3.4 Accounting v.Economic Measures of Income---For income statement Accountant's Measure of Net Income Revenue Less Expenses Less Taxes Economist's Measure of Net Income Net cash flow to shareholders plus change in market value of existing shareholders equity(market value adjusted) Considering the cost of equity The above two measures would be equal if accountants marked all relevant assets and liabilities to market (they don't!) .THE COURSE OF FINANCE 2017 SPRING SJTU 16

3.4 Accounting v. Economic Measures of Income---For income statement Accountant's Measure of Net Income Revenue Less Expenses Less Taxes Economist’s Measure of Net Income Net cash flow to shareholders plus change in market value of existing shareholders equity(market value adjusted) Considering the cost of equity The above two measures would be equal if accountants marked all relevant assets and liabilities to market (they don’t!) •THE COURSE OF FINANCE 2017 SPRING SJTU •16

Accounting v.Economic Measures of Income:Example GPC's accounting net income was plus $23,400,000in2001 Assume the total market value of the stock fell from$200,000,000to$187,200,000 from year 2xx0 to 2xx1.We saw earlier that the cash dividend to shareholders was $10,000,000.The economic income in year 2xx1 was minus $2,800,000 The Accounting and Economic measures of Income may differ substantially .THE COURSE OF FINANCE 2017 SPRING SJTU 17

Accounting v. Economic Measures of Income: Example GPC’s accounting net income was plus $23,400,000 in 2001 Assume the total market value of the stock fell from $200,000,000 to $187,200,000 from year 2xx0 to 2xx1. We saw earlier that the cash dividend to shareholders was $10,000,000. The economic income in year 2xx1 was minus $2,800,000 The Accounting and Economic measures of Income may differ substantially •THE COURSE OF FINANCE 2017 SPRING SJTU •17

3.5 Returns to Shareholders v. Return on Book Equity Recall our definition in Chapter 2 of the holding period return,and compare this with the economic measure of income (EndPrice-StartPrice)+CashDividends Re turn StartPrice Economiclncome $-2.8Million =-1.4 StartPrice $200 Million This is the Total Shareholder Return .THE COURSE OF FINANCE 2017 SPRING SJTU -18

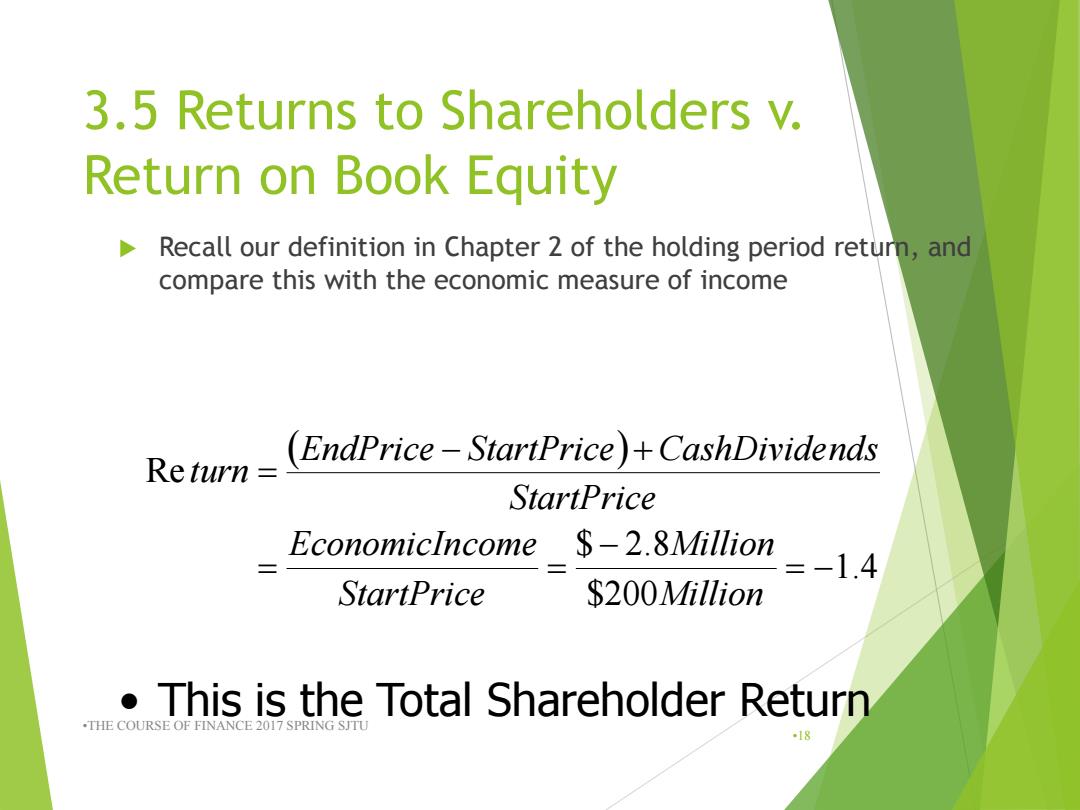

3.5 Returns to Shareholders v. Return on Book Equity Recall our definition in Chapter 2 of the holding period return, and compare this with the economic measure of income •THE COURSE OF FINANCE 2017 SPRING SJTU •18 1.4 $200 $ 2.8 Re Million Million StartPrice EconomicIncome StartPrice EndPrice StartPrice CashDividends turn • This is the Total Shareholder Return

Returns to Shareholders v.Return on Book Equity (Continued) Traditionally,corporate performance has been measured by Return on Equity,ROE Accounting Income ROE ShareHolde rsEquity NetIncome ShareHolde rsEquity $23.4 Million =7.8% $300 Million .THE COURSE OF FINANCE 2017 SPRING SJTU 19

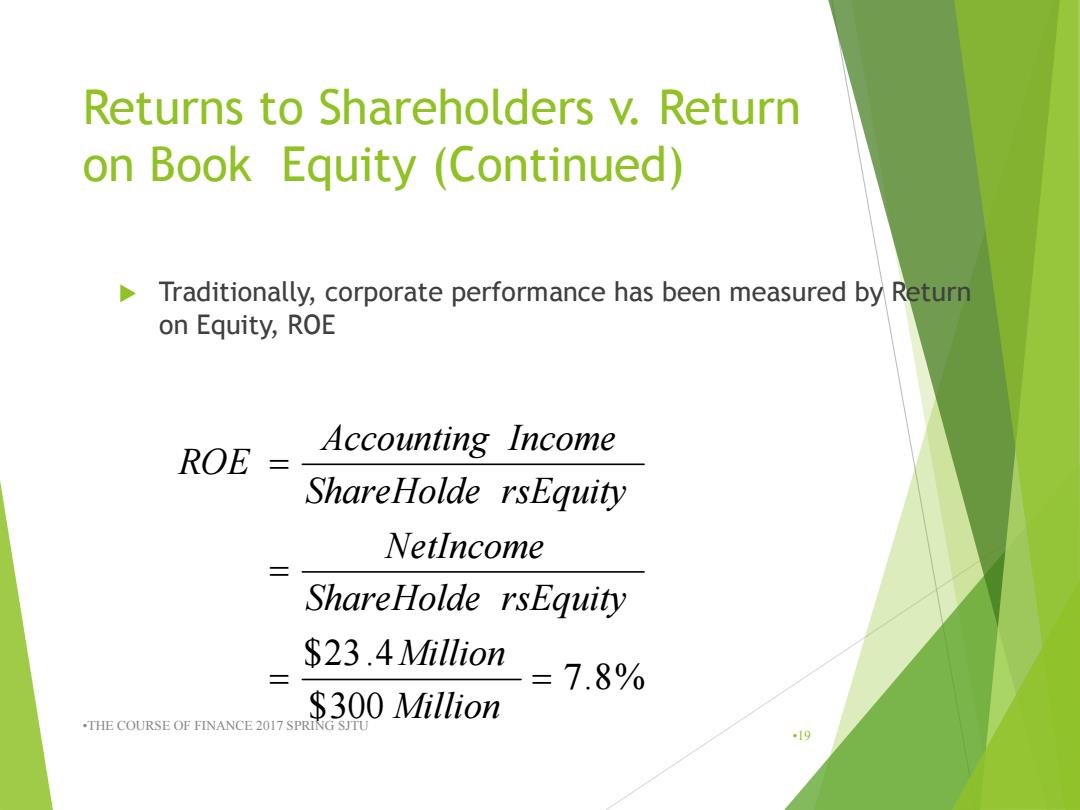

Returns to Shareholders v. Return on Book Equity (Continued) Traditionally, corporate performance has been measured by Return on Equity, ROE •THE COURSE OF FINANCE 2017 SPRING SJTU •19 7.8% $300 $23.4 Million Million ShareHolde rsEquity NetIncome ShareHolde rsEquity Accounting Income ROE

Returns to Shareholders v.Return on Book Equity (Conclusion) Thus,we see that there is no correspondence between a firm's ROE in any year the total rate of return earned by shareholders on their investment in the company's stock Class discussion:The two rates of rate,-1.4%and 7.8%are so different.Tell us why they are so different?which one is good for financial decision?Why? .THE COURSE OF FINANCE 2017 SPRING SJTU 20

Returns to Shareholders v. Return on Book Equity (Conclusion) Thus, we see that there is no correspondence between a firm's ROE in any year & the total rate of return earned by shareholders on their investment in the company’s stock Class discussion:The two rates of rate ,-1.4% and 7.8% are so different. Tell us why they are so different? which one is good for financial decision? Why? •THE COURSE OF FINANCE 2017 SPRING SJTU •20