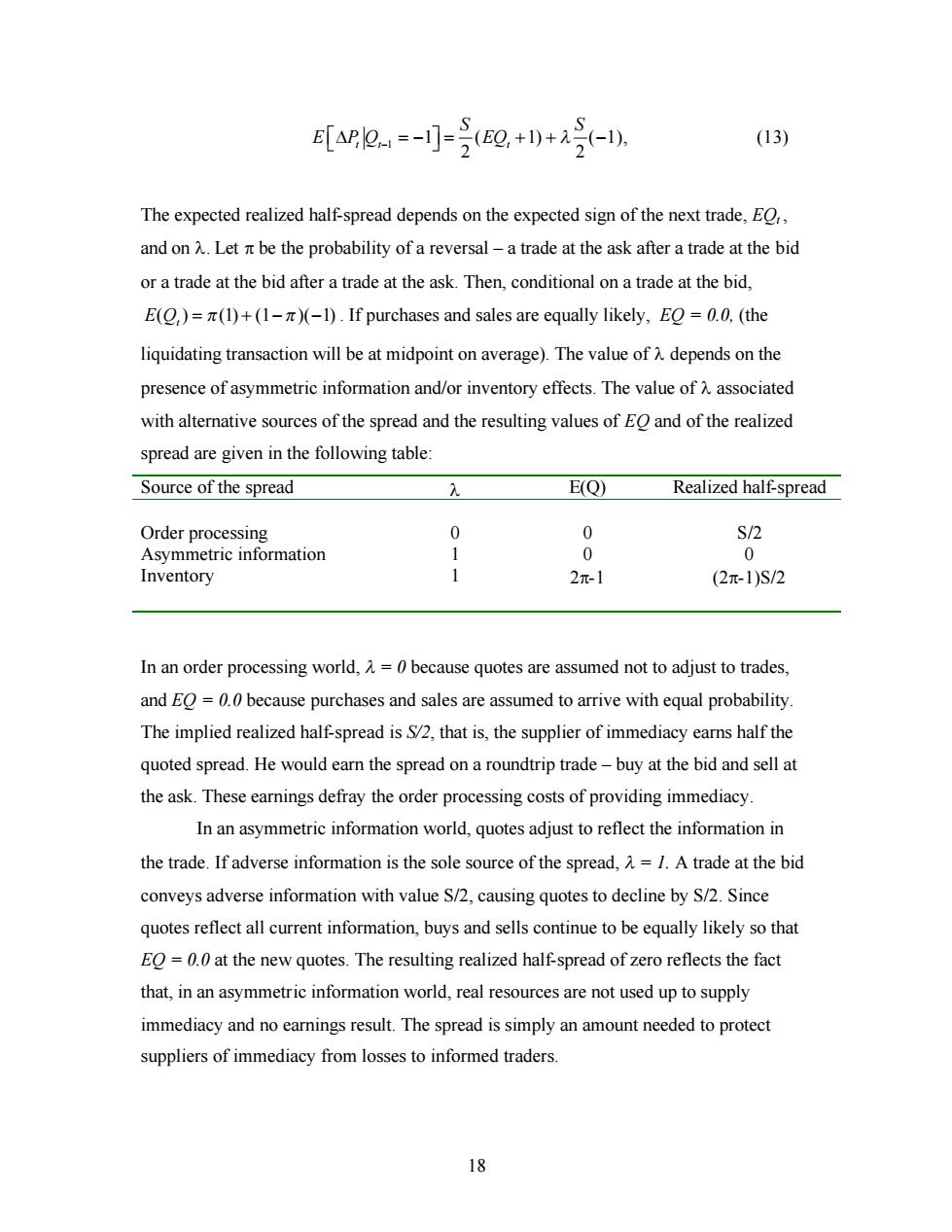

[2=-]=3(e现,+0+-i (13) The expected realized half-spread depends on the expected sign of the next trade,E, and on A.Let n be the probability of a reversal-a trade at the ask after a trade at the bid or a trade at the bid after a trade at the ask.Then,conditional on a trade at the bid, E()=(1)+(1-)(-1).If purchases and sales are equally likely,EO=0.0,(the liquidating transaction will be at midpoint on average).The value of A depends on the presence of asymmetric information and/or inventory effects.The value of associated with alternative sources of the spread and the resulting values of EO and of the realized spread are given in the following table: Source of the spread E(Q) Realized half-spread Order processing 0 0 Asymmetric information 1 0 0 Inventory 1 2元-1 (2π-1)S/2 In an order processing world,=0 because quotes are assumed not to adjust to trades, and EO =0.0 because purchases and sales are assumed to arrive with equal probability. The implied realized half-spread is S/2,that is,the supplier of immediacy earns half the quoted spread.He would earn the spread on a roundtrip trade-buy at the bid and sell at the ask.These earnings defray the order processing costs of providing immediacy In an asymmetric information world,quotes adjust to reflect the information in the trade.If adverse information is the sole source of the spread,=1.A trade at the bid conveys adverse information with value S/2,causing quotes to decline by S/2.Since quotes reflect all current information,buys and sells continue to be equally likely so that EO=0.0 at the new quotes.The resulting realized half-spread of zero reflects the fact that,in an asymmetric information world,real resources are not used up to supply immediacy and no earnings result.The spread is simply an amount needed to protect suppliers of immediacy from losses to informed traders. 18

18 1 1 ( 1) ( 1), 2 2 t t t S S E é ù DP Q - = - = EQ + + - l ë û (13) The expected realized half-spread depends on the expected sign of the next trade, EQt , and on l. Let p be the probability of a reversal – a trade at the ask after a trade at the bid or a trade at the bid after a trade at the ask. Then, conditional on a trade at the bid, ( ) (1) (1 )( 1) E Qt = p p + - - . If purchases and sales are equally likely, EQ = 0.0, (the liquidating transaction will be at midpoint on average). The value of l depends on the presence of asymmetric information and/or inventory effects. The value of l associated with alternative sources of the spread and the resulting values of EQ and of the realized spread are given in the following table: Source of the spread l E(Q) Realized half-spread Order processing 0 0 S/2 Asymmetric information 1 0 0 Inventory 1 2p-1 (2p-1)S/2 In an order processing world, l = 0 because quotes are assumed not to adjust to trades, and EQ = 0.0 because purchases and sales are assumed to arrive with equal probability. The implied realized half-spread is S/2, that is, the supplier of immediacy earns half the quoted spread. He would earn the spread on a roundtrip trade – buy at the bid and sell at the ask. These earnings defray the order processing costs of providing immediacy. In an asymmetric information world, quotes adjust to reflect the information in the trade. If adverse information is the sole source of the spread, l = 1. A trade at the bid conveys adverse information with value S/2, causing quotes to decline by S/2. Since quotes reflect all current information, buys and sells continue to be equally likely so that EQ = 0.0 at the new quotes. The resulting realized half-spread of zero reflects the fact that, in an asymmetric information world, real resources are not used up to supply immediacy and no earnings result. The spread is simply an amount needed to protect suppliers of immediacy from losses to informed traders