1907 16-6 Money Creation When a bank makes a loan from its reserves,the money supply increases. -The money supply is affected by the amount deposited in banks and the amount that banks loan. Deposits into a bank are recorded as both assets and liabilities. The fraction of total deposits that a bank has to keep as reserves is called the reserve ratio. Loans become an asset to the bank Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-6 Money Creation – When a bank makes a loan from its reserves, the money supply increases. – The money supply is affected by the amount deposited in banks and the amount that banks loan. • Deposits into a bank are recorded as both assets and liabilities. • The fraction of total deposits that a bank has to keep as reserves is called the reserve ratio. • Loans become an asset to the bank

16-7 Money Creation Suppose banks hold 20%of deposits in reserve,making loans with the rest. Firstbank will make $800 in loans. The money supply FIRSTBANK'S now equals $1800: balance sheet The depositor still Assets Liabilities has $1000 in demand reserves $200 deposits $1000 deposits, loans $800 but now the borrower holds $800 in currency. Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-7 The money supply now equals $1800: The depositor still has $1000 in demand deposits, but now the borrower holds $800 in currency. FIRSTBANK’S balance sheet Assets Liabilities deposits $1000 • Suppose banks hold 20% of deposits in reserve, making loans with the rest. • Firstbank will make $800 in loans. reserves $1000 reserves $200 loans $800 Money Creation

1907 16-8 Money Creation Suppose the borrower deposits the $800 in Secondbank. Initially,Secondbank's balance sheet is: SECONDBANK'S ·But then balance sheet Secondbank will loan 80%of this Assets Liabilities deposit reserves $160 deposits $800 and its balance loans $640 sheet will look like this: Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-8 • But then Secondbank will loan 80% of this deposit • and its balance sheet will look like this: SECONDBANK’S balance sheet Assets Liabilities reserves $800 loans $0 deposits $800 • Suppose the borrower deposits the $800 in Secondbank. • Initially, Secondbank’s balance sheet is: reserves $160 loans $640 Money Creation

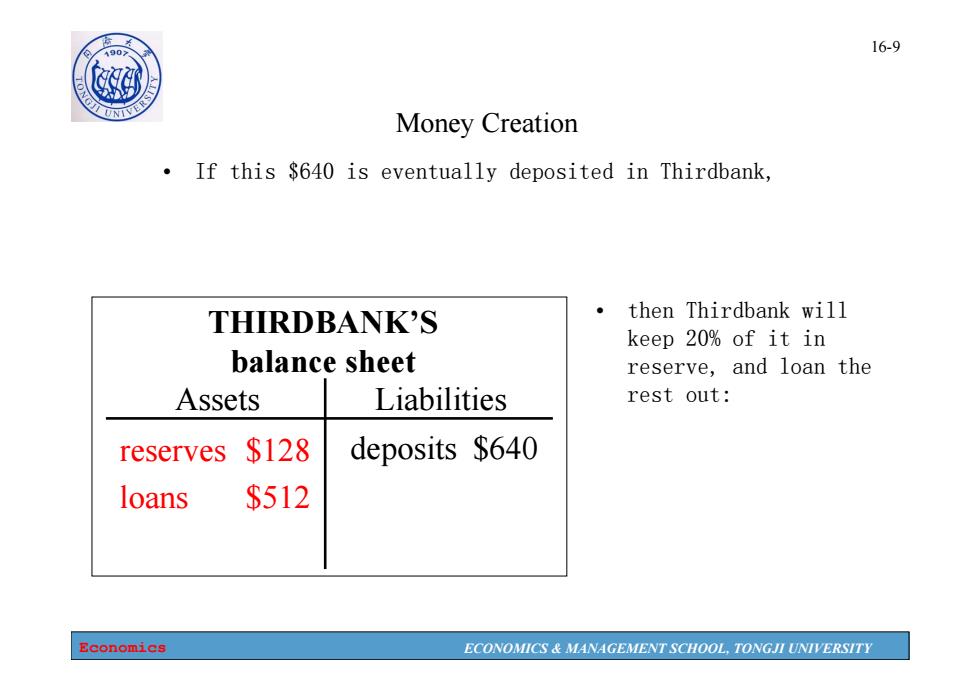

16-9 0 Money Creation If this $640 is eventually deposited in Thirdbank, THIRDBANK'S ·then Thirdbank will keep 20%of it in balance sheet reserve,and loan the Assets Liabilities rest out: reserves $128 deposits $640 loans $512 Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-9 THIRDBANK’S balance sheet Assets Liabilities reserves $640 loans $0 deposits $640 • If this $640 is eventually deposited in Thirdbank, reserves $128 loans $512 • then Thirdbank will keep 20% of it in reserve, and loan the rest out: Money Creation

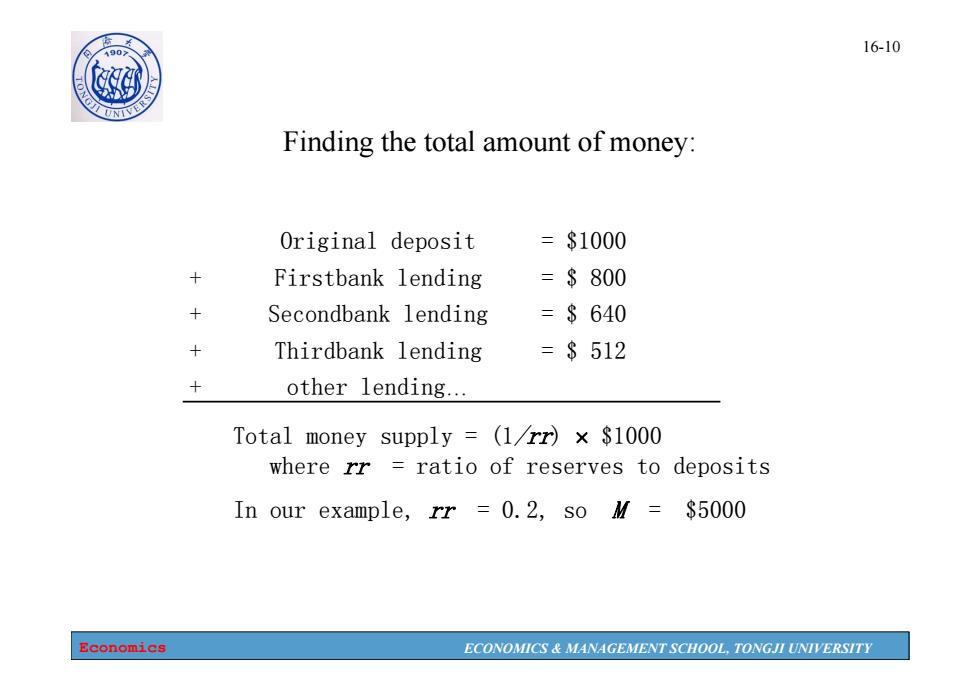

1907 16-10 Finding the total amount of money: Original deposit =$1000 Firstbank lending =$800 Secondbank lending =$640 Thirdbank lending =$512 other lending... Total money supply (1rr)x $1000 where rr ratio of reserves to deposits In our example,rr =0.2,so M=$5000 Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-10 Finding the total amount of money: Original deposit = $1000 + Firstbank lending = $ 800 + Secondbank lending = $ 640 + Thirdbank lending = $ 512 + other lending… Total money supply = (1/rr) $1000 where rr = ratio of reserves to deposits In our example, rr = 0.2, so M = $5000